Answered step by step

Verified Expert Solution

Question

1 Approved Answer

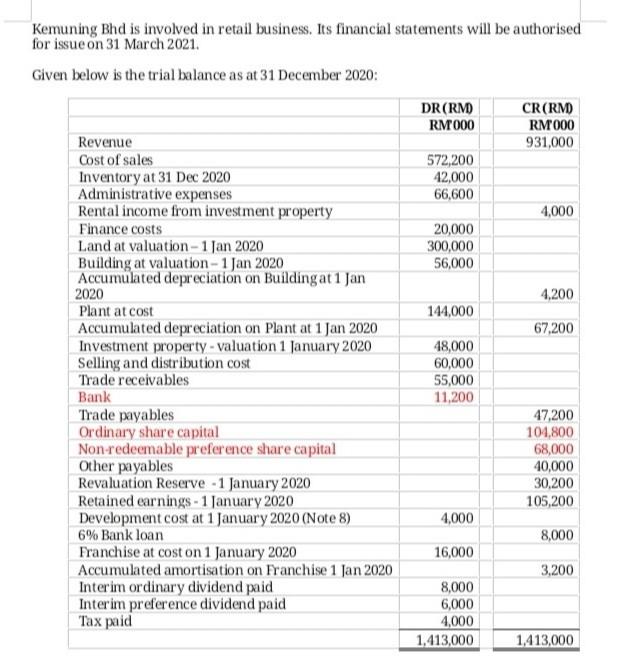

Kemuning Bhd is involved in retail business. Its financial statements will be authorised for issue on 31 March 2021. Given below is the trial balance

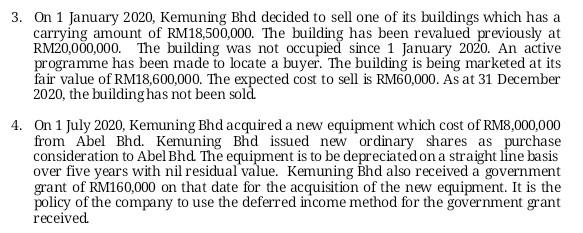

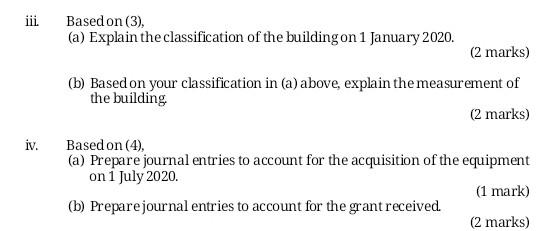

Kemuning Bhd is involved in retail business. Its financial statements will be authorised for issue on 31 March 2021. Given below is the trial balance as at 31 December 2020: DR(RMD CR(RM) RM000 RM000 Revenue 931,000 Cost of sales 572,200 Inventory at 31 Dec 2020 42,000 Administrative expenses 66,600 Rental income from investment property 4,000 Finance costs 20,000 Land at valuation - 1 Jan 2020 300,000 Building at valuation - 1 Jan 2020 56,000 Accumulated depreciation on Building at 1 Jan 2020 4,200 Plant at cost 144,000 Accumulated depreciation on Plart at 1 Jan 2020 67,200 Investment property-valuation 1 January 2020 48,000 Selling and distribution cost 60,000 Trade receivables 55,000 Bank 11,200 Trade payables 47,200 Ordinary share capital 104,800 Non-redeemable preference share capital 68,000 Other payables 40,000 Revaluation Reserve - 1 January 2020 30,200 Retained earnings - 1 January 2020 105,200 Development cost at 1 January 2020 (Note 8) 4,000 6% Bank loan 8,000 Franchise at cost on 1 January 2020 16,000 Accumulated amortisation on Franchise 1 Jan 2020 3,200 Interim ordinary dividend paid 8,000 Interim preference dividend paid 6,000 Tax paid 4,000 1,413,000 1,413,000 3. On 1 January 2020, Kemuning Bhd decided to sell one of its buildings which has a carrying amount of RM18,500,000. The building has been revalued previously at RM20,000,000. The building was not occupied since 1 January 2020. An active programme has been made to locate a buyer. The building is being marketed at its fair value of RM18,600,000. The expected cost to sell is RM60,000. As at 31 December 2020, the building has not been sold. 4. On 1 July 2020, Kemuning Bhd acquired a new equipment which cost of RM8,000,000 from Abel Bhd. Kemuning Bhd issued new ordinary shares as purchase consideration to Abel Bhd. The equipment is to be depreciated on a straight line basis over five years with nil residual value. Kemuning Bhd also received a government grant of RM160,000 on that date for the acquisition of the new equipment. It is the policy of the company to use the deferred income method for the government grant received iii. Based on (3), (a) Explain the classification of the building on 1 January 2020. (2 marks) iv. (b) Based on your classification in (a)above, explain the measurement of the building (2 marks) Based on (4), (a) Prepare journal entries to account for the acquisition of the equipment on 1 July 2020. (1 mark) (b) Prepare journal entries to account for the grant received (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started