Answered step by step

Verified Expert Solution

Question

1 Approved Answer

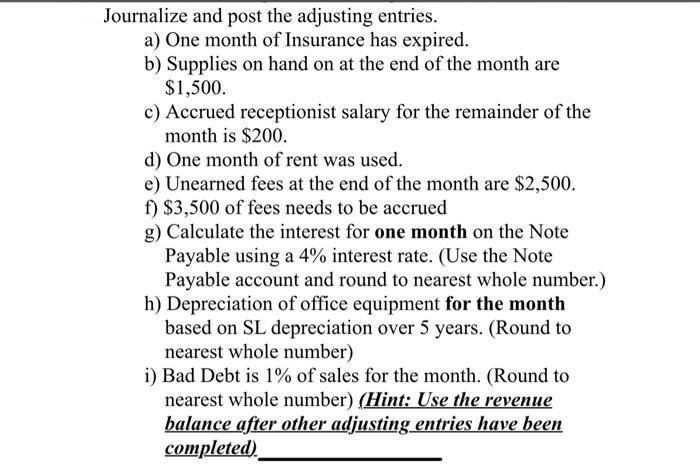

Journalize and post the adjusting entries. a) One month of Insurance has expired. b) Supplies on hand on at the end of the month

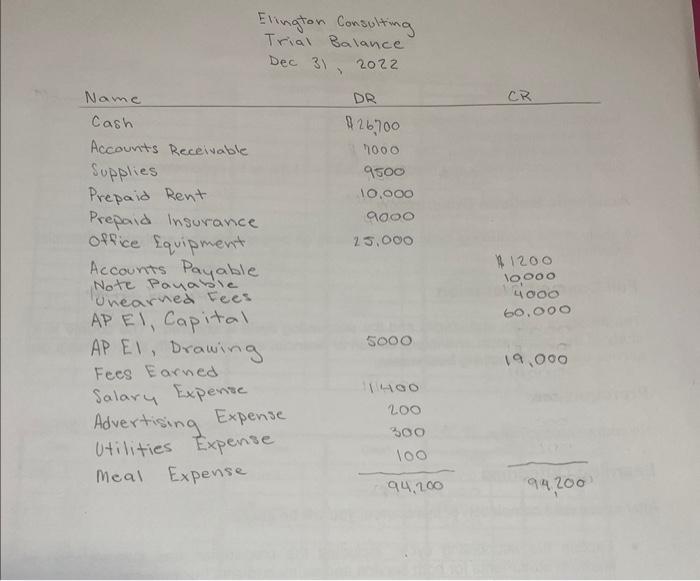

Journalize and post the adjusting entries. a) One month of Insurance has expired. b) Supplies on hand on at the end of the month are $1,500. c) Accrued receptionist salary for the remainder of the month is $200. d) One month of rent was used. e) Unearned fees at the end of the month are $2,500. f) $3,500 of fees needs to be accrued g) Calculate the interest for one month on the Note Payable using a 4% interest rate. (Use the Note Payable account and round to nearest whole number.) h) Depreciation of office equipment for the month based on SL depreciation over 5 years. (Round to nearest whole number) i) Bad Debt is 1% of sales for the month. (Round to nearest whole number) (Hint: Use the revenue balance after other adjusting entries have been completed) Name Cash Elington Consulting Trial Balance Dec 31, 2022 Accounts Receivable Supplies Prepaid Rent Prepaid Insurance Office Equipment Accounts Payable Note Payable Unearned Fees AP EI, Capital AP E1, Drawing Fees Earned Salary Expense Expense Advertising Utilities Expense Meal Expense DR 826700 7000 9500 10,000 9000 13,000 5000 11400 200 300 100 94,200 CR #1200 10,000 4000 60,000 19,000 94,200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Adjusting Entries Elington Consulting Adjusting Entries Date Accounts Title Debit Credit a Insurance Expense 750 Prepaid Insurance 750 To record insurance Expense incurred 9000 12 Months b Supplies ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started