Answered step by step

Verified Expert Solution

Question

1 Approved Answer

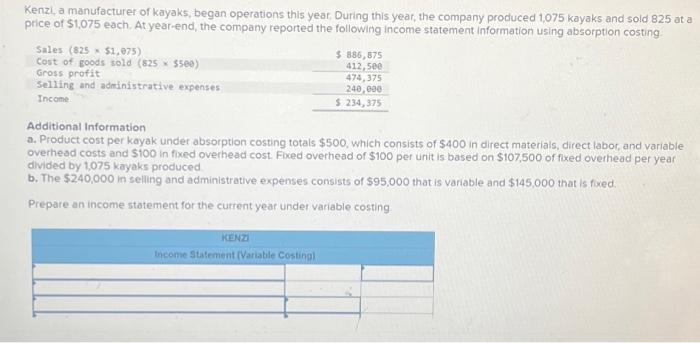

Kenzi, a manufacturer of kayaks, began operations this year. During this year, the company produced 1,075 kayaks and sold 825 at a price of $1,075

Kenzi, a manufacturer of kayaks, began operations this year. During this year, the company produced 1,075 kayaks and sold 825 at a price of $1,075 each. At year-end, the company reported the following income statement information using absorption costing. Sales (825 x $1,075) Cost of goods sold (825 x $500) Gross profit Selling and administrative expenses Income Additional Information a. Product cost per kayak under absorption costing totals $500, which consists of $400 in direct materials, direct labor, and variable overhead costs and $100 in fixed overhead cost. Fixed overhead of $100 per unit is based on $107,500 of fixed overhead per year divided by 1,075 kayaks produced. b. The $240,000 in selling and administrative expenses consists of $95,000 that is variable and $145,000 that is fixed. Prepare an income statement for the current year under variable costing. KENZI $886,875 412,500 474,375 240,000 $ 234,375 Income Statement (Variable Costing)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started