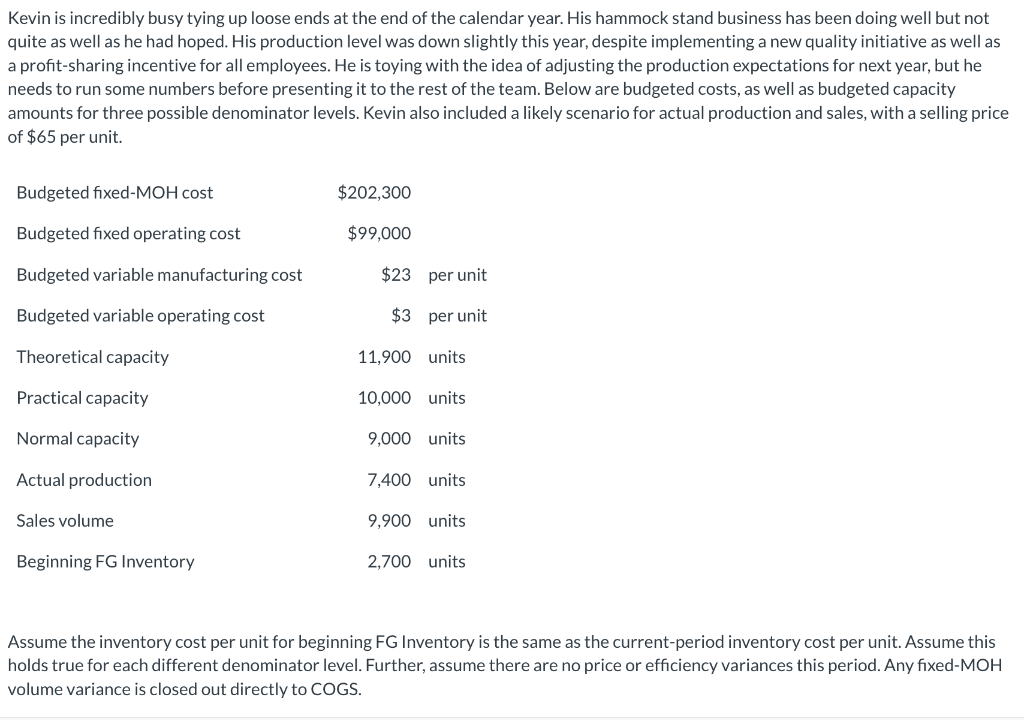

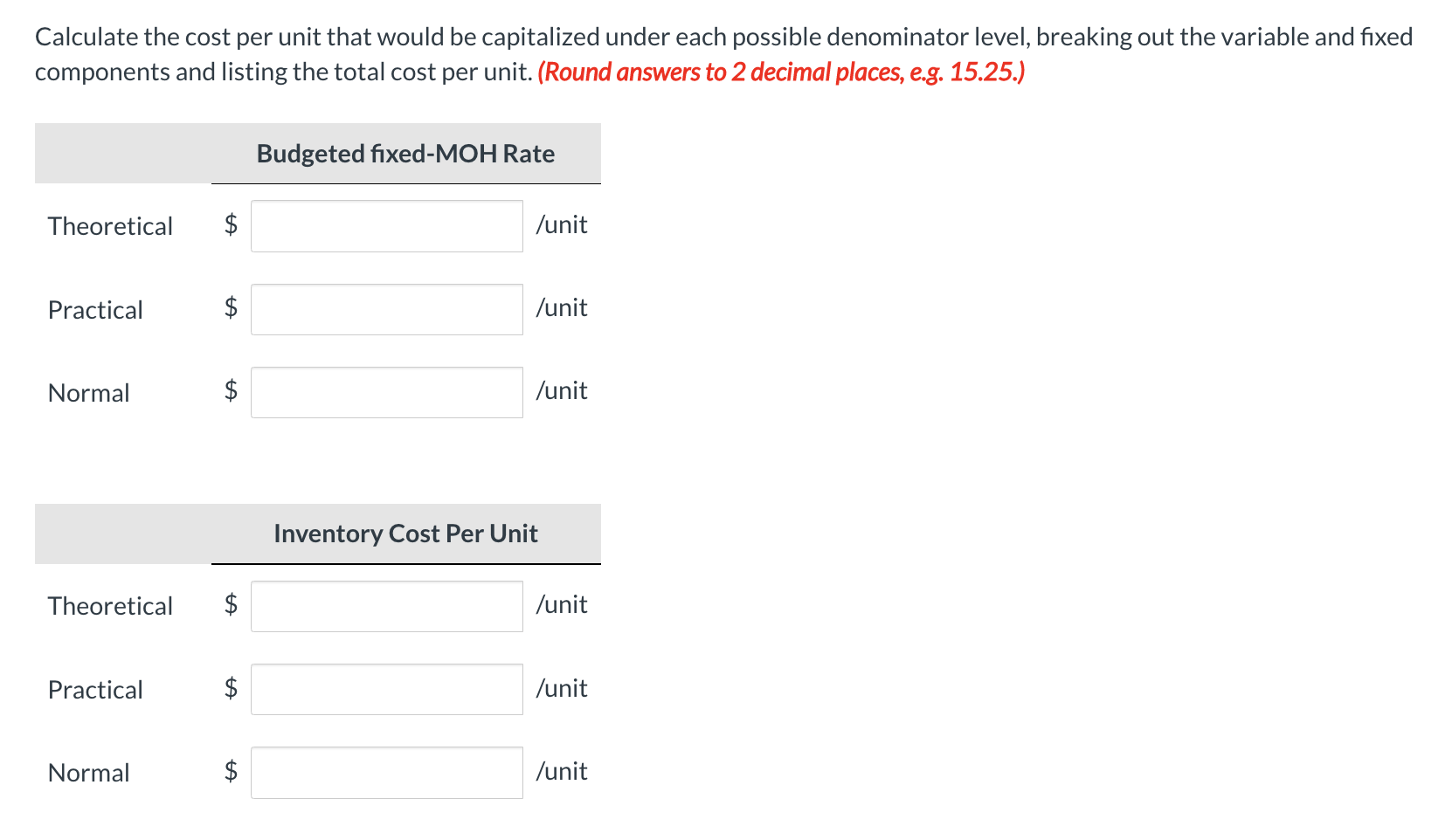

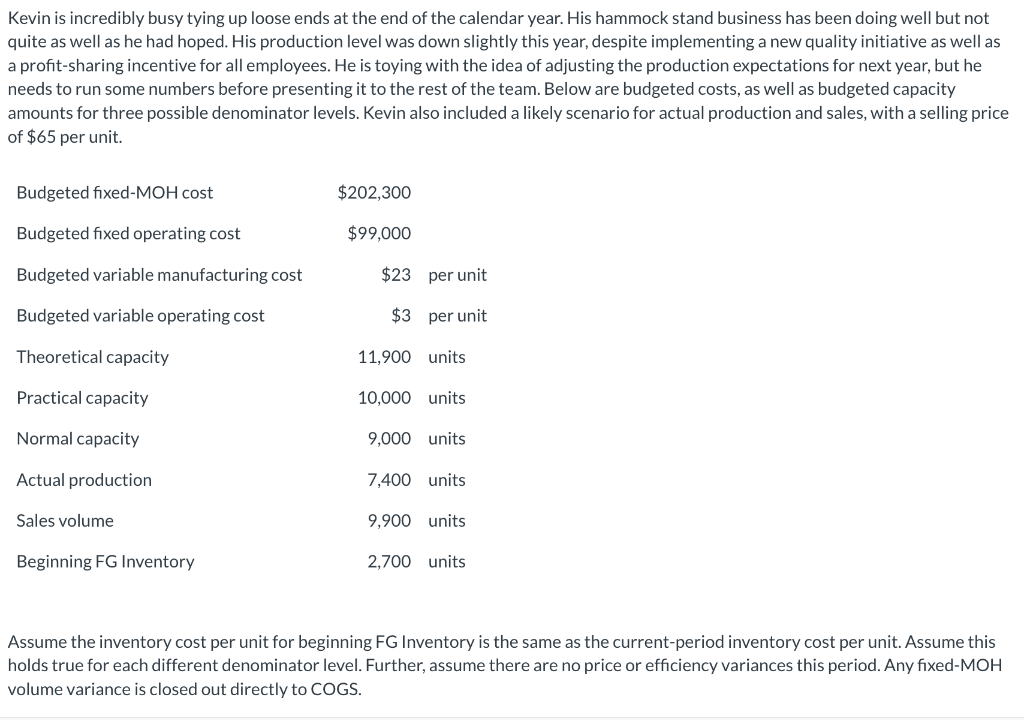

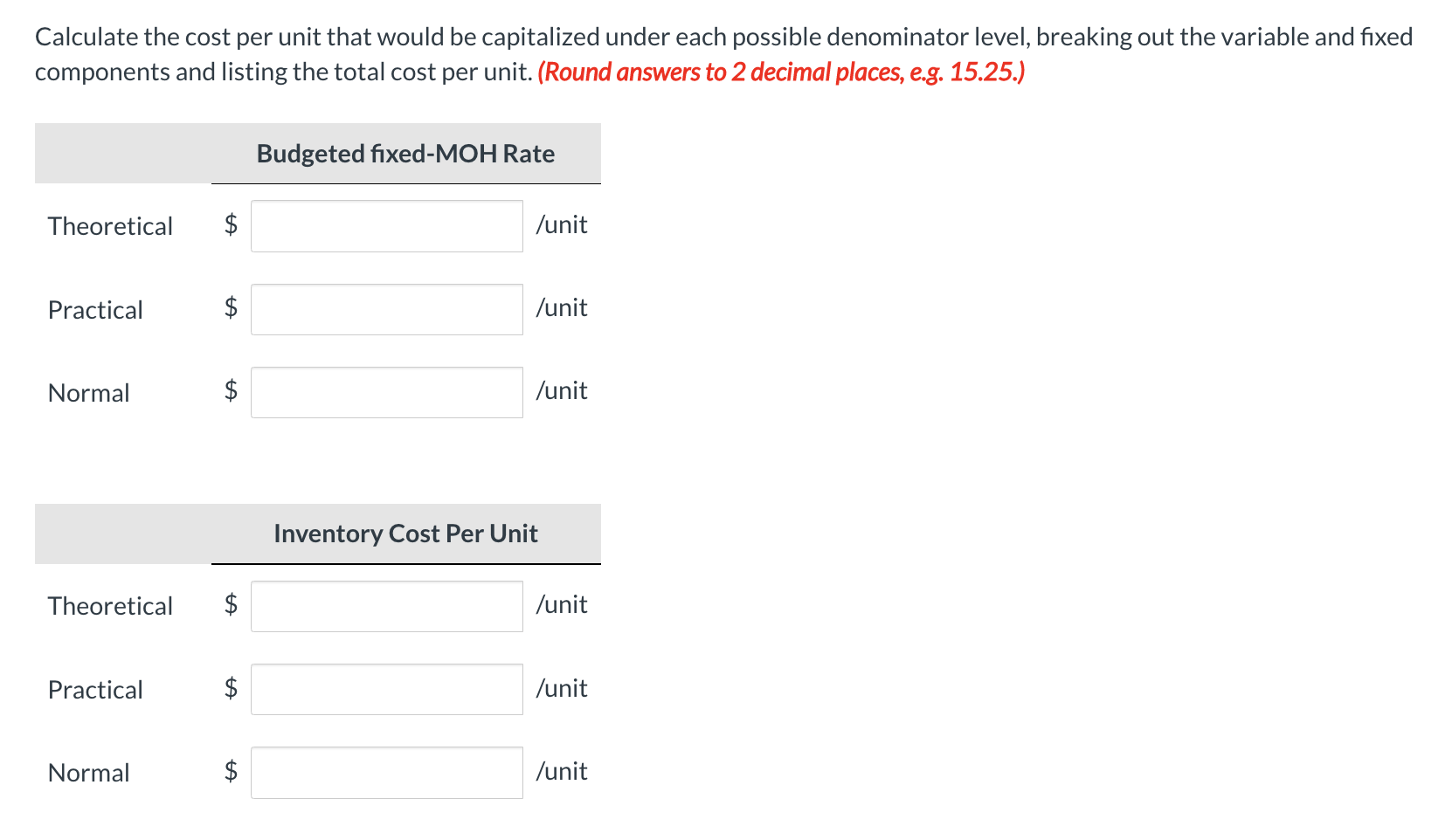

Kevin is incredibly busy tying up loose ends at the end of the calendar year. His hammock stand business has been doing well but not quite as well as he had hoped. His production level was down slightly this year, despite implementing a new quality initiative as well as a profit-sharing incentive for all employees. He is toying with the idea of adjusting the production expectations for next year, but he needs to run some numbers before presenting it to the rest of the team. Below are budgeted costs, as well as budgeted capacity amounts for three possible denominator levels. Kevin also included a likely scenario for actual production and sales, with a selling price of $65 per unit. Assume the inventory cost per unit for beginning FG Inventory is the same as the current-period inventory cost per unit. Assume this holds true for each different denominator level. Further, assume there are no price or efficiency variances this period. Any fixed-MOH volume variance is closed out directly to COGS. Calculate the cost per unit that would be capitalized under each possible denominator level, breaking out the variable and fixed components and listing the total cost per unit. (Round answers to 2 decimal places, e.g. 15.25.) Kevin is incredibly busy tying up loose ends at the end of the calendar year. His hammock stand business has been doing well but not quite as well as he had hoped. His production level was down slightly this year, despite implementing a new quality initiative as well as a profit-sharing incentive for all employees. He is toying with the idea of adjusting the production expectations for next year, but he needs to run some numbers before presenting it to the rest of the team. Below are budgeted costs, as well as budgeted capacity amounts for three possible denominator levels. Kevin also included a likely scenario for actual production and sales, with a selling price of $65 per unit. Assume the inventory cost per unit for beginning FG Inventory is the same as the current-period inventory cost per unit. Assume this holds true for each different denominator level. Further, assume there are no price or efficiency variances this period. Any fixed-MOH volume variance is closed out directly to COGS. Calculate the cost per unit that would be capitalized under each possible denominator level, breaking out the variable and fixed components and listing the total cost per unit. (Round answers to 2 decimal places, e.g. 15.25.)