Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been assigned to establish a portfolio for your clients, Encik Azmi and Puan Aini. Encik Azmi has a risk tolerance of 20

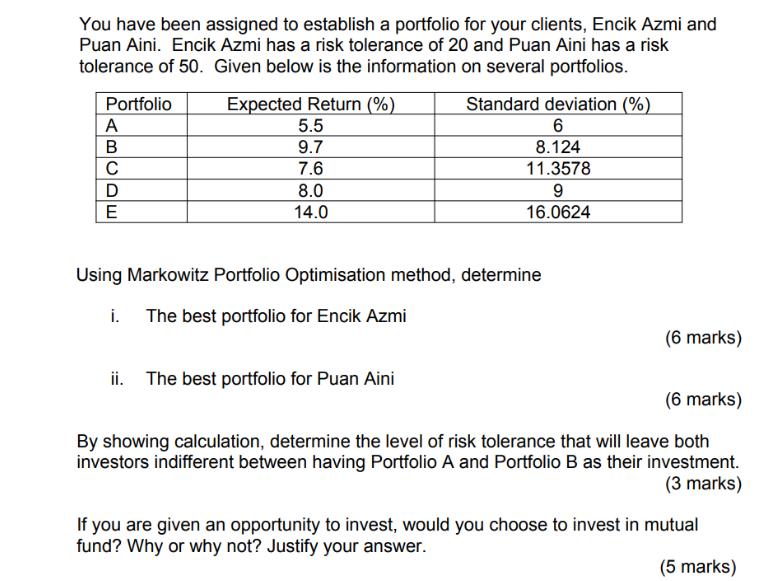

You have been assigned to establish a portfolio for your clients, Encik Azmi and Puan Aini. Encik Azmi has a risk tolerance of 20 and Puan Aini has a risk tolerance of 50. Given below is the information on several portfolios. Portfolio A B C D E Expected Return (%) 5.5 9.7 7.6 8.0 14.0 Standard deviation (%) 6 8.124 11.3578 9 16.0624 Using Markowitz Portfolio Optimisation method, determine i. The best portfolio for Encik Azmi ii. The best portfolio for Puan Aini (6 marks) (6 marks) By showing calculation, determine the level of risk tolerance that will leave both investors indifferent between having Portfolio A and Portfolio B as their investment. (3 marks) If you are given an opportunity to invest, would you choose to invest in mutual fund? Why or why not? Justify your answer. (5 marks)

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

i Using the Markowitz Portfolio Optimization method calculate the riskreturn tradeoffs for each portfolio as follows Portfolio A Expected Return A 55 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started