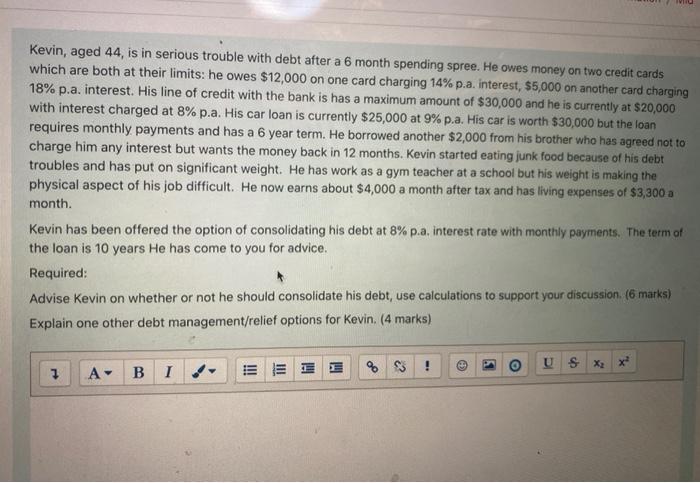

Kevin, aged 44, is in serious trouble with debt after a 6 month spending spree. He owes money on two credit cards which are both at their limits: he owes $12,000 on one card charging 14% p.a. interest, $5,000 on another card charging 18% p.a. interest. His line of credit with the bank is has a maximum amount of $30,000 and he is currently at $20,000 with interest charged at 8% p.a. His car loan is currently $25,000 at 9% p.a. His car is worth $30,000 but the loan requires monthly payments and has a 6 year term. He borrowed another $2,000 from his brother who has agreed not to charge him any interest but wants the money back in 12 months. Kevin started eating junk food because of his debt troubles and has put on significant weight. He has work as a gym teacher at a school but his weight is making the physical aspect of his job difficult. He now earns about $4,000 a month after tax and has living expenses of $3,300 a month. Kevin has been offered the option of consolidating his debt at 8% p.a. interest rate with monthly payments. The term of the loan is 10 years He has come to you for advice. Required: Advise Kevin on whether or not he should consolidate his debt, use calculations to support your discussion (6 marks) Explain one other debt management/relief options for Kevin. (4 marks) US Xxx 1 A Kevin, aged 44, is in serious trouble with debt after a 6 month spending spree. He owes money on two credit cards which are both at their limits: he owes $12,000 on one card charging 14% p.a. interest, $5,000 on another card charging 18% p.a. interest. His line of credit with the bank is has a maximum amount of $30,000 and he is currently at $20,000 with interest charged at 8% p.a. His car loan is currently $25,000 at 9% p.a. His car is worth $30,000 but the loan requires monthly payments and has a 6 year term. He borrowed another $2,000 from his brother who has agreed not to charge him any interest but wants the money back in 12 months. Kevin started eating junk food because of his debt troubles and has put on significant weight. He has work as a gym teacher at a school but his weight is making the physical aspect of his job difficult. He now earns about $4,000 a month after tax and has living expenses of $3,300 a month. Kevin has been offered the option of consolidating his debt at 8% p.a. interest rate with monthly payments. The term of the loan is 10 years He has come to you for advice. Required: Advise Kevin on whether or not he should consolidate his debt, use calculations to support your discussion (6 marks) Explain one other debt management/relief options for Kevin. (4 marks) US Xxx 1 A