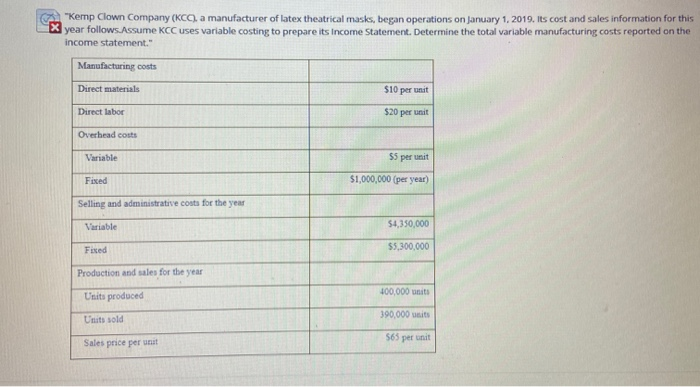

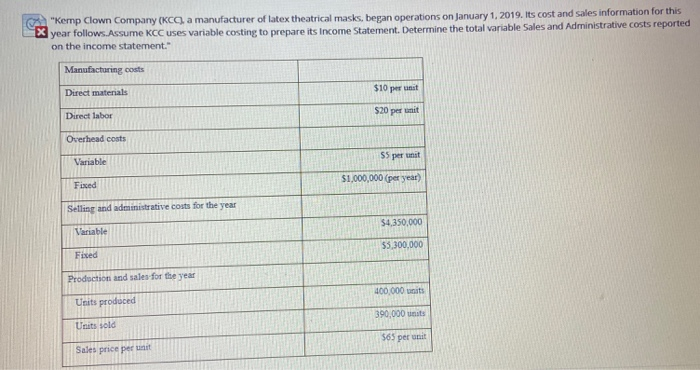

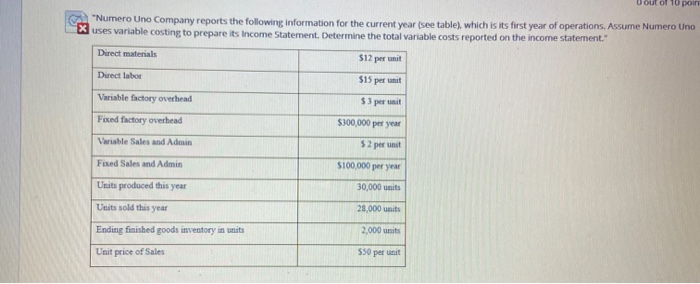

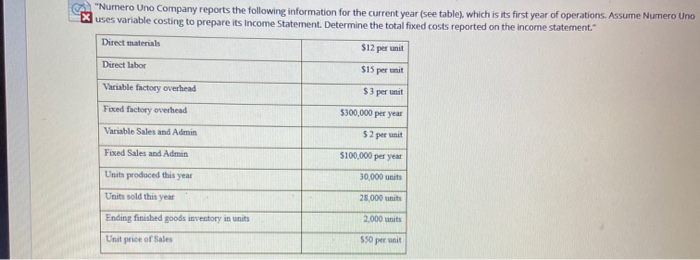

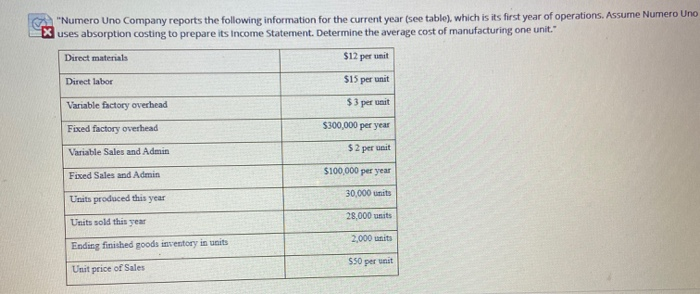

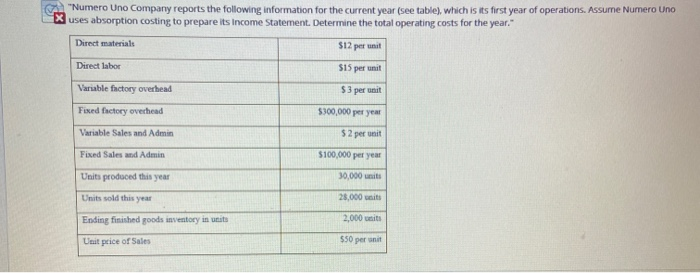

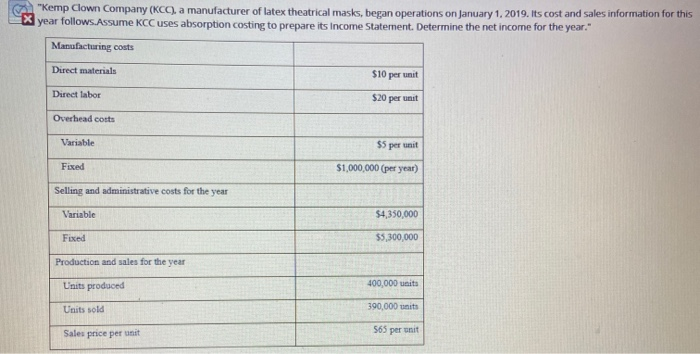

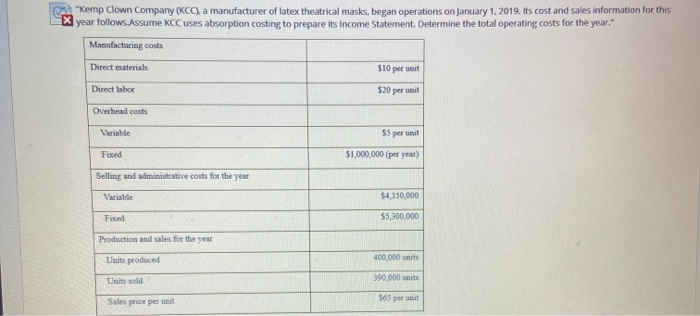

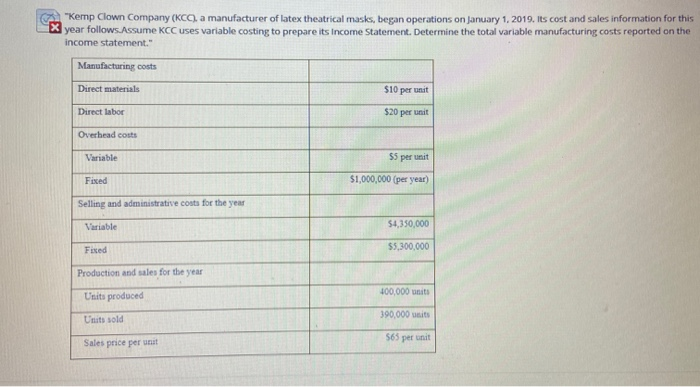

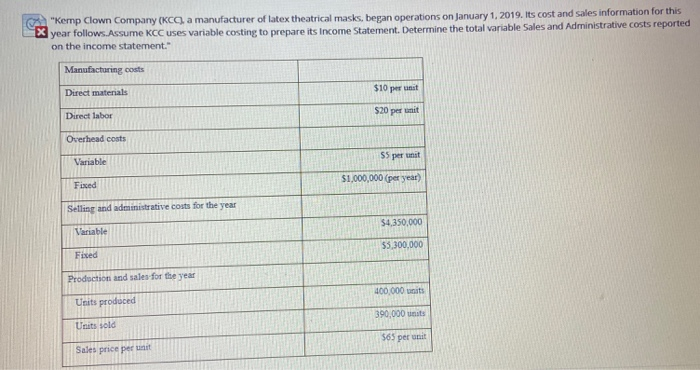

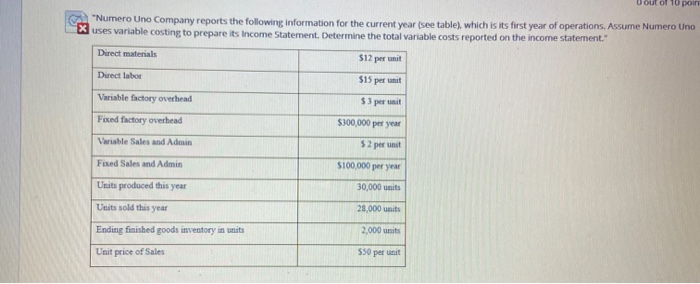

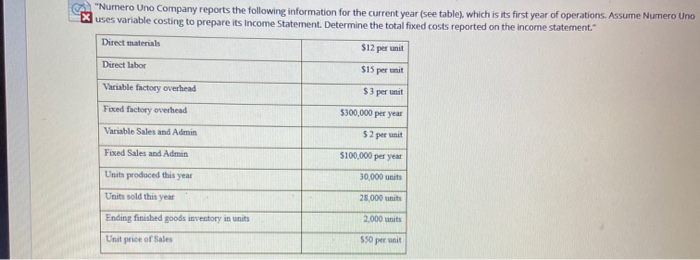

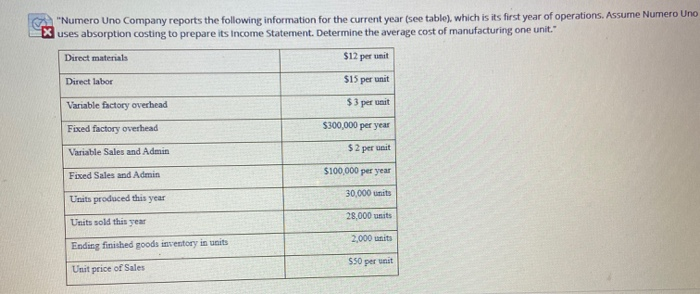

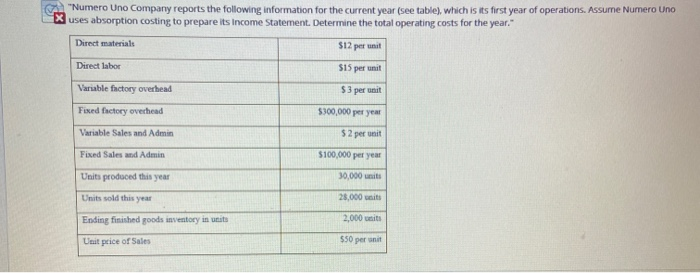

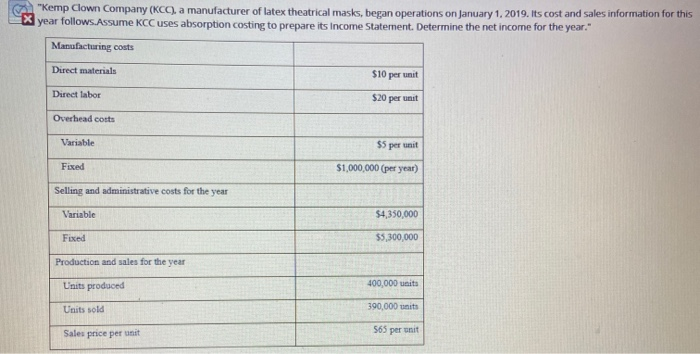

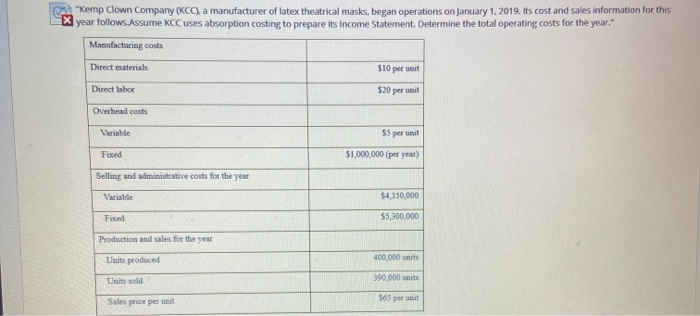

"Kemp Clown Company (KC), a manufacturer of latex theatrical masks, began operations on January 1, 2019. Its cost and sales information for this X year follows. Assume KCC uses variable costing to prepare its Income Statement. Determine the total variable manufacturing costs reported on the income statement." Manufacturing costs Direct materials $10 per Direct labor $20 per un Overhead costs Variable $5 per unit Fixed $1,000,000 (per year) Selling and administrative costs for the year Variable 54,350,000 $5,300,000 Fixed Production and sales for the year 400,000 Units produced 390,000 to Units sold 565 per unit Sales price per ut "Kemp Clown Company (KC), a manufacturer of latex theatrical masks, began operations on January 1, 2019. Its cost and sales information for this X year follows.Assume KCC uses variable costing to prepare its Income Statement. Determine the total variable Sales and Administrative costs reported on the income statement." Manufacturing costs Direct materials $10 per unit Direct labor $20 per unit Overhead costs Variable Fixed $1,000,000 (per year) Selling and administrative cos Variable $4,350,000 Ficed 55,300,000 Production and sales for the year Units produced 400,000 units 300.000 Units sold 565 per unit Sales price per unit "Numero Uno Company reports the following information for the current year (see table), which is its first year of operations. Assume Numero Uno Xuses variable costing to prepare its Income Statement. Determine the total variable costs reported on the income statement." Direct materials $12 per il Direct labor $15 per unit Variable factory overhead $ 3 perut Fixed factory overhead $300,000 per year Variable Sales and Admin 52 per unit Fixed Sales and Admin $100.000 per year Units produced this year 30,000 units Units sold this year 28,000 units Ending finished goods inventory in units 2.000 Unit price of Sales 550 per mit "Numero Uno Company reports the following information for the current year(see table), which is its first year of operations. Assume Numero Uno Xuses variable costing to prepare its Income Statement. Determine the total fixed costs reported on the income statement." Direct materials $12 per unit Direct labore $15 per unit Viable factory overhead 53 per unit Fixed factory overhead 5300,000 per year Variable Sales and Admin 52 per Fixed Sales and Admin $100,000 per year Units produced this year 30.000 Units sold this year 25,000 Ending finished goods inventory in units 2.000 units Unit price of Sales $50 per nit "Numero Uno Company reports the following information for the current year (see table), which is its first year of operations. Assume Numero Uno X uses absorption costing to prepare its Income Statement. Determine the average cost of manufacturing one unit." Direct materials $12 permit Direct labor $15 per unit Variable factory overhead $3 per unit Fixed factory overhead $300,000 per year Variable Sales and Admin Fred Sales and Admin $2 per unit $100,000 per year 30,000 units 28,000 units Units produced this year Units sold this year Endocg finished goods inventory in its 2,000 units Unit price of Sales $50 per unit A "Numero Uno Company reports the following information for the current year (see table), which is its first year of operations. Assume Numero Uno W uses absorption costing to prepare its Income Statement. Determine the total operating costs for the year." Direct materials S12 perunt Direct labor $15 per unit Variable factory overhead $ 3 perut Fixed factory overhead $300,000 per year Variable Sales and Admin $2 per unit Fixed Sales and Admin $100,000 per year Units produced this year 30,000 units Units sold this year 28,000 units Ending finished goods inventory in units 2.000 its Unit price of Sales $50 per unit "Kemp Clown Company (KCC), a manufacturer of latex theatrical masks, began operations on January 1, 2019. Its cost and sales information for this year follows.Assume KCC uses absorption costing to prepare its Income Statement. Determine the net income for the year." Manufacturing costs Direct materials $10 per unit Direct labor $20 per unit Overhead costs Variable $5 per unit $1,000,000 (per year) Fixed Selling and administrative costs for the year Variable $4,350,000 Fixed $5,300,000 Production and sales for the year tinits produced 400,000 units Units sold 390,000 units Sales price per unit 565 per unit al "Kemp Clown Company (KCC), a manufacturer of latex theatrical masks, began operations on January 1, 2019. Its cost and sales information for this year follows.Assume KCC uses absorption costing to prepare its Income Statement. Determine the total operating costs for the year." Manufacturing costs Direct materials $10 per unit Direct labor $20 permit Overhead costs Variable 55 per un Fixed $1,000,000 (per year) Selling and administrative costs for the year Variable 54,350,000 Fixed 55,300,000 Production and sales for the year Units produced 400,000 units Units sold 390,000 units Sales price per ut 565 per una