Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kerry is a partner in the Kerry, Davis, Smith & Jones Partnership. Kerry owned 25% from January 1, 2019, to June 30, 2019, when he

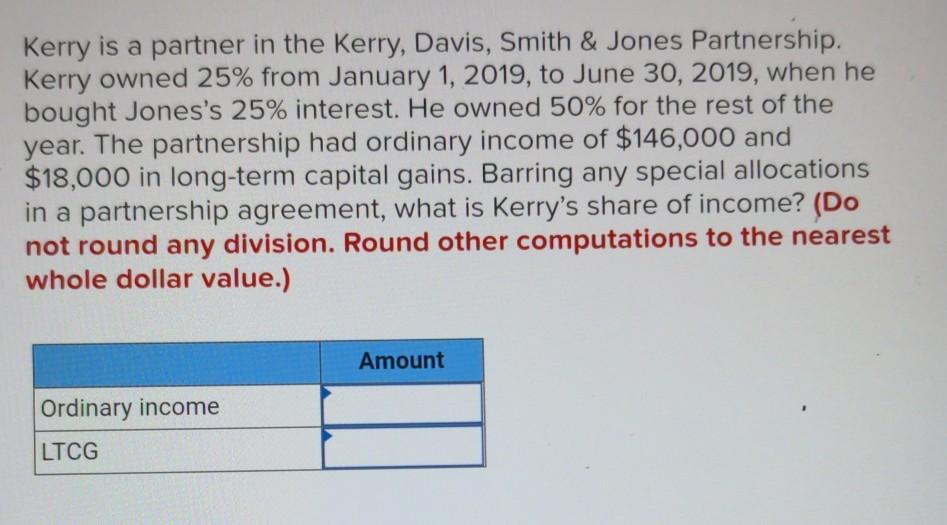

Kerry is a partner in the Kerry, Davis, Smith & Jones Partnership. Kerry owned 25% from January 1, 2019, to June 30, 2019, when he bought Jones's 25% interest. He owned 50% for the rest of the year. The partnership had ordinary income of $146,000 and $18,000 in long-term capital gains. Barring any special allocations in a partnership agreement, what is Kerry's share of income? (Do not round any division. Round other computations to the nearest whole dollar value.) Amount Ordinary income LTCG

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started