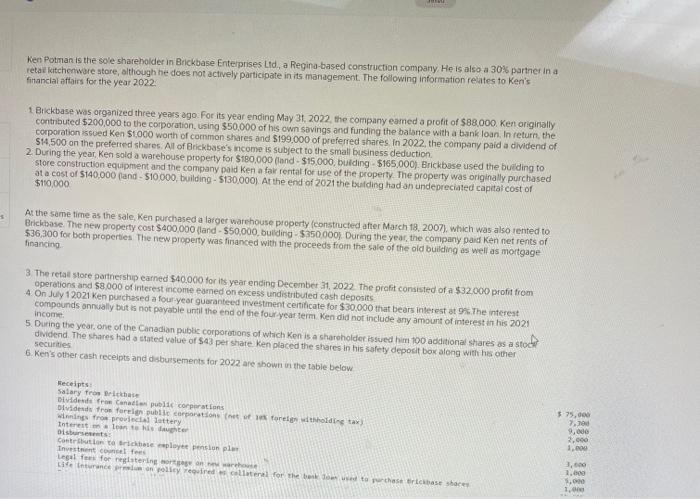

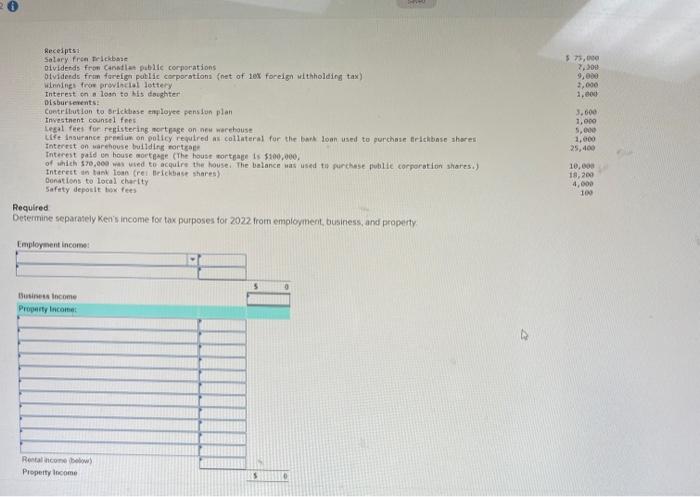

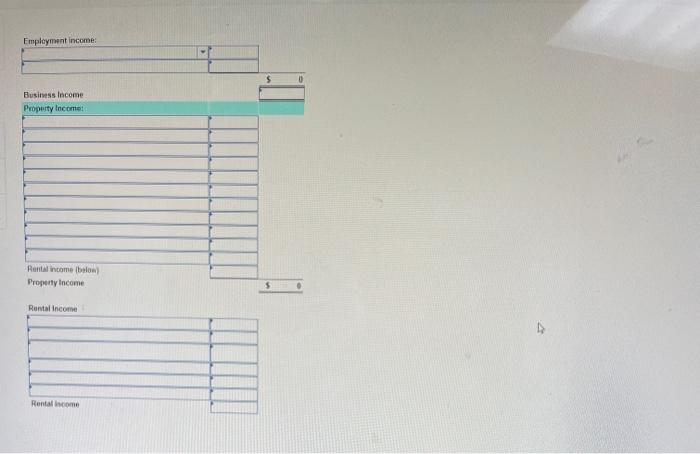

Ken Potman is the sole shareholder in Brickbase Enterprises Lid, a Regina-based construction company He is also a 3035 partner in a retae kitchionware store, although he does not actively participate in its management. The following information reates to Ken's financlal aftairs for the year 2022 . 1. Bichtbase was arganized three yeass ago. For its year ending May 31, 2022, the company eamed a protit of $88.000. Ken oniginally contributed $200,000 to the corporation. using $50.000 of his own savings and funding the balarice with a bank loan. In return, the corporation issued Ken $1,000 worth of common shares and $199,000 of preferred shares in 2022 , the company paid a dividend of. \$14,500 an the prefented shares. Al of Brickbose's ncome is subject to the small business deduction. 2. During the year, Ken sold a warehouse property for $180,000 (land - $15,000, bulding - $165,000 ). Erickbuse used the buiding to store construction equipment and the company paid Ken a far rental for use of the property. The property was originally purchased at a cost of $140,000 (land - $10000, building - $130,000). At the end of 2021 the bulding hadan undeprecialed capital cost of $10,000 At the same time as the sale, Ken purchased a larger warchouse property (constructed after March 19, 2007), which was also rented to Brichbase. The new property cost $400,000 (land - $50,000. bulding - $350,000. During the year, the company paid Ken net rents of $36,300 for both properties The new property was financed with the proceeds from the sale of the old building as well as mortgage financing. 3. The real store partnership earned $40.000 for its year ending December 31,2022 . The profit consisted of a $32,000profit from operations and $9,000 of interest income eamed on excess undistributed cash deposits 4. On July 12021 Ken purchesed a four-yeor guaranteed investinent ceititicate for $30,000 that beers interest at 9$. The intereat compounds annually but is not payable until the end of the fouryearterm. Ken did not include any amount of interest in his 2021 5. During the year, one of the Canadian pubic corporations of which Ken is a sharoholdecissued him 100 additional stares as a stoch dividend. The shares had a stated value of $43 per state Ken placed the shares in his safety deposit bax aleng with his other securities 6. Ken's other cash recelpts and disbulsements for 2022 are shown in the table below. Recedptsi Solary frem trickbse olvidetds from Cansalat publile corporatjons Dtvideeds fran farefigr poblic cocporattona (net of 10x foreigh witholding tax) winningl fraw provinclal lottery Interest on a lone to his daighter Disbursenents: contriltutlon to Srickbose enployec-pension plan Investnent counsel fees Lesal fees for registering nortgage on meu morehouse Life Inaurance preelum on policy repuired as collateral for the bark loan used to gurchose frichbase ahores totertit on warehovie bullding nortsage Tnterest paie en house aor teage (The house nortpage is 5100,000 . of which 370,000 mal wied to acquire the house. The batance was used tis purchase publite corporation shares,) Interett an tank toan (rei Deickbase shares) Conations to local charity Safety depoult twoxifees equlfect eetermine separately Reis income for tak purposes for 2022 . from emplogment, business, and property. Empleyment income: Business lncome Property Income: Rental Inconne Ken Potman is the sole shareholder in Brickbase Enterprises Lid, a Regina-based construction company He is also a 3035 partner in a retae kitchionware store, although he does not actively participate in its management. The following information reates to Ken's financlal aftairs for the year 2022 . 1. Bichtbase was arganized three yeass ago. For its year ending May 31, 2022, the company eamed a protit of $88.000. Ken oniginally contributed $200,000 to the corporation. using $50.000 of his own savings and funding the balarice with a bank loan. In return, the corporation issued Ken $1,000 worth of common shares and $199,000 of preferred shares in 2022 , the company paid a dividend of. \$14,500 an the prefented shares. Al of Brickbose's ncome is subject to the small business deduction. 2. During the year, Ken sold a warehouse property for $180,000 (land - $15,000, bulding - $165,000 ). Erickbuse used the buiding to store construction equipment and the company paid Ken a far rental for use of the property. The property was originally purchased at a cost of $140,000 (land - $10000, building - $130,000). At the end of 2021 the bulding hadan undeprecialed capital cost of $10,000 At the same time as the sale, Ken purchased a larger warchouse property (constructed after March 19, 2007), which was also rented to Brichbase. The new property cost $400,000 (land - $50,000. bulding - $350,000. During the year, the company paid Ken net rents of $36,300 for both properties The new property was financed with the proceeds from the sale of the old building as well as mortgage financing. 3. The real store partnership earned $40.000 for its year ending December 31,2022 . The profit consisted of a $32,000profit from operations and $9,000 of interest income eamed on excess undistributed cash deposits 4. On July 12021 Ken purchesed a four-yeor guaranteed investinent ceititicate for $30,000 that beers interest at 9$. The intereat compounds annually but is not payable until the end of the fouryearterm. Ken did not include any amount of interest in his 2021 5. During the year, one of the Canadian pubic corporations of which Ken is a sharoholdecissued him 100 additional stares as a stoch dividend. The shares had a stated value of $43 per state Ken placed the shares in his safety deposit bax aleng with his other securities 6. Ken's other cash recelpts and disbulsements for 2022 are shown in the table below. Recedptsi Solary frem trickbse olvidetds from Cansalat publile corporatjons Dtvideeds fran farefigr poblic cocporattona (net of 10x foreigh witholding tax) winningl fraw provinclal lottery Interest on a lone to his daighter Disbursenents: contriltutlon to Srickbose enployec-pension plan Investnent counsel fees Lesal fees for registering nortgage on meu morehouse Life Inaurance preelum on policy repuired as collateral for the bark loan used to gurchose frichbase ahores totertit on warehovie bullding nortsage Tnterest paie en house aor teage (The house nortpage is 5100,000 . of which 370,000 mal wied to acquire the house. The batance was used tis purchase publite corporation shares,) Interett an tank toan (rei Deickbase shares) Conations to local charity Safety depoult twoxifees equlfect eetermine separately Reis income for tak purposes for 2022 . from emplogment, business, and property. Empleyment income: Business lncome Property Income: Rental Inconne