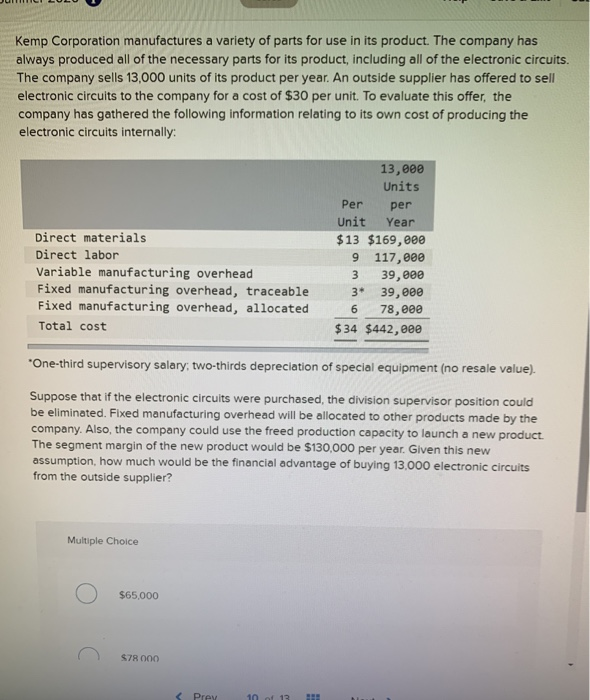

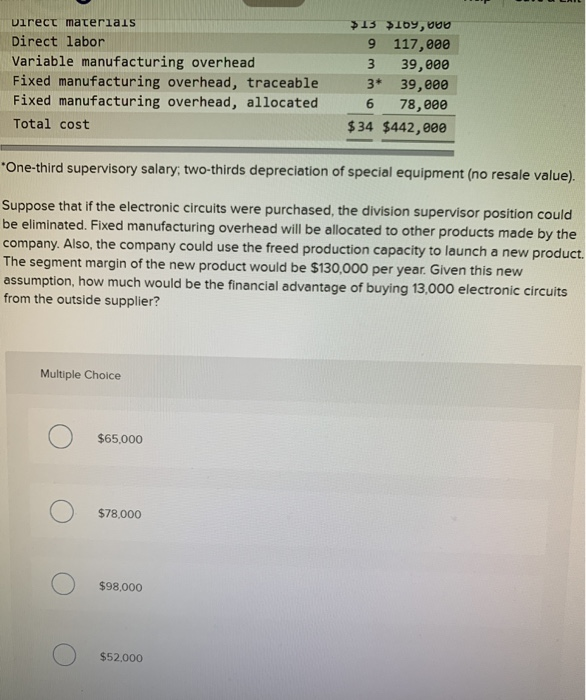

Kemp Corporation manufactures a variety of parts for use in its product. The company has always produced all of the necessary parts for its product, including all of the electronic circuits. The company sells 13,000 units of its product per year. An outside supplier has offered to sell electronic circuits to the company for a cost of $30 per unit. To evaluate this offer, the company has gathered the following information relating to its own cost of producing the electronic circuits internally: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead, traceable Fixed manufacturing overhead, allocated Total cost 13,000 Units Per per Unit Year $13 $169,000 9 117,000 3 39,000 3* 39,000 6 78,000 $ 34 $442,000 One-third supervisory salary, two-thirds depreciation of special equipment (no resale value). Suppose that if the electronic circuits were purchased, the division supervisor position could be eliminated. Fixed manufacturing overhead will be allocated to other products made by the company. Also, the company could use the freed production capacity to launch a new product. The segment margin of the new product would be $130,000 per year. Given this new assumption, how much would be the financial advantage of buying 13,000 electronic circuits from the outside supplier? Multiple Choice $65,000 $78 000 Prey in 13 SHE Direct materiais Direct labor Variable manufacturing overhead Fixed manufacturing overhead, traceable Fixed manufacturing overhead, allocated Total cost >13 >169,00 9 117,000 3 39,000 3* 39,000 6 78,000 $ 34 $442,000 'One-third supervisory salary, two-thirds depreciation of special equipment (no resale value). Suppose that if the electronic circuits were purchased, the division supervisor position could be eliminated. Fixed manufacturing overhead will be allocated to other products made by the company. Also, the company could use the freed production capacity to launch a new product. The segment margin of the new product would be $130,000 per year. Given this new assumption, how much would be the financial advantage of buying 13,000 electronic circuits from the outside supplier? Multiple Choice $65.000 $78,000 $98.000 $52.000