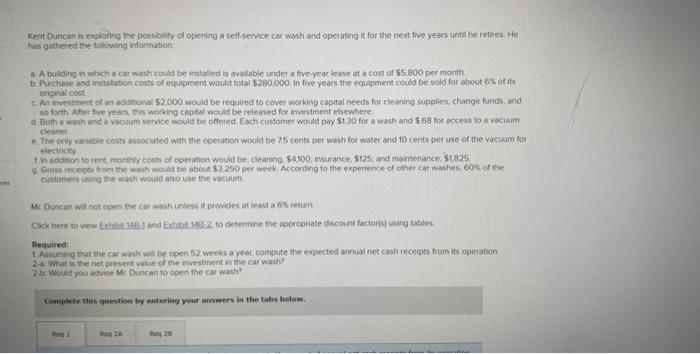

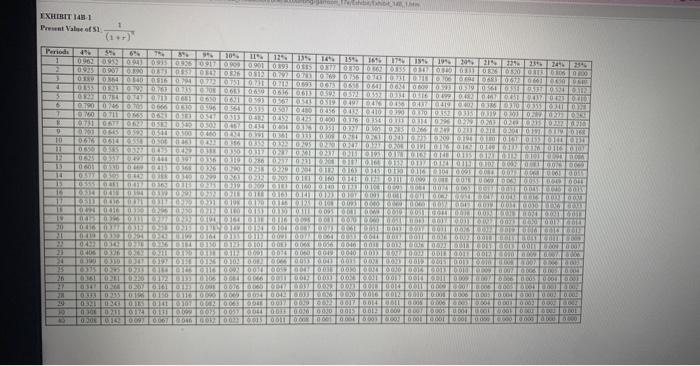

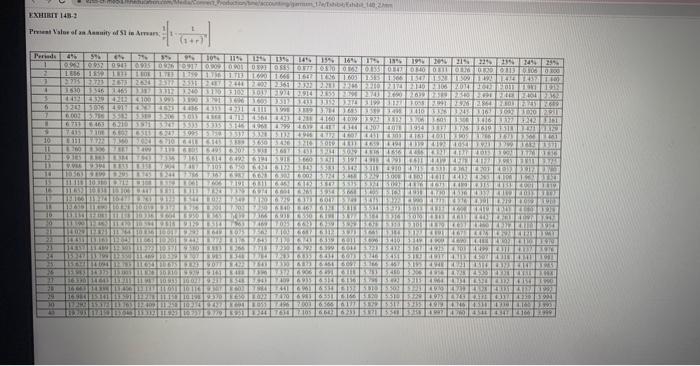

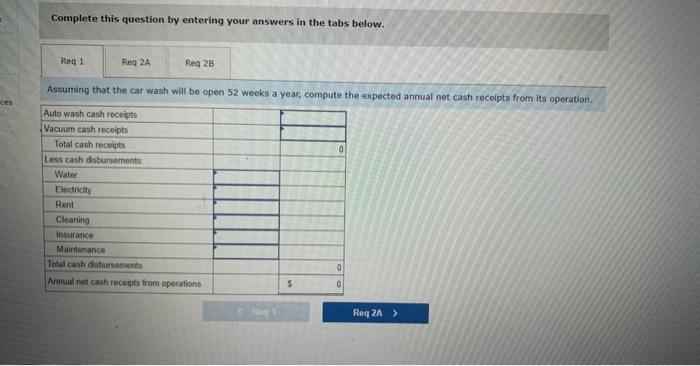

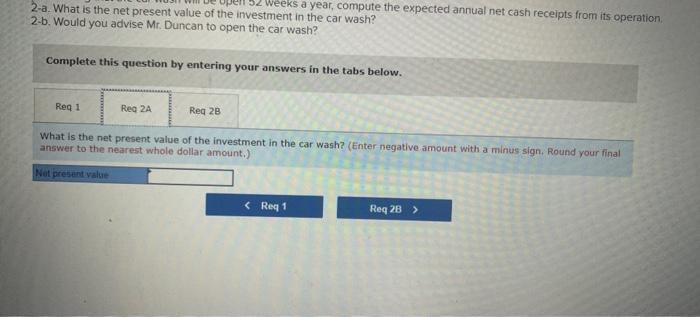

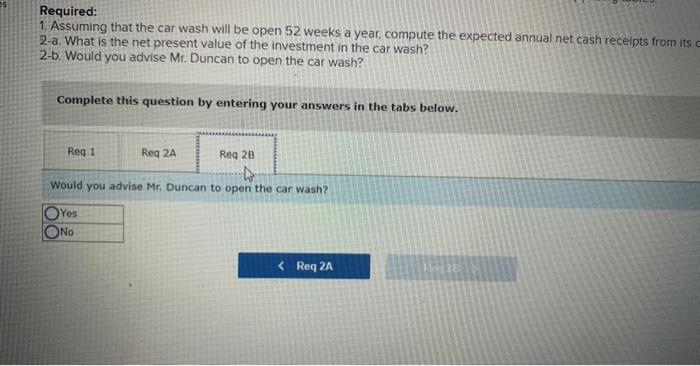

Kent Duacan is cxplocing the possibiaty of opening a self-service car wash and operating it for the next five years until he retires. He has gathered the followng eforination. a. A buiding t which a cor wath could be installed is avolsbie under a treverer lease at a cost of 55,800 per month b. Purchase and irnatatabon costs of equigment would votal $280.000 in five years the equagenent cocild be sold for bbout 67 of its. oripenal cont. C Ap ifvestment of an additional $2000 would be required to cover working capital needs for clearing supplies, change funds, and so farth. Aher frue years this working caphal would be released for atvestment etsewtiere d. Doth a wash and a vacuum service would be offered Each costomer would poy 5130 for a wash and 568 for accest to a vaciam. cleanes e. The orly vanabie costs associated with the operotion would be 74 cents per wain for water and 10 cents per use of the vaciaum for f in eddition to rent monthly costs of ogeration would be: clearing. 54.400 , insurance. 5125 and mainsenance. 51.225 9. Gros teceiphi from the wan woidd be about 53,250 per week. According to the experience of other car washes, 60% of the cukborters inang the wanh woudd also use the vacium. Mi. Duncah will not agen the car wadt untess it provides at least a 6 wreturn Cack here to view Extibli 148. 1 and Eetibit MAlz to determine the appropiate discoun factor(s) asing tables. Required: t. Assurting that the car wash will be open 52 weeks a year, compute the expected annual net cash receipts from its operation. 2. What is the net pieient watie of the investinent in the car wash? 2 th Would you advise Mr. Duncan to open the car wash? Canculete this question by nutering your answers in the tabs hefow. I XHHTT I41-1 Porsent Valee ot 51(1++)T1 11[1+1+11+11] Complete this question by entering your answers in the tabs below. Assuming that the car wash will be open 52 weeks a year, compute the expected annual net cash receipts from its operation. 2-a. What is the net present value of the investment in thear, compute the expected annual net cash receipts from its operation 2-b. Would you advise Mr. Duncan to open the car wash? Complete this question by entering your answers in the tabs below. What is the net present value of the investment in the car wash? (Enter negative amount with a minus sign, Round your final answer to the nearest whole dollar amount.) Required: 1. Assuming that the car wash will be open 52 weeks a year, compute the expected annual net cash receipts from its 2-a. What is the net present value of the investment in the car wash? 2-b. Would you advise Mr. Duncan to open the car wash? Complete this question by entering your answers in the tabs below. Would you advise Mr. Duncan to open the car wash? Kent Duacan is cxplocing the possibiaty of opening a self-service car wash and operating it for the next five years until he retires. He has gathered the followng eforination. a. A buiding t which a cor wath could be installed is avolsbie under a treverer lease at a cost of 55,800 per month b. Purchase and irnatatabon costs of equigment would votal $280.000 in five years the equagenent cocild be sold for bbout 67 of its. oripenal cont. C Ap ifvestment of an additional $2000 would be required to cover working capital needs for clearing supplies, change funds, and so farth. Aher frue years this working caphal would be released for atvestment etsewtiere d. Doth a wash and a vacuum service would be offered Each costomer would poy 5130 for a wash and 568 for accest to a vaciam. cleanes e. The orly vanabie costs associated with the operotion would be 74 cents per wain for water and 10 cents per use of the vaciaum for f in eddition to rent monthly costs of ogeration would be: clearing. 54.400 , insurance. 5125 and mainsenance. 51.225 9. Gros teceiphi from the wan woidd be about 53,250 per week. According to the experience of other car washes, 60% of the cukborters inang the wanh woudd also use the vacium. Mi. Duncah will not agen the car wadt untess it provides at least a 6 wreturn Cack here to view Extibli 148. 1 and Eetibit MAlz to determine the appropiate discoun factor(s) asing tables. Required: t. Assurting that the car wash will be open 52 weeks a year, compute the expected annual net cash receipts from its operation. 2. What is the net pieient watie of the investinent in the car wash? 2 th Would you advise Mr. Duncan to open the car wash? Canculete this question by nutering your answers in the tabs hefow. I XHHTT I41-1 Porsent Valee ot 51(1++)T1 11[1+1+11+11] Complete this question by entering your answers in the tabs below. Assuming that the car wash will be open 52 weeks a year, compute the expected annual net cash receipts from its operation. 2-a. What is the net present value of the investment in thear, compute the expected annual net cash receipts from its operation 2-b. Would you advise Mr. Duncan to open the car wash? Complete this question by entering your answers in the tabs below. What is the net present value of the investment in the car wash? (Enter negative amount with a minus sign, Round your final answer to the nearest whole dollar amount.) Required: 1. Assuming that the car wash will be open 52 weeks a year, compute the expected annual net cash receipts from its 2-a. What is the net present value of the investment in the car wash? 2-b. Would you advise Mr. Duncan to open the car wash? Complete this question by entering your answers in the tabs below. Would you advise Mr. Duncan to open the car wash