Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kelly is dissatisfied with the divorce decree and persuades the court to issue a new order stating that, in addition to the $175 monthly

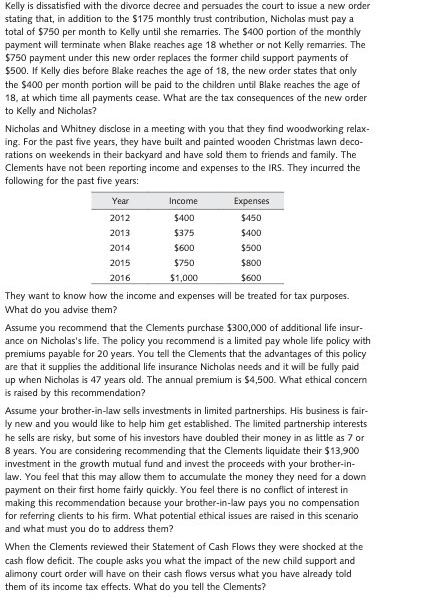

Kelly is dissatisfied with the divorce decree and persuades the court to issue a new order stating that, in addition to the $175 monthly trust contribution, Nicholas must pay a total of $750 per month to Kelly until she remarries. The $400 portion of the monthly payment will terminate when Blake reaches age 18 whether or not Kelly remarries. The $750 payment under this new order replaces the former child support payments of $500. If Kelly dies before Blake reaches the age of 18, the new order states that only the $400 per month portion will be paid to the children until Blake reaches the age of 18, at which time all payments cease. What are the tax consequences of the new order to Kelly and Nicholas? Nicholas and Whitney disclose in a meeting with you that they find woodworking relax- ing. For the past five years, they have built and painted wooden Christmas lawn deco- rations on weekends in their backyard and have sold them to friends and family. The Clements have not been reporting income and expenses to the IRS. They incurred the following for the past five years: Year 2012 2013 2014 2015 2016 Income $400 $375 $600 $750 $1,000 Expenses $450 $400 $500 $800 $600 They want to know how the income and expenses will be treated for tax purposes. What do you advise them? Assume you recommend that the Clements purchase $300,000 of additional life insur- ance on Nicholas's life. The policy you recommend is a limited pay whole life policy with premiums payable for 20 years. You tell the Clements that the advantages of this policy are that it supplies the additional life insurance Nicholas needs and it will be fully paid up when Nicholas is 47 years old. The annual premium is $4,500. What ethical concern is raised by this recommendation? Assume your brother-in-law sells investments in limited partnerships. His business is fair- ly new and you would like to help him get established. The limited partnership interests he sells are risky, but some of his investors have doubled their money in as little as 7 or 8 years. You are considering recommending that the Clements liquidate their $13,900 investment in the growth mutual fund and invest the proceeds with your brother-in- law. You feel that this may allow them to accumulate the money they need for a down payment on their first home fairly quickly. You feel there is no conflict of interest in making this recommendation because your brother-in-law pays you no compensation for referring clients to his firm. What potential ethical issues are raised in this scenario and what must you do to address them? When the Clements reviewed their Statement of Cash Flows they were shocked at the cash flow deficit. The couple asks you what the impact of the new child support and alimony court order will have on their cash flows versus what you have already told them of its income tax effects. What do you tell the Clements?

Step by Step Solution

★★★★★

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Here are the key points to address the questions 1 The new court order for Nicholas to pay Kelly 750 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started