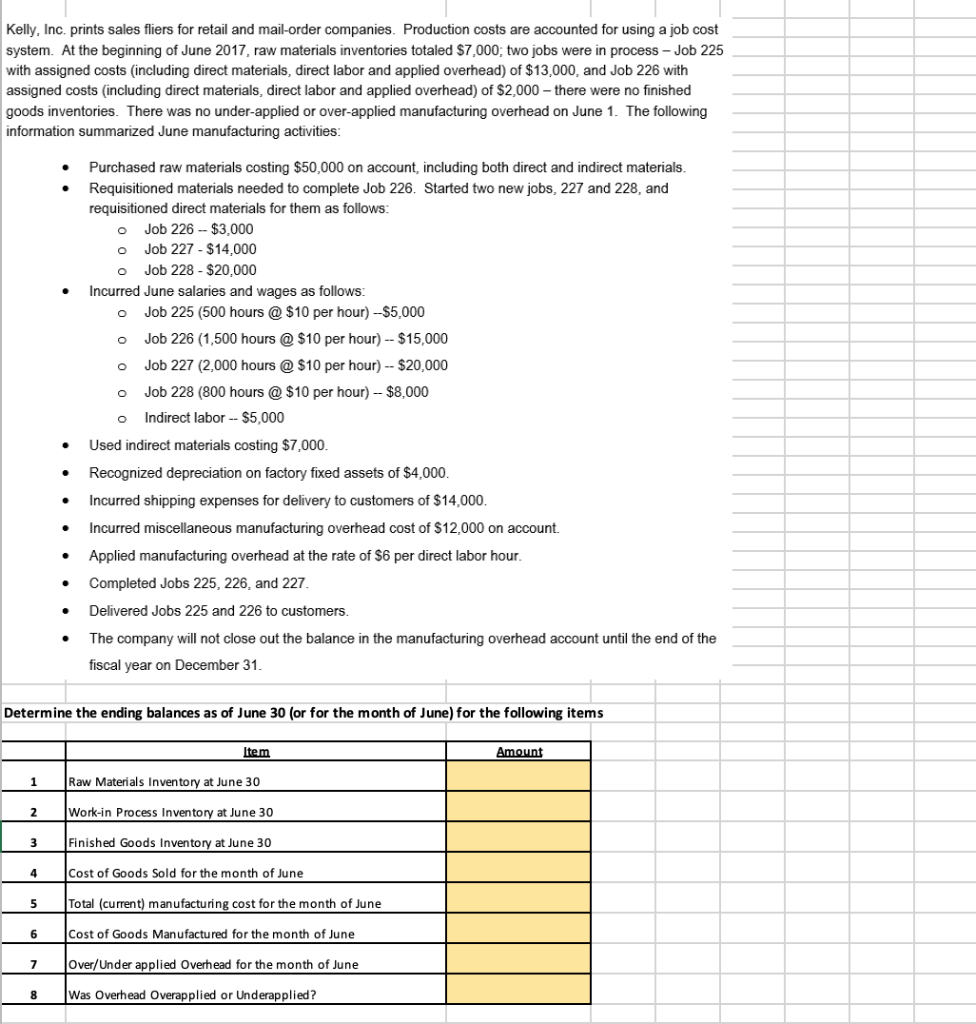

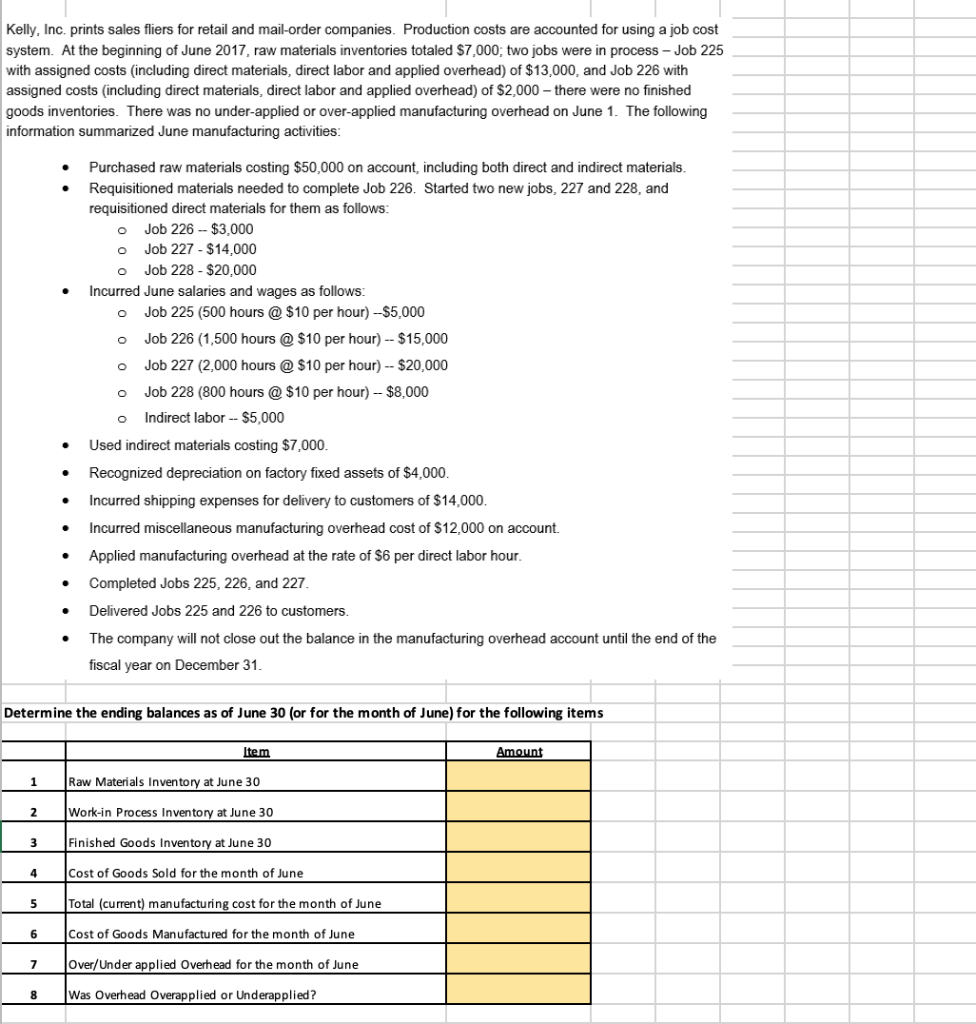

Kelly, Inc. prints sales fliers for retail and mail-order companies. Production costs are accounted for using a job cost system. At the beginning of June 2017, raw materials inventories totaled $7,000; two jobs were in process - Job 225 with assigned costs (including direct materials, direct labor and applied overhead) of $13,000, and Job 226 with assigned costs (including direct materials, direct labor and applied overhead) of $2,000 - there were no finished goods inventories. There was no under-applied or over-applied manufacturing overhead on June 1. The following information summarized June manufacturing activities: . . O O o Purchased raw materials costing $50,000 on account, including both direct and indirect materials. Requisitioned materials needed to complete Job 226. Started two new jobs, 227 and 228, and requisitioned direct materials for them as follows: Job 226 -- $3,000 Job 227 - $14,000 Job 228 - $20,000 Incurred June salaries and wages as follows: Job 225 (500 hours @ $10 per hour) --$5,000 Job 226 (1,500 hours @ $10 per hour) -- $15,000 Job 227 (2,000 hours @ $10 per hour) -- $20,000 Job 228 (800 hours @ $10 per hour) - $8,000 Indirect labor -- $5,000 Used indirect materials costing $7,000. Recognized depreciation on factory fixed assets of $4,000, Incurred shipping expenses for delivery to customers of $14,000. Incurred miscellaneous manufacturing overhead cost of $12.000 on account. Applied manufacturing overhead at the rate of $6 per direct labor hour. Completed Jobs 225, 226, and 227 Delivered Jobs 225 and 226 to customers. The company will not close out the balance in the manufacturing overhead account until the end of the fiscal year on December 31 o . Determine the ending balances as of June 30 (or for the month of June) for the following items Item Amount 1 Raw Materials Inventory at June 30 2 Work-in Process Inventory at June 30 3 Finished Goods Inventory at June 30 4 Cost of Goods Sold for the month of June 5 Total (current) manufacturing cost for the month of June 6 Cost of Goods Manufactured for the month of June 7 Over/Under applied Overhead for the month of June 8 Was Overhead Overapplied or Underapplied