Answered step by step

Verified Expert Solution

Question

1 Approved Answer

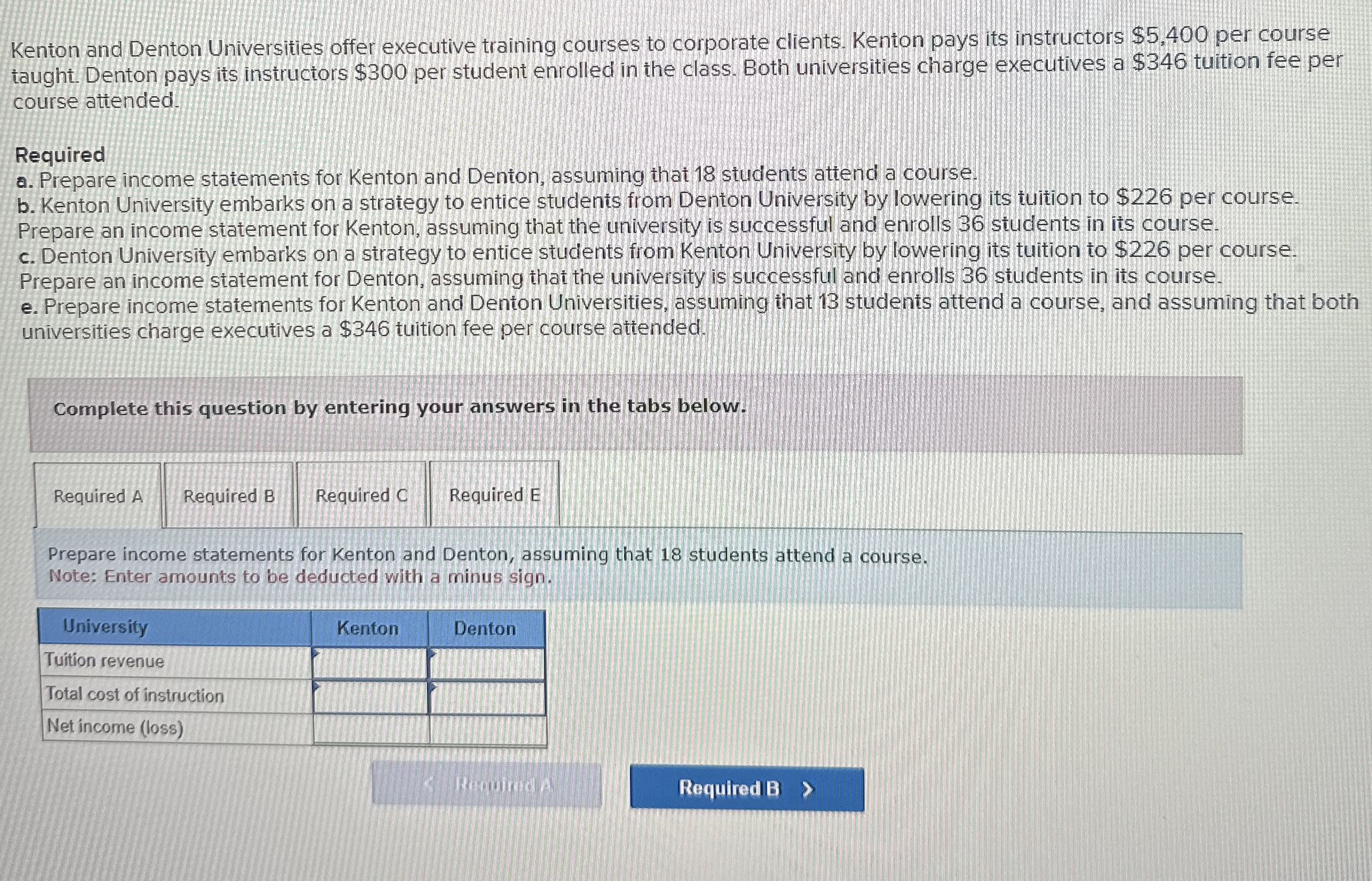

Kenton and Denton Universities offer executive training courses to corporate clients. Kenton pays its instructors $ 5 , 4 0 0 per course taught. Denton

Kenton and Denton Universities offer executive training courses to corporate clients. Kenton pays its instructors $ per course taught. Denton pays its instructors $ per student enrolled in the class. Both universities charge executives a $ tuition fee per course attended.

Required

a Prepare income statements for Kenton and Denton, assuming that students attend a course.

b Kenton University embarks on a strategy to entice students from Denton University by lowering its tuition to $ per course. Prepare an income statement for Kenton, assuming that the university is successful and enrolls students in its course.

c Denton University embarks on a strategy to entice students from Kenton University by lowering its tuition to $ per course. Prepare an income statement for Denton, assuming that the university is successful and enrolls students in its course.

e Prepare income statements for Kenton and Denton Universities, assuming that students attend a course, and assuming that both universities charge executives a $ tuition fee per course attended.

Complete this question by entering your answers in the tabs below.

Required

Required C

Required E

Prepare income statements for Kenton and Denton, assuming that students attend a course.

Note: Enter amounts to be deducted with a minus sign.

tableUniversityKenton,DentonTuition revenue,,Total cost of instruction,,Net income loss

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started