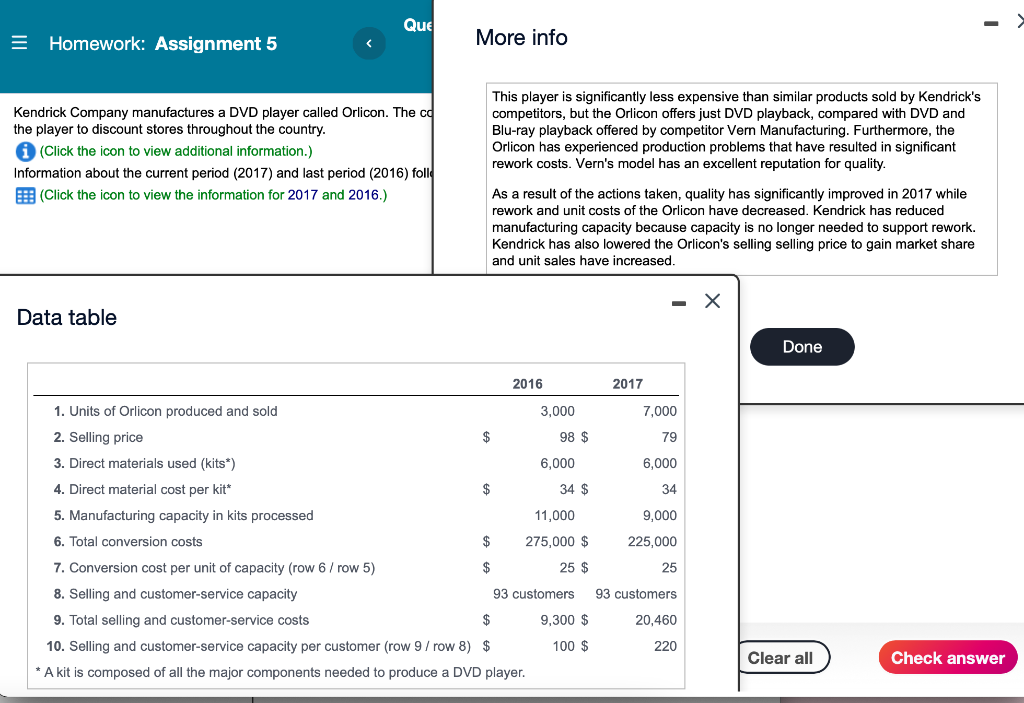

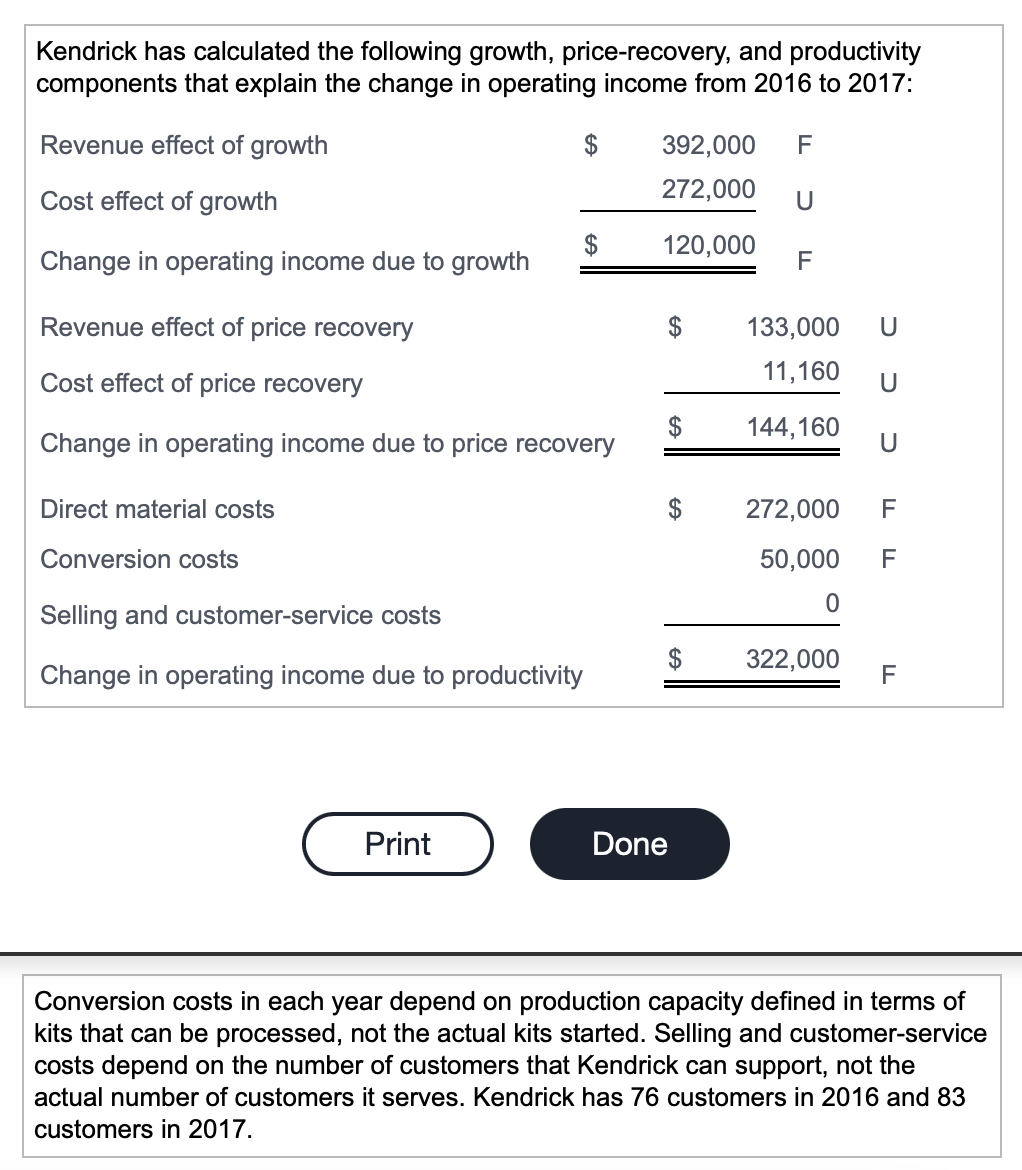

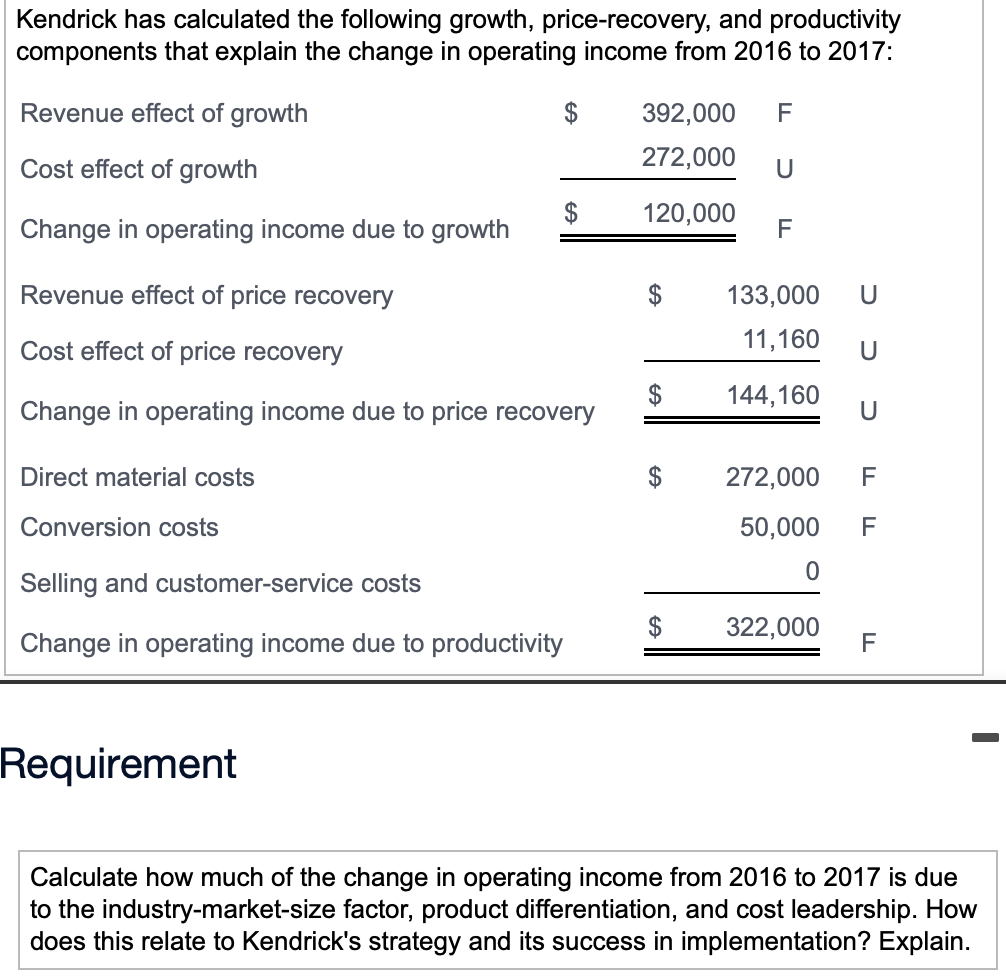

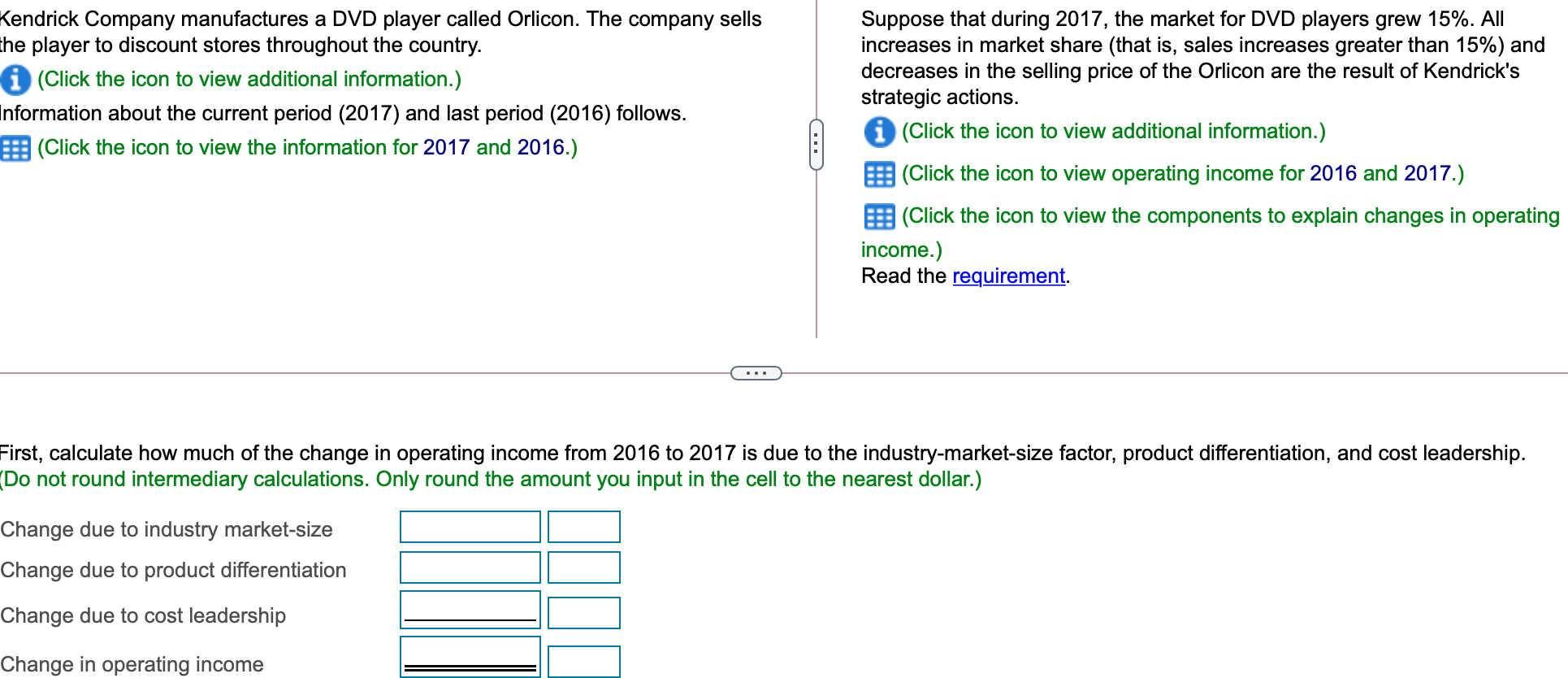

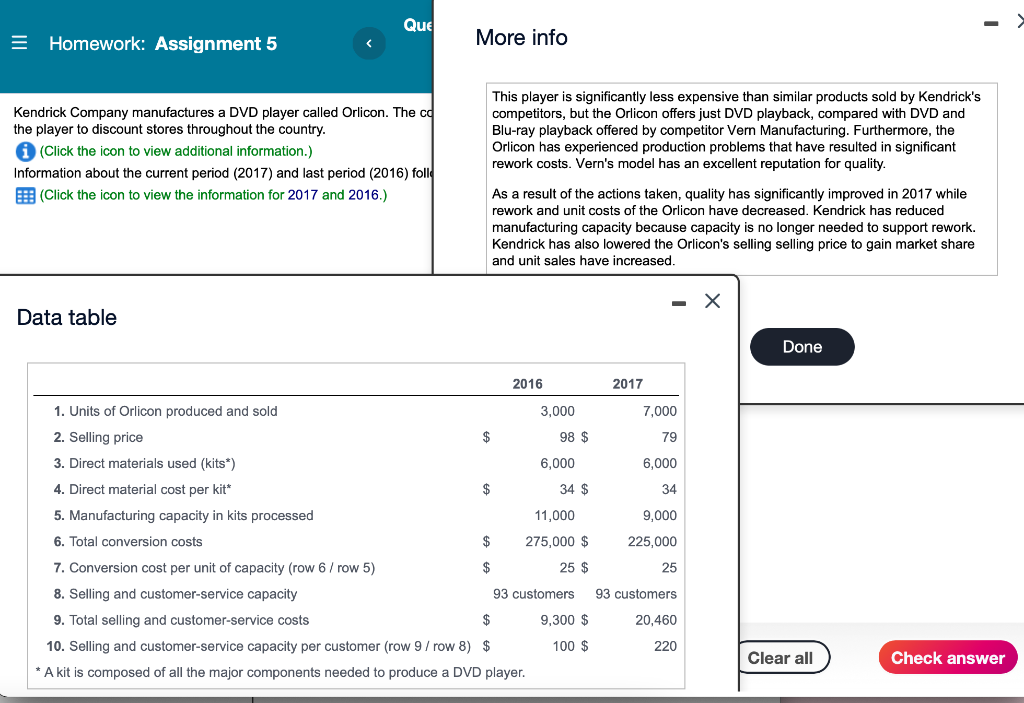

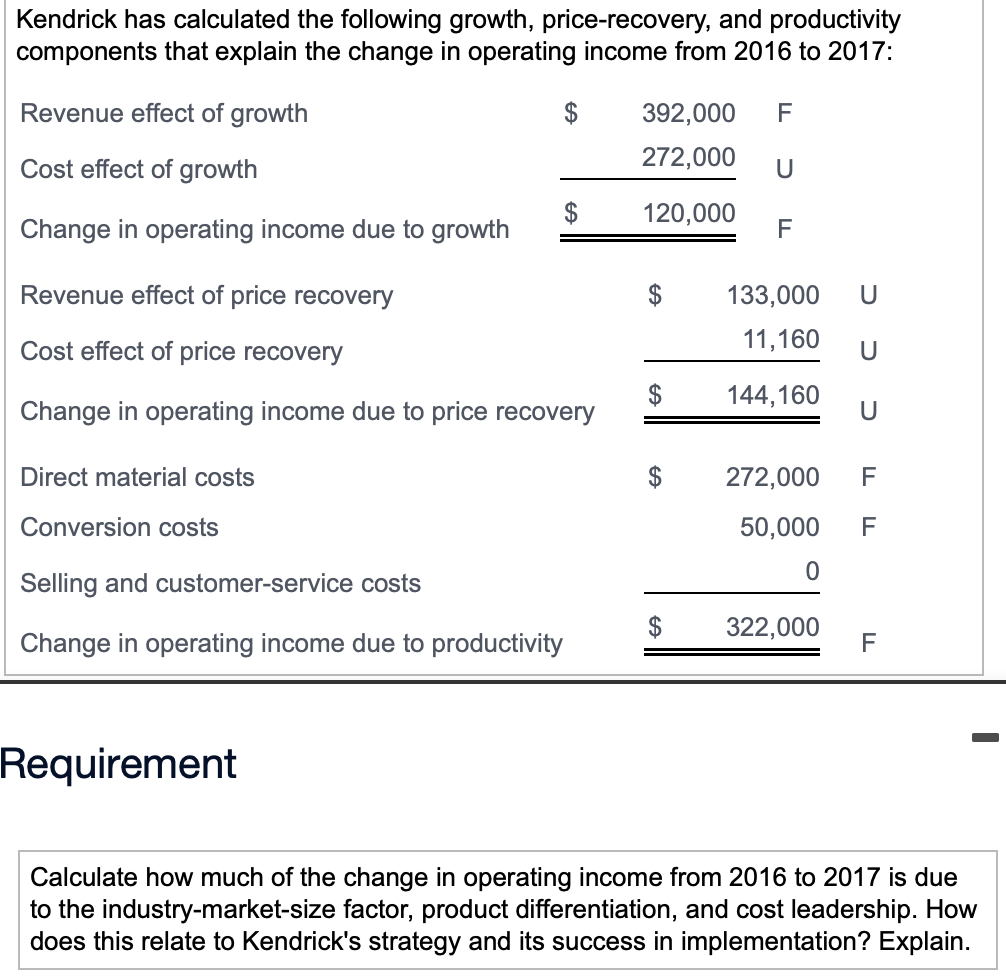

Kendrick Company manufactures a DVD player called Orlicon. The company sells the player to discount stores throughout the country. (Click the icon to view additional information.) Information about the current period (2017) and last period (2016) follows. (Click the icon to view the information for 2017 and 2016.) Suppose that during 2017, the market for DVD players grew 15%. All increases in market share (that is, sales increases greater than 15%) and decreases in the selling price of the Orlicon are the result of Kendrick's strategic actions. (Click the icon to view additional information.) (Click the icon to view operating income for 2016 and 2017.) (Click the icon to view the components to explain changes in operating income.) Read the requirement. First, calculate how much of the change in operating income from 2016 to 2017 is due to the industry-market-size factor, product differentiation, and cost leadership. (Do not round intermediary calculations. Only round the amount you input in the cell to the nearest dollar.) Change due to industry market-size Change due to product differentiation Change due to cost leadership Change in operating income Que = III Homework: Assignment 5 More info Kendrick Company manufactures a DVD player called Orlicon. The ca the player to discount stores throughout the country. (Click the icon to view additional information.) Information about the current period (2017) and last period (2016) folie E: (Click the icon to view the information for 2017 and 2016.) This player is significantly less expensive than similar products sold by Kendrick's competitors, but the Orlicon offers just DVD playback, compared with DVD and Blu-ray playback offered by competitor Ver Manufacturing. Furthermore, the Orlicon has experienced production problems that have resulted in significant rework costs. Vern's model has an excellent reputation for quality. As a result of the actions taken, quality has significantly improved in 2017 while rework and unit costs of the Orlicon have decreased. Kendrick has reduced manufacturing capacity because capacity is no longer needed to support rework. Kendrick has also lowered the Orlicon's selling selling price to gain market share and unit sales have increased. - Data table Done 2016 2017 3,000 7,000 $ 98 $ 79 6,000 6,000 1. Units of Orlicon produced and sold 2. Selling price 3. Direct materials used (kits*) 4. Direct material cost per kit* 5. Manufacturing capacity in kits processed 6. Total conversion costs $ 34 $ 34 11,000 9,000 $ 275,000 $ 225,000 25 93 customers 7. Conversion cost per unit of capacity (row 6 / row 5) $ 25 $ 8. Selling and customer-service capacity 93 customers 9. Total selling and customer-service costs $ 9,300 $ 10. Selling and customer-service capacity per customer (row 9 / row 8) $ 100 $ * A kit is composed of all the major components needed to produce a DVD player. 20,460 220 Clear all Check answer Kendrick has calculated the following growth, price-recovery, and productivity components that explain the change in operating income from 2016 to 2017: Revenue effect of growth $ F 392,000 272,000 Cost effect of growth U $ 120,000 Change in operating income due to growth F Revenue effect of price recovery $ U 133,000 11,160 Cost effect of price recovery U $ 144,160 Change in operating income due to price recovery U Direct material costs $ 272,000 F Conversion costs 50,000 F 0 Selling and customer-service costs $ 322,000 Change in operating income due to productivity F Print Done Conversion costs in each year depend on production capacity defined in terms of kits that can be processed, not the actual kits started. Selling and customer-service costs depend on the number of customers that Kendrick can support, not the actual number of customers it serves. Kendrick has 76 customers in 2016 and 83 customers in 2017. Kendrick has calculated the following growth, price-recovery, and productivity components that explain the change in operating income from 2016 to 2017: Revenue effect of growth F 392,000 272,000 Cost effect of growth U $ 120,000 Change in operating income due to growth F Revenue effect of price recovery $ U 133,000 11,160 Cost effect of price recovery U $ 144,160 Change in operating income due to price recovery U Direct material costs 272,000 F Conversion costs 50,000 F 0 Selling and customer-service costs $ 322,000 Change in operating income due to productivity F Requirement Calculate how much of the change in operating income from 2016 to 2017 is due to the industry-market-size factor, product differentiation, and cost leadership. How does this relate to Kendrick's strategy and its success in implementation? Explain