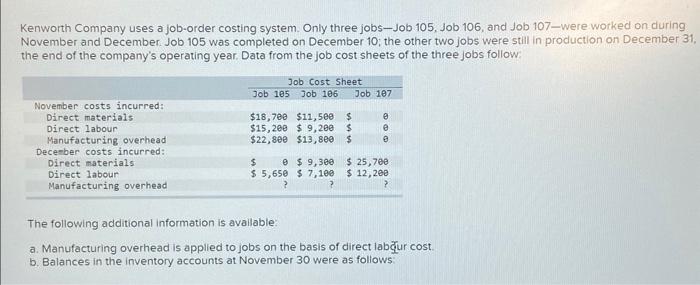

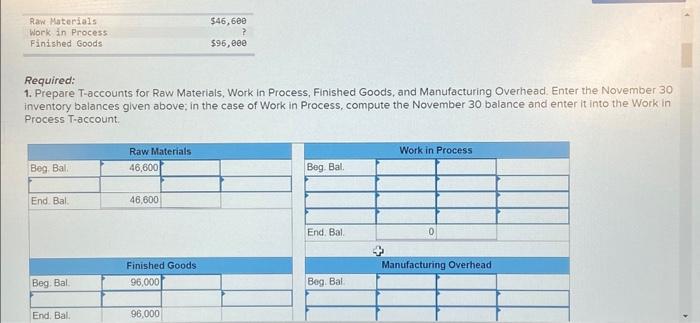

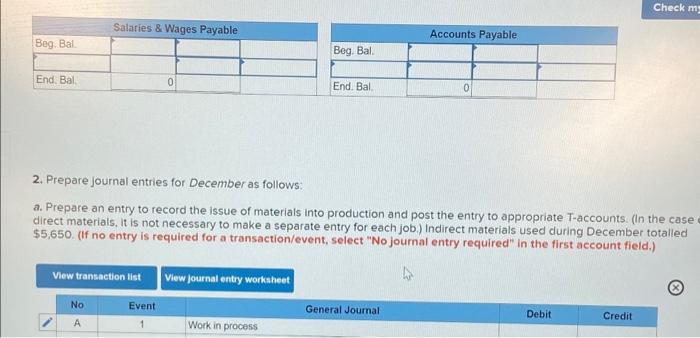

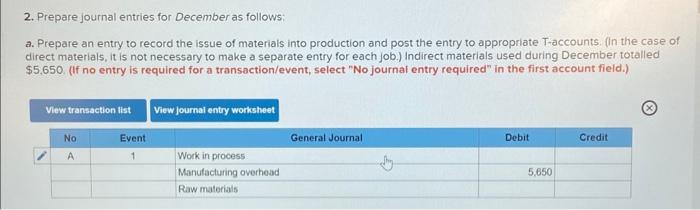

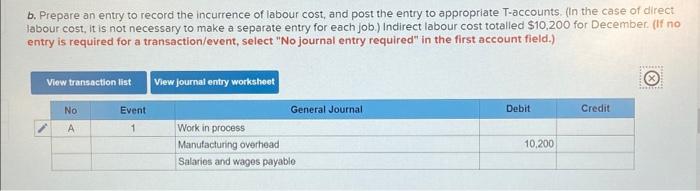

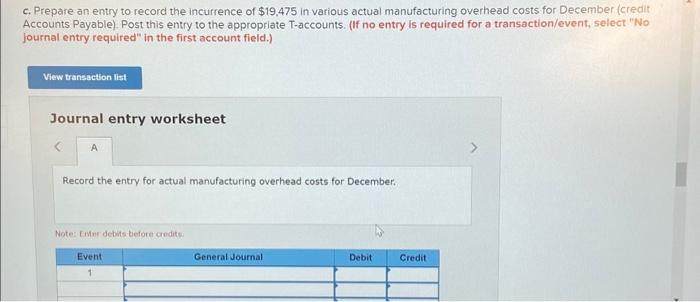

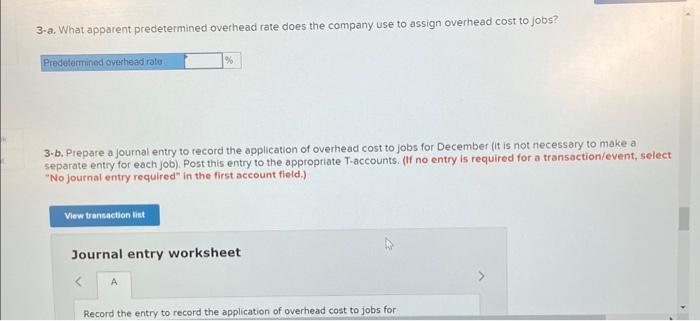

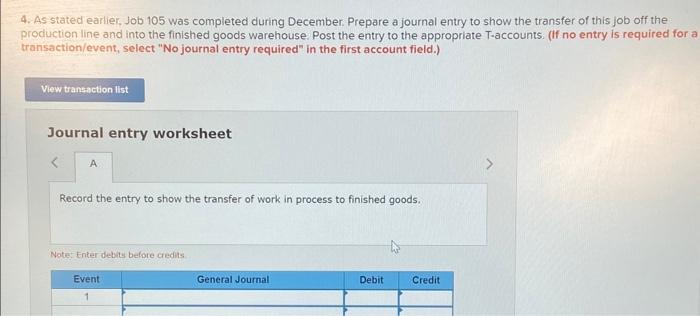

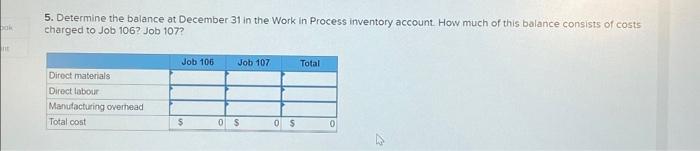

Kenworth Company uses a job-order costing system. Only three jobs-Job 105, Job 106, and Job 107-were worked on during November and December Job 105 was completed on December 10; the other two jobs were still in production on December 31 , the end of the company's operating year. Data from the job cost sheets of the three jobs follow: The following additional information is avallable: a. Manufacturing overhead is applied to jobs on the basis of direct labur cost. b. Balances in the inventory accounts at November 30 were as follows: Required: 1. Prepare T-accounts for Raw Materials, Work in Process, Finished Goods, and Manufacturing Overhead. Enter the November 30 inventory balances given above; in the case of Work in Process, compute the November 30 balance and enter it into the Work in Process T-account. 2. Prepare journal entries for December as follows: a. Prepare an entry to record the issue of materials into production and post the entry to appropriate T-accounts: (In the case direct materials, it is not necessary to make a separate entry for each job.) Indirect materials used during December totalled \$5.650. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 2. Prepare journal entries for December as follows: a. Prepare an entry to record the issue of materials into production and post the entry to appropriate T-accounts. (In the case of direct materials, it is not necessary to make a separate entry for each job.) Indirect materials used during December totalled \$5.650. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) b. Prepare an entry to record the incurrence of labour cost, and post the entry to appropriate T-accounts. (In the case of direct) labour cost, it is not necessary to make a separate entry for each job.) Indirect labour cost totalled $10,200 for December. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) c. Prepare an entry to record the incurrence of $19,475 in various actual manufacturing overhead costs for December (credit Accounts Payable). Post this entry to the appropriate T-accounts. (If no entry is required for a transaction/event, select "No Journal entry required" in the first account field.) View traneaction list Journal entry worksheet A Record the entry for actual manufacturing overhead costs for December. Notez finnr debis beforet areditse \begin{tabular}{|c|c|c|c|} \hline Event & General Journal & Debit & Credit \\ \hline 1 & & & \\ \hline & & & \\ \hline \end{tabular} 3-a. What apparent predetermined overhead rate does the company use to assign overhead cost to jobs? 3-b. Prepare a journal entry to record the application of overhead cost to jobs for December (it is not necessary to make a separate entry for each job). Post this entry to the appropriate T-accounts. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 4. As stated earliek, Job 105 was completed during December. Prepare a journal entry to show the transfer of this job off the production line and into the finished goods warehouse. Post the entry to the appropriate T-accounts. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the entry to show the transfer of work in process to finished goods. Note: Enter debits belote credits. 5. Determine the balance at December 31 in the Work in Process inventory account. How much of this balance consists of costs charged to Job 106 ? Job 107