Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kermit Corp. manufactures a chemical called Muppet Powder. At the beginning of 20X3, the selling price was raised from $5/gram to $5.60/gram. Production costs

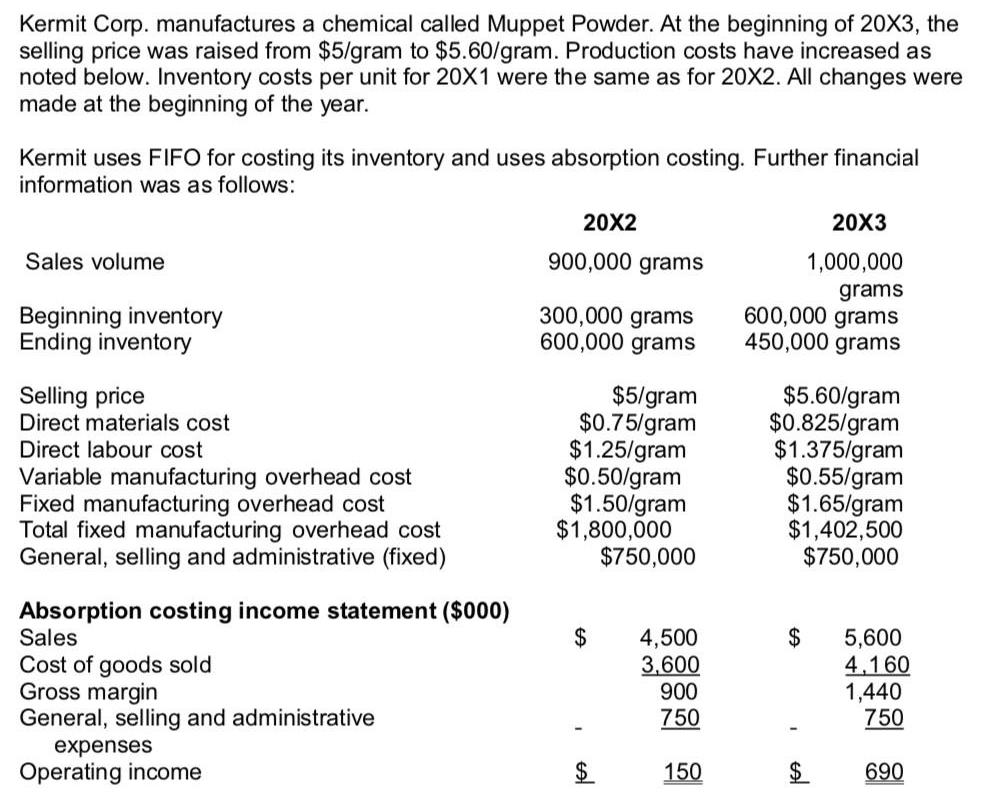

Kermit Corp. manufactures a chemical called Muppet Powder. At the beginning of 20X3, the selling price was raised from $5/gram to $5.60/gram. Production costs have increased as noted below. Inventory costs per unit for 20X1 were the same as for 20X2. All changes were made at the beginning of the year. Kermit uses FIFO for costing its inventory and uses absorption costing. Further financial information was as follows: 20X2 20X3 Sales volume 900,000 grams 1,000,000 Beginning inventory Ending inventory 300,000 grams 600,000 grams grams 600,000 grams 450,000 grams Selling price Direct materials cost Direct labour cost Variable manufacturing overhead cost Fixed manufacturing overhead cost Total fixed manufacturing overhead cost General, selling and administrative (fixed) $5/gram $0.75/gram $1.25/gram $0.50/gram $1.50/gram $1,800,000 $750,000 $5.60/gram $0.825/gram $1.375/gram $0.55/gram $1.65/gram $1,402,500 $750,000 Absorption costing income statement ($000) Sales 4,500 3,600 $4 2$ Cost of goods sold Gross margin General, selling and administrative 5,600 4.160 1,440 750 900 750 expenses Operating income $4 150 690 Required: a) Prepare the variable costing income statement for Kermit for each of 20X2 and 20X3. b) Reconcile the difference between the operating income under absorption costing and the operating income under variable costing. c) Explain to management why absorption costing shows a higher net income than variable costing in 20X2 and why variable costing shows a higher net income than absorption costing in 20X3. Kermit Corp. manufactures a chemical called Muppet Powder. At the beginning of 20X3, the selling price was raised from $5/gram to $5.60/gram. Production costs have increased as noted below. Inventory costs per unit for 20X1 were the same as for 20X2. All changes were made at the beginning of the year. Kermit uses FIFO for costing its inventory and uses absorption costing. Further financial information was as follows: 20X2 20X3 Sales volume 900,000 grams 1,000,000 Beginning inventory Ending inventory 300,000 grams 600,000 grams grams 600,000 grams 450,000 grams Selling price Direct materials cost Direct labour cost Variable manufacturing overhead cost Fixed manufacturing overhead cost Total fixed manufacturing overhead cost General, selling and administrative (fixed) $5/gram $0.75/gram $1.25/gram $0.50/gram $1.50/gram $1,800,000 $750,000 $5.60/gram $0.825/gram $1.375/gram $0.55/gram $1.65/gram $1,402,500 $750,000 Absorption costing income statement ($000) Sales 4,500 3,600 $4 2$ Cost of goods sold Gross margin General, selling and administrative 5,600 4.160 1,440 750 900 750 expenses Operating income $4 150 690 Required: a) Prepare the variable costing income statement for Kermit for each of 20X2 and 20X3. b) Reconcile the difference between the operating income under absorption costing and the operating income under variable costing. c) Explain to management why absorption costing shows a higher net income than variable costing in 20X2 and why variable costing shows a higher net income than absorption costing in 20X3. Kermit Corp. manufactures a chemical called Muppet Powder. At the beginning of 20X3, the selling price was raised from $5/gram to $5.60/gram. Production costs have increased as noted below. Inventory costs per unit for 20X1 were the same as for 20X2. All changes were made at the beginning of the year. Kermit uses FIFO for costing its inventory and uses absorption costing. Further financial information was as follows: 20X2 20X3 Sales volume 900,000 grams 1,000,000 Beginning inventory Ending inventory 300,000 grams 600,000 grams grams 600,000 grams 450,000 grams Selling price Direct materials cost Direct labour cost Variable manufacturing overhead cost Fixed manufacturing overhead cost Total fixed manufacturing overhead cost General, selling and administrative (fixed) $5/gram $0.75/gram $1.25/gram $0.50/gram $1.50/gram $1,800,000 $750,000 $5.60/gram $0.825/gram $1.375/gram $0.55/gram $1.65/gram $1,402,500 $750,000 Absorption costing income statement ($000) Sales 4,500 3,600 $4 2$ Cost of goods sold Gross margin General, selling and administrative 5,600 4.160 1,440 750 900 750 expenses Operating income $4 150 690 Required: a) Prepare the variable costing income statement for Kermit for each of 20X2 and 20X3. b) Reconcile the difference between the operating income under absorption costing and the operating income under variable costing. c) Explain to management why absorption costing shows a higher net income than variable costing in 20X2 and why variable costing shows a higher net income than absorption costing in 20X3.

Step by Step Solution

★★★★★

3.26 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer Income Statement Variable Costing Grams 2002 Grams 2003 Sales 900000 4500000 1000000 5600000 Less Cost of Goods Sold Opening Inventory 300000 7...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started