Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kelly works for a plastics company as a risk manager. Kelly had used crude oil futures as a cross hedge because plastic prices and crude

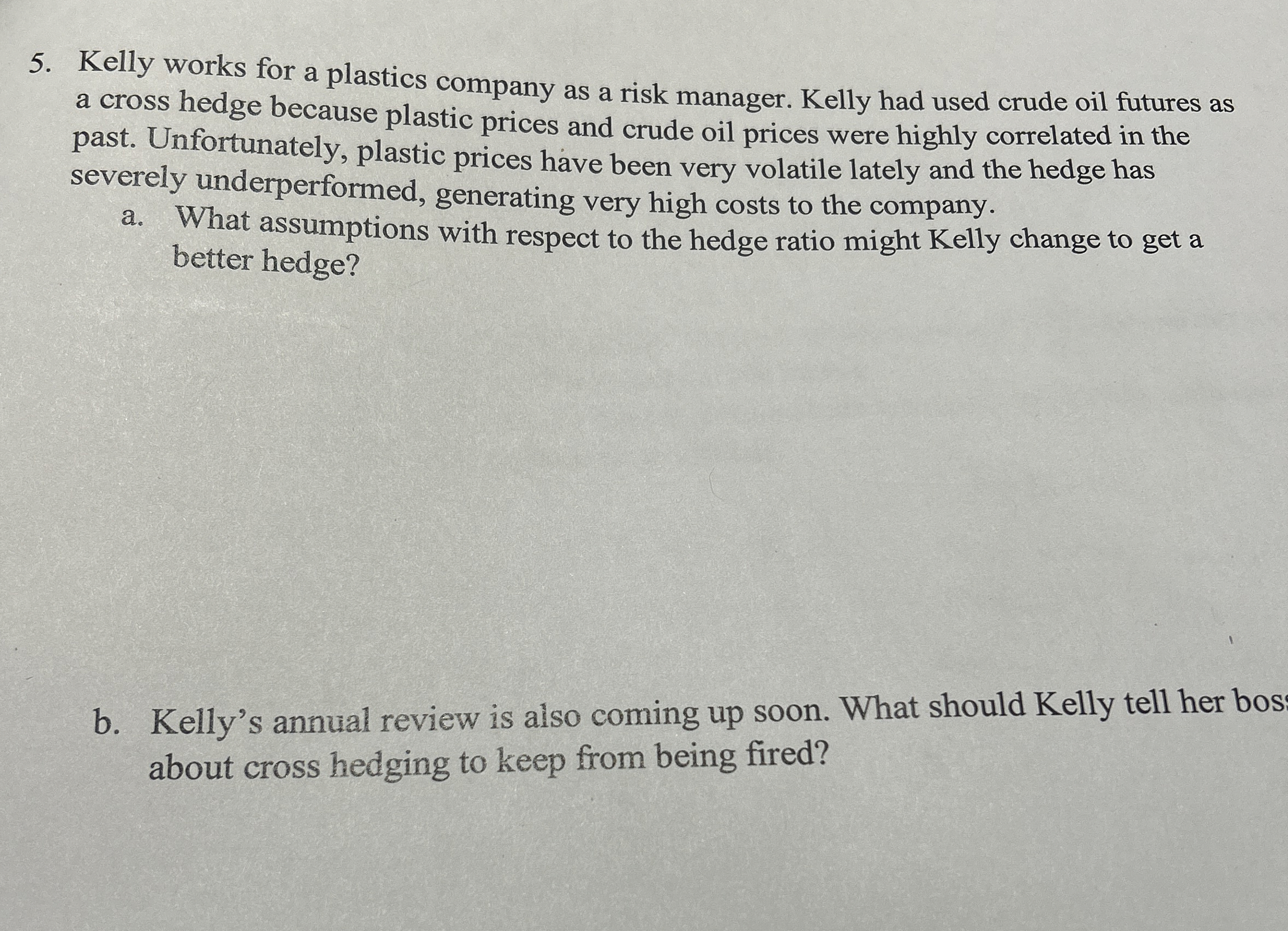

Kelly works for a plastics company as a risk manager. Kelly had used crude oil futures as

a cross hedge because plastic prices and crude oil prices were highly correlated in the

past. Unfortunately, plastic prices have been very volatile lately and the hedge has

severely underperformed, generating very high costs to the company.

a What assumptions with respect to the hedge ratio might Kelly change to get a

better hedge?

b Kelly's annual review is also coming up soon. What should Kelly tell her bos

about cross hedging to keep from being fired?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started