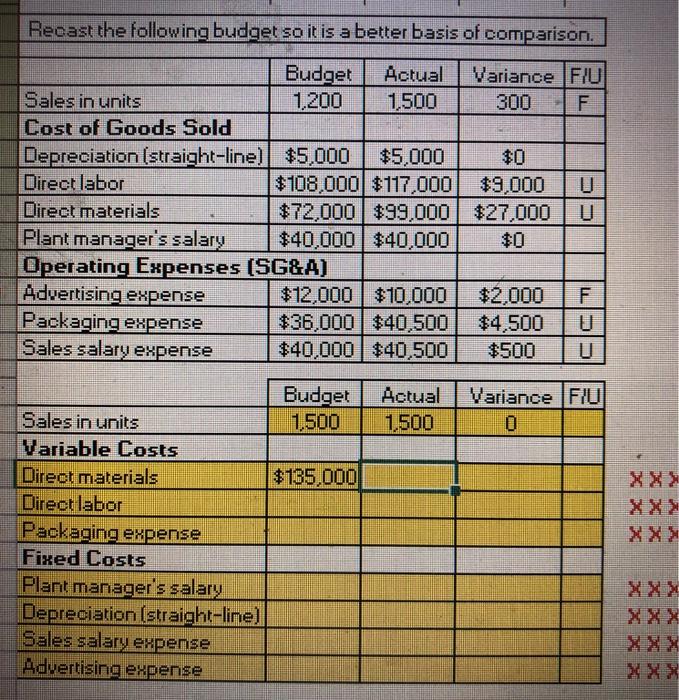

Question: Recast the following budget so it is a better basis of comparison. Variance FIU Budget 1,200 Actual Sales in units 1,500 300 Cost of

Recast the following budget so it is a better basis of comparison. Variance FIU Budget 1,200 Actual Sales in units 1,500 300 Cost of Goods Sold Depreciation (straight-line) $5.000 $5,000 $108.000 $117,.000 $9,000 $72,000 $99,000 $27.000 $40,000 $40,000 $0 Direct labor Direct materials Plant manager's salary Operating Expenses (SG&A) Advertising expense Packaging expense Sales salary expense $0 $12,000 $10.000 $36,000 $40,500 $40,000 $40,500 $2,000 $4,500 $500 Budget 1,500 Actual Variance FIU Sales in units 1,500 0. Variable Costs Direct materials Direct labor Packaging expense Fixed Costs Plant manager's salary Depreciation (straight-line) Sales salary expense Advertising expense $135,000 XXX XXX XXX XXX XXX XXX

Step by Step Solution

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Budget Workings Actual Variance FU Sales in units 1500 ... View full answer

Get step-by-step solutions from verified subject matter experts