Answered step by step

Verified Expert Solution

Question

1 Approved Answer

KENDS CO. issued 10%, 3-year, 1,000,000 convertible bonds at 105 . Each 1,000 peso bond is convertible into 8 shares with par value of 100

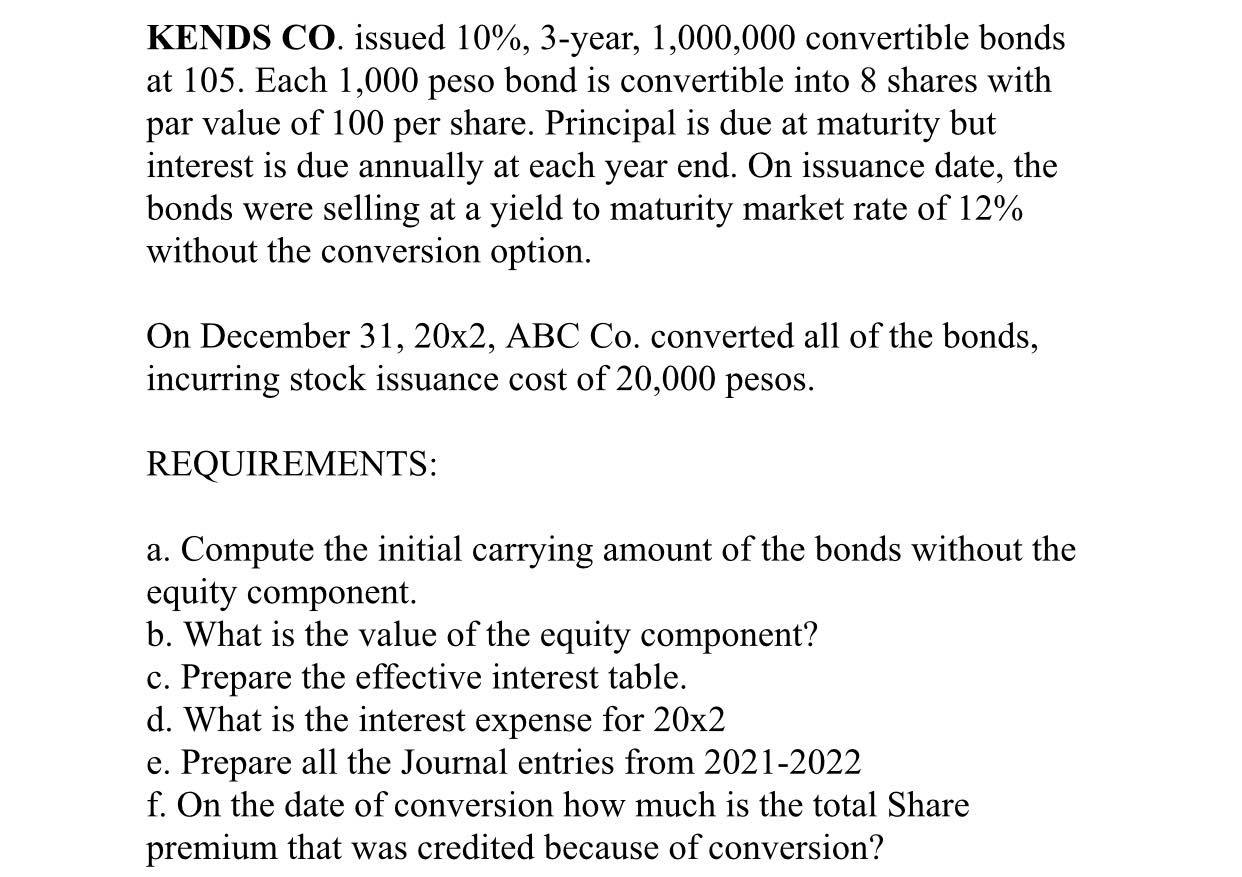

KENDS CO. issued 10\%, 3-year, 1,000,000 convertible bonds at 105 . Each 1,000 peso bond is convertible into 8 shares with par value of 100 per share. Principal is due at maturity but interest is due annually at each year end. On issuance date, the bonds were selling at a yield to maturity market rate of 12% without the conversion option. On December 31,202, ABC Co. converted all of the bonds, incurring stock issuance cost of 20,000 pesos. REQUIREMENTS: a. Compute the initial carrying amount of the bonds without the equity component. b. What is the value of the equity component? c. Prepare the effective interest table. d. What is the interest expense for 202 e. Prepare all the Journal entries from 2021-2022 f. On the date of conversion how much is the total Share premium that was credited because of conversion

KENDS CO. issued 10\%, 3-year, 1,000,000 convertible bonds at 105 . Each 1,000 peso bond is convertible into 8 shares with par value of 100 per share. Principal is due at maturity but interest is due annually at each year end. On issuance date, the bonds were selling at a yield to maturity market rate of 12% without the conversion option. On December 31,202, ABC Co. converted all of the bonds, incurring stock issuance cost of 20,000 pesos. REQUIREMENTS: a. Compute the initial carrying amount of the bonds without the equity component. b. What is the value of the equity component? c. Prepare the effective interest table. d. What is the interest expense for 202 e. Prepare all the Journal entries from 2021-2022 f. On the date of conversion how much is the total Share premium that was credited because of conversion Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started