Question

Ken is 63 years old and unmarried. He retired at age 55 when he sold his business, Understock.com. Though Ken is retired, he is still

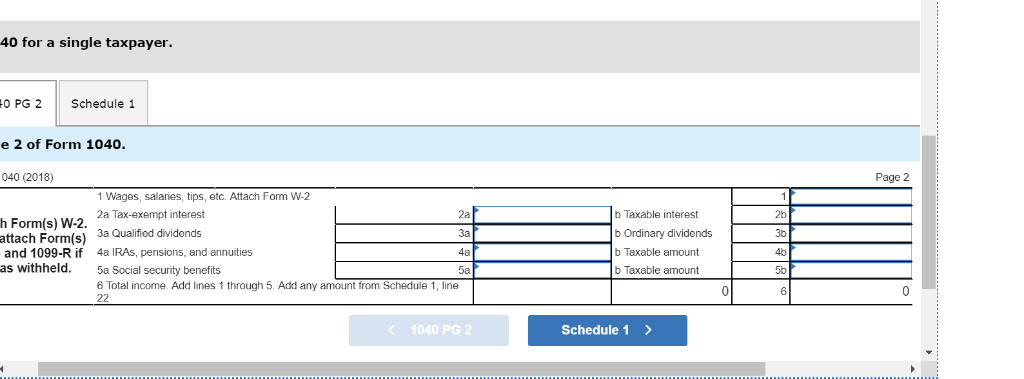

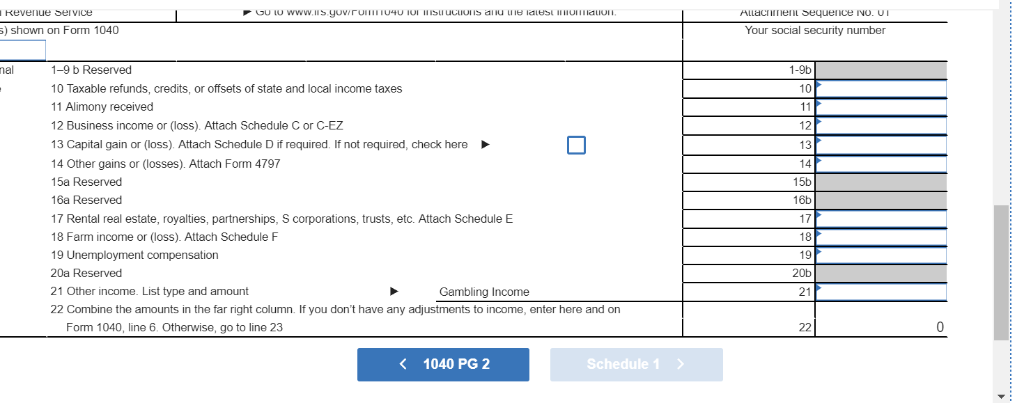

Ken is 63 years old and unmarried. He retired at age 55 when he sold his business, Understock.com. Though Ken is retired, he is still very active. Ken reported the following financial information this year. Assume Ken files as a single taxpayer. Determine Kens gross income and complete page 2 of Form 1040 (through line 6) and Schedule 1 for Ken.

Ken is 63 years old and unmarried. He retired at age 55 when he sold his business, Understock.com. Though Ken is retired, he is still very active. Ken reported the following financial information this year. Assume Ken files as a single taxpayer. Determine Kens gross income and complete page 2 of Form 1040 (through line 6) and Schedule 1 for Ken.

- Ken won $1,200 in an illegal game of poker (the game was played in Utah, where gambling is illegal).

- Ken sold 1,000 shares of stock for $32 a share. He inherited the stock two years ago. His tax basis (or investment) in the stock was $31 per share.

- Ken received $25,000 from an annuity he purchased eight years ago. He purchased the annuity, to be paid annually for 20 years, for $210,000.

- Ken received $13,000 in disability benefits for the year. He purchased the disability insurance policy last year.

- Ken decided to go back to school to learn about European history. He received a $500 cash scholarship to attend. He used $300 to pay for his books and tuition, and he applied the rest toward his new car payment.

- Kens son, Mike, instructed his employer to make half of his final paycheck of the year payable to Ken as a gift from Mike to Ken. Ken received the check on December 30 in the amount of $1,100.

- Ken received a $610 refund of the $3,600 in state income taxes his employer withheld from his pay last year. Ken claimed $6,400 in itemized deductions last year (the standard deduction for a single filer was $6,350).

- Ken received $30,000 of interest from corporate bonds and money market accounts.

Complete page 2 of Form 1040, Line 1-6 and Form 1040, Schedule 1, Lines 1-22 for Ken.

(Input all the values as positive numbers. Enter any non-financial information, (e.g. Names, Addresses, social security numbers) EXACTLY as they appear in any given information or Problem Statement. Use 2018 tax laws.)

Kevenue Servic GU IU www.lis yuvru""IU4U IU' "isliuulu"s aliu uiales! "ii U"..aliu" AllacTiient Sequence NO. UI Your social security number shown on Form 1040 1-9 b Reserved 10 Taxable refunds, credits, or offsets of state and local income taxes 11 Alimony received 12 Business income or (loss). Attach Schedule C or C-EZ 13 Capital gain or (loss). Attach Schedule D if required. If not required, check here 14 Other gains or (losses). Attach Form 4797 15a Reserved 16a Reserved 17 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 18 Farm income or (loss). Attach Schedule F 1-9b 10 nal 12 13 15b 16b 17 18 20a Reserved 21 Other income. List type and amount 22 Combine the amounts in the far right column. If you don't have any adjustments to income, enter here and on 20b Gambling Income Form 1040, line 6. Otherwise, go to line 23Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started