Answered step by step

Verified Expert Solution

Question

1 Approved Answer

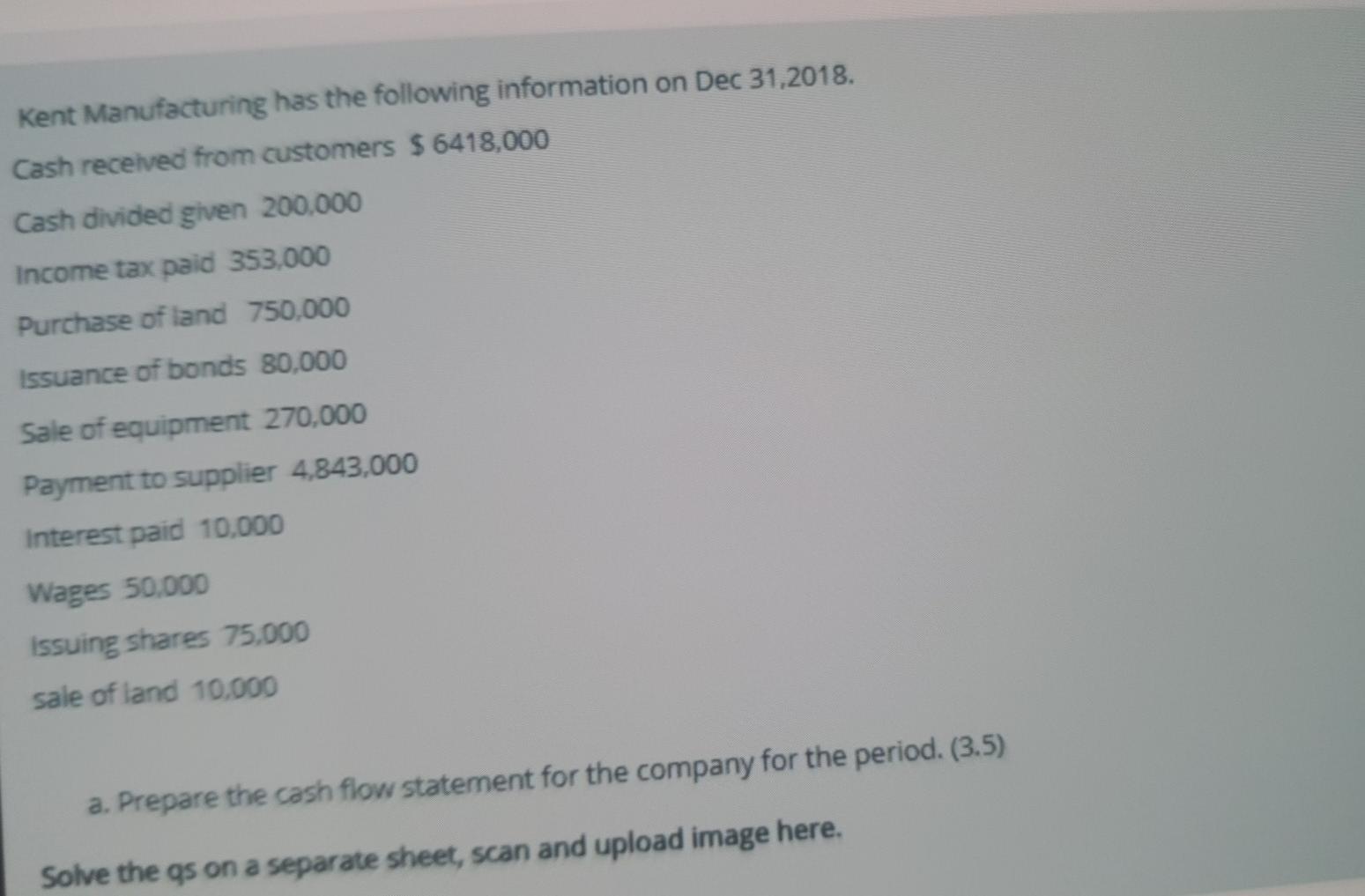

Kent Manufacturing has the following information on Dec 31,2018. Cash received from customers $ 6418,000 Cash divided given 200.000 Income tax paid 353,000 Purchase of

Kent Manufacturing has the following information on Dec 31,2018. Cash received from customers $ 6418,000 Cash divided given 200.000 Income tax paid 353,000 Purchase of land 750,000 Issuance of bonds 80.000 Sale of equipment 270,000 Payment to supplier 4.843,000 Interest paid 10,000 Wages 50,000 Issuing shares 75.000 sale of land 10.000 a. Prepare the cash flow statement for the company for the period. (3.5) Solve the qs on a separate sheet, scan and upload image here

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started