Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kencana Bhd has been listed for the past 15 years at Bursa Malaysia. At present, the company's level of debt to total assets ratio

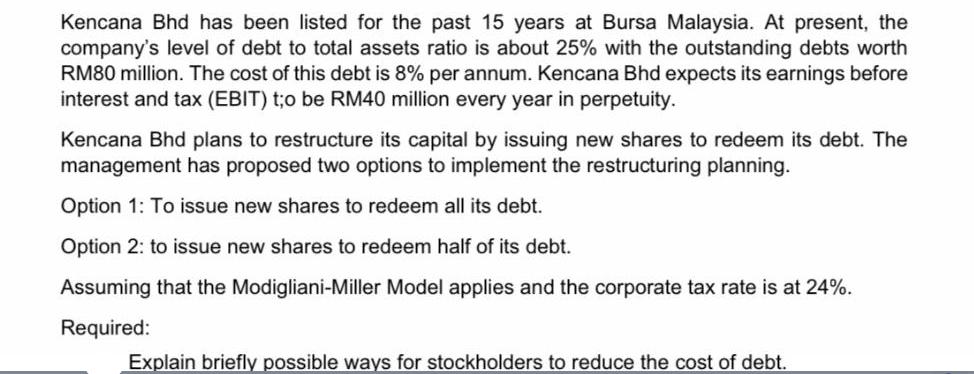

Kencana Bhd has been listed for the past 15 years at Bursa Malaysia. At present, the company's level of debt to total assets ratio is about 25% with the outstanding debts worth RM80 million. The cost of this debt is 8% per annum. Kencana Bhd expects its earnings before interest and tax (EBIT) t;o be RM40 million every year in perpetuity. Kencana Bhd plans to restructure its capital by issuing new shares to redeem its debt. The management has proposed two options to implement the restructuring planning. Option 1: To issue new shares to redeem all its debt. Option 2: to issue new shares to redeem half of its debt. Assuming that the Modigliani-Miller Model applies and the corporate tax rate is at 24%. Required: Explain briefly possible ways for stockholders to reduce the cost of debt.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Stockholders can employ several strategies to reduce the cost of debt 1 Refinancing Refinancing existing debt at a lower interest rate is one of the m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started