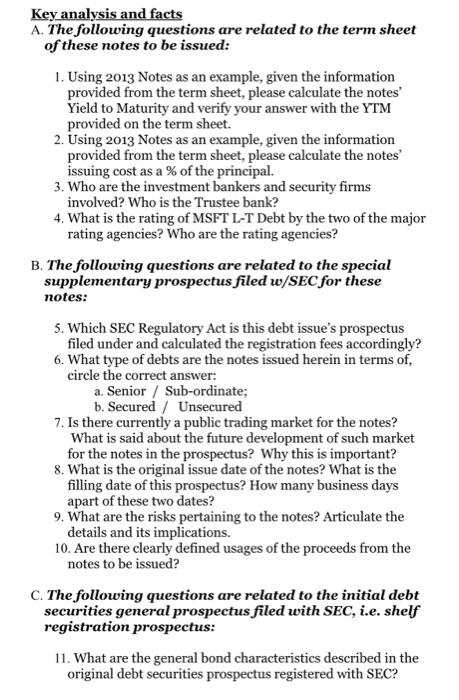

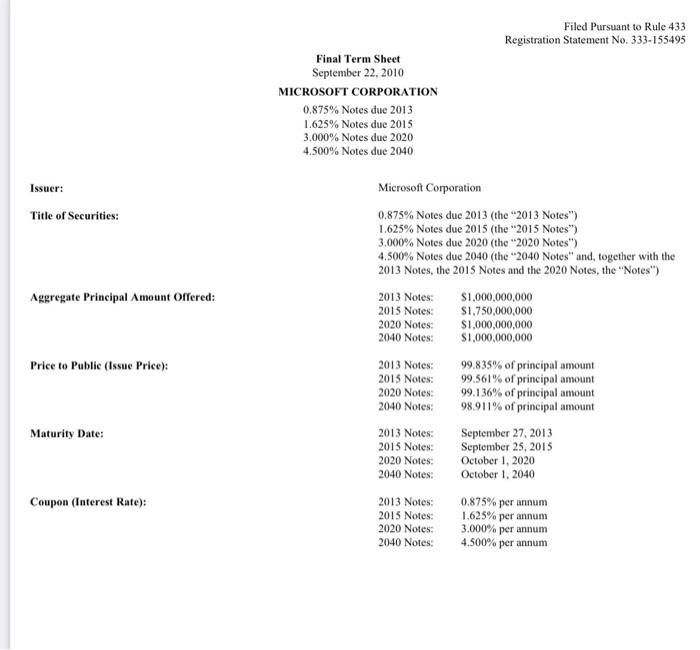

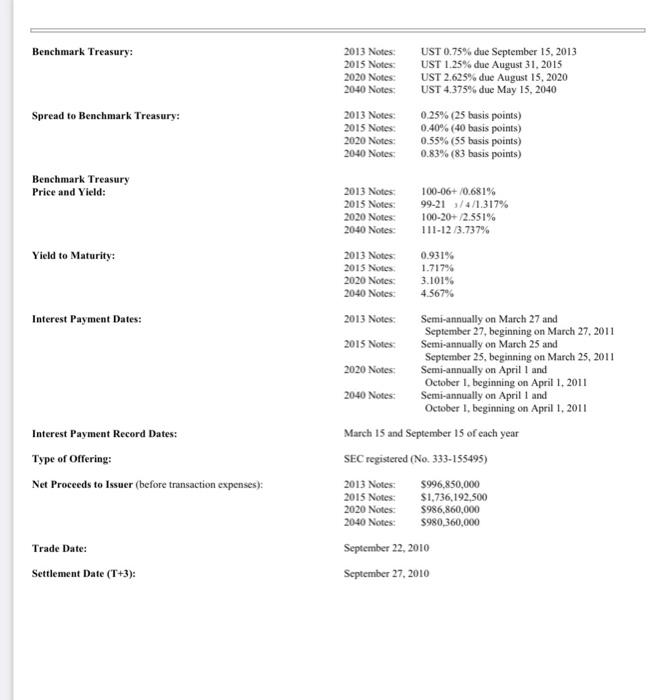

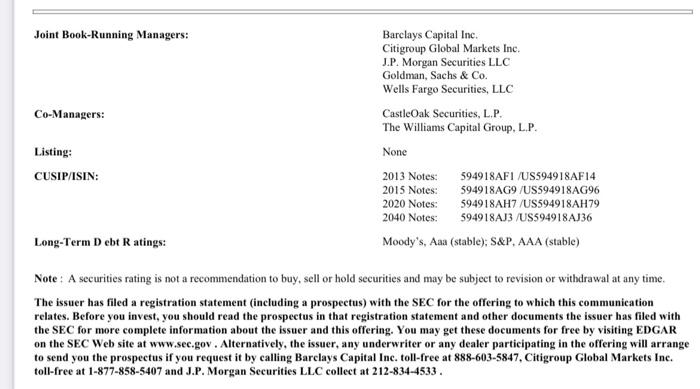

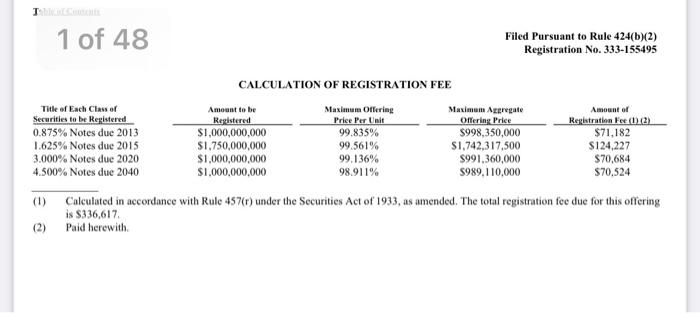

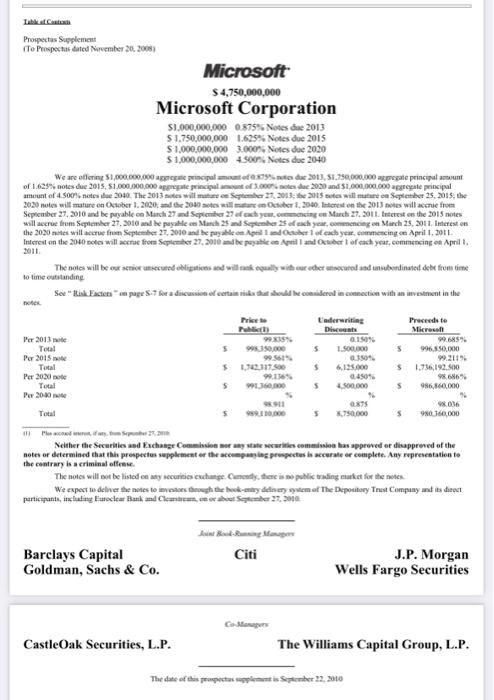

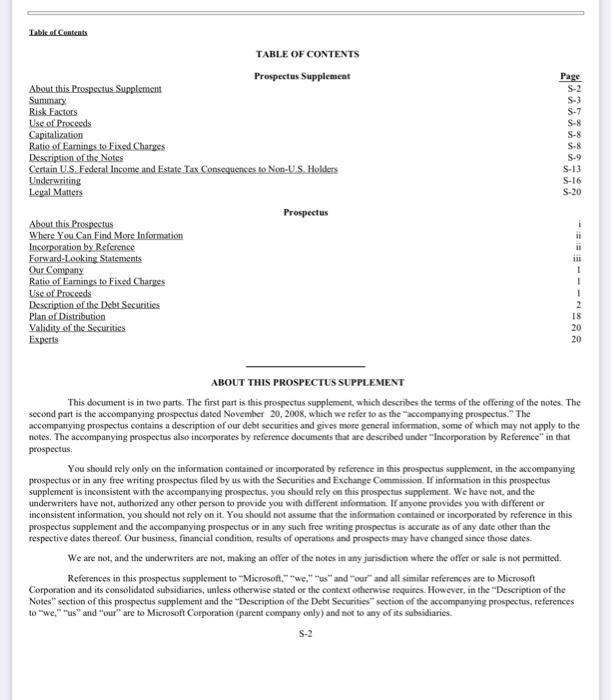

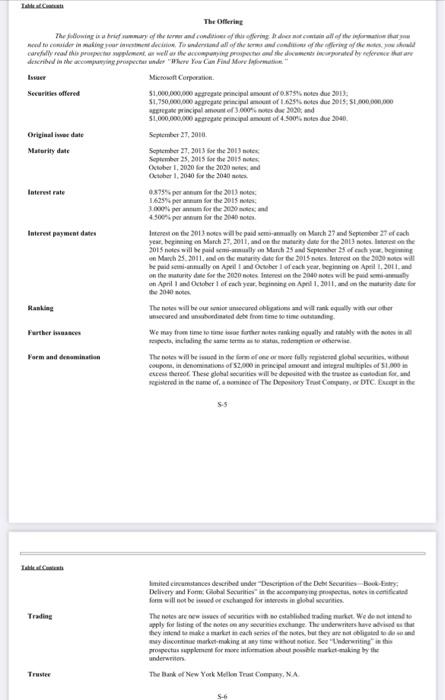

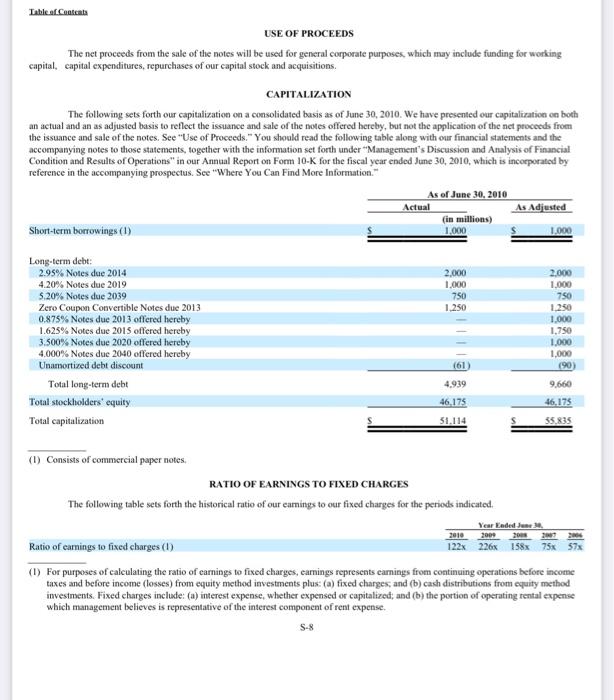

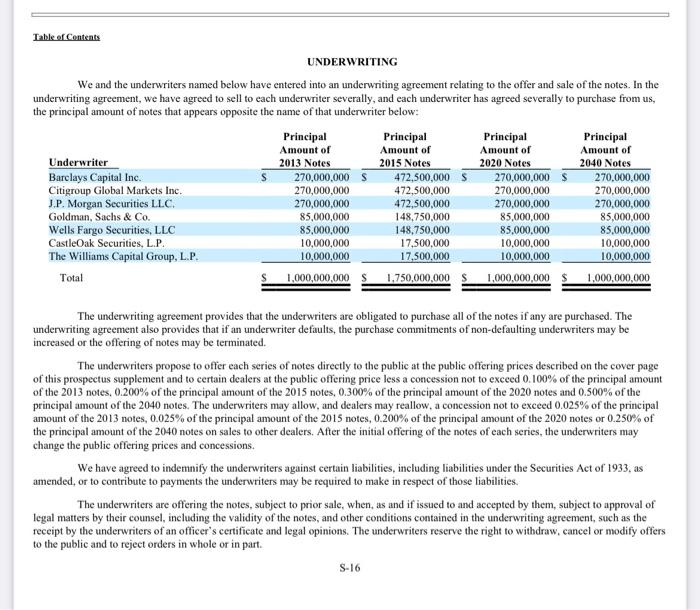

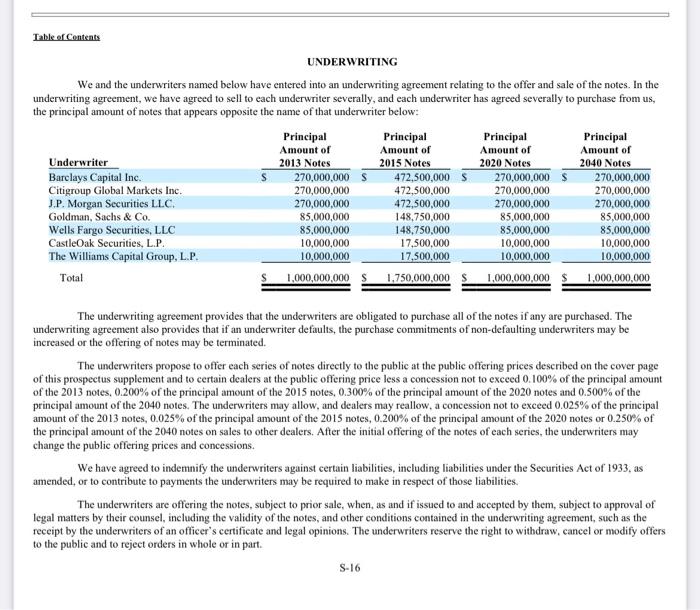

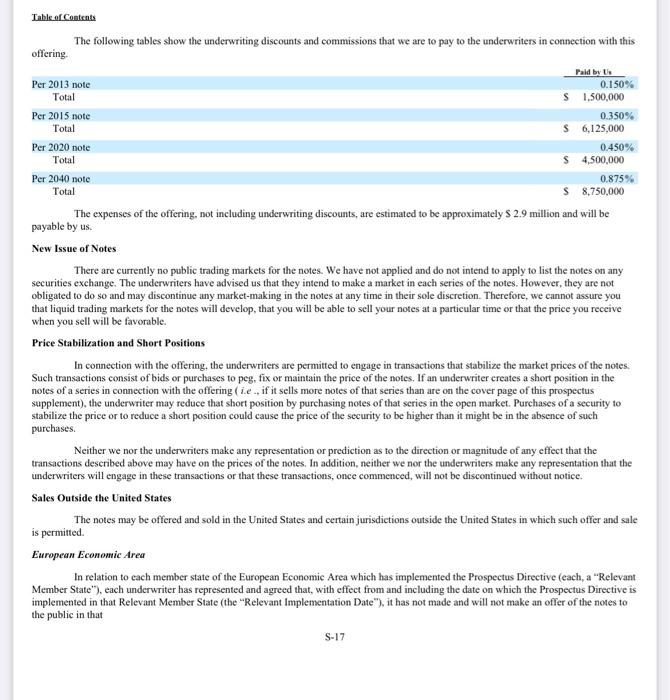

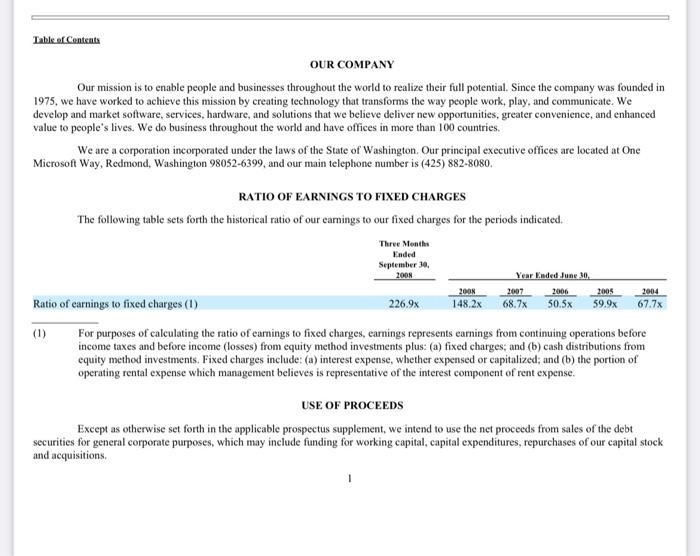

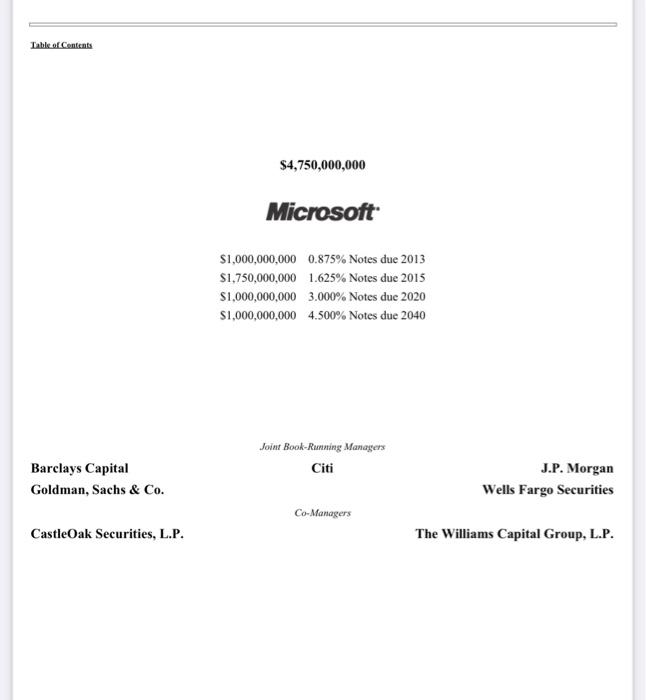

Key analysis and facts A. The following questions are related to the term sheet of these notes to be issued: 1. Using 2013 Notes as an example, given the information provided from the term sheet, please calculate the notes' Yield to Maturity and verify your answer with the YTM provided on the term sheet. 2. Using 2013 Notes as an example, given the information provided from the term sheet, please calculate the notes' issuing cost as a % of the principal. 3. Who are the investment bankers and security firms involved? Who is the Trustee bank? 4. What is the rating of MSFT L-T Debt by the two of the major rating agencies? Who are the rating agencies? B. The following questions are related to the special supplementary prospectus filed w/SEC for these notes: 5. Which SEC Regulatory Act is this debt issue's prospectus filed under and calculated the registration fees accordingly? 6. What type of debts are the notes issued herein in terms of, circle the correct answer: a. Senior / Sub-ordinate; b. Secured / Unsecured 7. Is there currently a public trading market for the notes? What is said about the future development of such market for the notes in the prospectus? Why this is important? 8. What is the original issue date of the notes? What is the filling date of this prospectus? How many business days apart of these two dates? 9. What are the risks pertaining to the notes? Articulate the details and its implications. 10. Are there clearly defined usages of the proceeds from the notes to be issued? C. The following questions are related to the initial debt securities general prospectus filed with SEC, i.e. shelf registration prospectus: 11. What are the general bond characteristics described in the original debt securities prospectus registered with SEC? Filed Pursuant to Rule 433 Registration Statement No. 333-155495 Final Term Sheet September 22, 2010 MICROSOFT CORPORATION 0.875% Notes due 2013 1.625% Notes due 2015 3.000% Notes due 2020 4.500% Notes due 2040 Issuer: Microsoft Corporation Title of Securities: 0.875% Notes due 2013 (the "2013 Notes") 1.625% Notes due 2015 (the "2015 Notes") 3.000% Notes due 2020 (the "2020 Notes") 4.500% Notes due 2040 (the "2040 Notes" and, together with the 2013 Notes, the 2015 Notes and the 2020 Notes, the "Notes") Aggregate Principal Amount Offered: 2013Notes:2015Notes:2020Notes:2040Notes:$1,000,000,000$1,750,000,000$1,000,000,000$1,000,000,000 Price to Public (Issue Price): 2013 Notes: 99.835% of principal amount 2015 Notes: 99.561% of principal amount 2020 Notes: 99.136% of principal amount 2040 Notes: 98.911% of principal amount Maturity Date: 2013 Notes: September 27, 2013 2015 Notes: September 25,2015 2020 Notes: October 1, 2020 2040 Notes: October 1, 2040 Coupon (Interest Rate): 2013 Notes: 0.875% per annum 2015 Notes: 1.625% per annum 2020 Notes: 3.000% per annum 2040 Notes: 4.500% per annum Benchmark Treasury: 2013Notes:2015Notes:2020Notes:2040Notes:2013Notes:2015Notes:2020Notes:2040Notes:UST0.75%dueSeptember15,2013UST1.25%dueAugust31,2015UST2.625%dueAugust15,2020UST4.375%dueMay15,20400.25%(25basispoints)0.40%(40basispoints)0.55%(55basispoints)0.83%(83basispoints) Benchmark Treasury Price and Yield: Yield to Maturity: Interest Payment Dates: 2013Notes:2015Notes:2020Notes:2040Notes:2013Notes:2013Notes:2020Notes:2040Notes:2013Notes:2015Notes:2020Notes:2040Notes:10006+10.681%9921,1/4/1.317%10020+/2.551%11112/3.737%0.931%1.717%3.101%4.567%Semi-annuallyonMarch27andSeptember27,beginningonMarch27,2011Semi-annuallyonMarch25andSeptember25,beginningonMarch25,2011Semi-annuallyonApril1andOetober1,beginningonApril1,2011Semi-annuallyonApril1andOctober1,beginningonApril1,2011 Interest Payment Record Dates: March 15 and September 15 of each year Type of Offering: SEC registered (No. 333-155495) Net Proceeds to Issuer (before transaction expenses): 2013Notes:2015Notes:2020Notes:2040Notes:$996,850,000$1,736,192,500$986,860,000$980,360,000 Trade Date: September 22, 2010 Settlement Date ( T+3) : September 27, 2010 Note : A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time. The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Barclays Capital Inc. toll-free at 888-603-5847, Citigroup Global Markets Ine. toll-free at 1-877-858-5407 and J.P. Morgan Securities LLC collect at 212-834-4533. Filed Pursuant to Rule 424(b)(2) Registration No. 333-155495 CALCULATION OF REGISTRATION FEE (1) Calculated in accordance with Rule 457(r) under the Securities Act of 1933, as amended. The total registration fee due for this offering is $336,617. (2) Paid herewith. 201t. to time eutitandine Per 2013 pute Total Per 2015 mite Tital Per 2020 aste Total Per 2039 noes Total notes or determined that thh prespectus sepplement er the aceenpangine prespectes is accurate er cemplete. Any ropresestation te the centrary is a criminal efferes. ABOUT THIS PROSPECTUS SUPPLEMENT This document is in two parts. The first part is this prospectas supplement, which describes the terms of the offering of the notes. The second part is the accompanying prospectus dated November 20,2008 , which we refer to as the "accompanying prospectus." The accompanying prospectus contains a description of our debt securities and gives mote general information, some of which may not apply to the notes. The accompanying prospectus also incorporates by reference documents that are described under "Incorporation by Reference" in that prospectus. You should rely only on the information contained or incorporated by reference in this prospectus supplement, in the accompanying prospectus or in any free writing prospectus filed by us with the Securities and Exchange Cemmission. If information in this prospectus supplement is inconsistent with the accompanying prospectus, you should rely on this prospectus supplement. We have not, and the underwriters have not, authorined any other perwon to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. You should not assume that the information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus or in any such free writing prospectus is accurate as of any dite other than the respective dates thereof. Our business, financial condition, results of operations and prespects may have changed since those dates. We are not, and the underwriters are not, making an offer of the notes in any jurisdiction where the offer or sale is not permitted. References in this prospectus supplement to "Microsott," "we," "ws" and "our" and all similar references are to Microsoft Corporation and its consolidated subsidianies, unless otherwise stated or the contex etherwise requires. However, in the "Description of the Notes" section of this prospectus supplement and the "Description of the Debt Securities" section of the accompanying prospectus, references to "we," "us" and "our" are to Microsoft Corpotation (parent company only) and not to any of its sabsidiarics. SUMUARY A4icruan Cerperatian We petcrate eevense by develepiog, mundectaring, likensieg. and appoting a wile range of aoflu are peodab aed acrvices lot server mith are phadects iereguting servises we offier cuereaby inchule - Bing our hikeroit searh iervice; and meiaging and mhance enbac safety; and - Xhex LIVE servios, which mables online ganiage weial rotworking, and conbent asces. Der current chus basd mevices fir buinss asen asclale: siepiliod entergnite It managencres 53 pomise. busines efficacy, and asoeuntatility. Fulte at Coucust The anfinst lseies. Miktomeft Cerparatin. Secueities offered 51. 060.000 .000 aferepate principal arsunt of 6.875% notes due 3013. Original iswet date Sppenber 27, 2010. Mlatority datc September 27, 2013 foe the 2013 nutes Nepermber 25, 2015 sor the 2015 notes Cxibber 1, 2020 for the 2020 mites, and Ocwher I. 2040 for the 2040 anke: laternt rate 0.875: por annem for the 2013 notes: 1.25/4 for atnam lor the 2015 metes, 3 ioepl, per antus for the Nogp nutes and 4.400 hi por amines for the 2040 notes. Internt payment dates year, he piming on March 27, 2011, and on the matuety date sur ite 2013 notes. Interet on the he paid iemi-innally on AFell 1 and Oviber 1 of eact year, beriening oe Apeil 1, 2011, and on the aunieity deet fot the 2020 notes loenel in the 2040 motes will be puid wembatenunty en April 1 and Octaber 1 of each year, berinting en April 1, 2011, and on the maturity dece fir the 20+0 neech. Manking The notei aill be our anaior uniccurad eblyations aad will rank eqully with eur ether anscured and anshondaated dobe fiom time se vine tetuandieg. Farthre hasases We muy forn time to biot isoe farther aites nanking equatly and ratally with the mos in all Varm and dreaminatian 55 Delivery and Fonn. Cabul Securities" is the accompam ing prigectat, nstes in centificatad Tratias The notes are are lasus of accurities nith no catablihed tradine nurkt. We de nat intend as propectus mpplemert for mone infirmation ahoul powble narket making by the anderwrites. Truster The Bark ef Nrw Yok Melke Truat Conpary, N.A. RISK FACTORS Investing in the notes involves risks. Before making a decision to invest in the notes, you should carefully consider the risks described under "Risk Factors" in Item 1A of our Annual Report on Form 10-K for the fiscal year ended June 30, 2010, which is incorporated by reference in the accompanying prospectus, as well as the risks set forth below. See "Where You Can Find More Information." The indenture governing the notes does not contain financial covenants or meaningful restrictions on us or our subsidiaries. Neither we nor any of our subsidiaries are restricted from incurring additional debt or other liabilities, including debt secured by liens, under the indenture. We may from time to time incur additional debt and other liabilities. In addition, we are not restricted from paying dividends or making distributions on our capital stock or purchasing or redeeming our capital stock under the indenture. Active trading markets for the notes may not develop. The notes constitute new issues of securities, for which there is no existing market. We do not intend to apply for listing of the notes on any securities exchange. We cannot assure you trading markets for the notes will develop, or of the ability of holders of the notes to sell their notes or of the prices at which holders may be able to sell their notes. The underwriters have advised us that they currently intend to make a market in each series of the notes. However, the underwriters are not obligated to do so, and any market-making with respect to the notes may be discontinued at any time without notice. If no active trading markets develop, you may be unable to resell the notes at any price or at their fair market value. If trading markets do develop, changes in our ratings or the financial markets could adversely affect the market prices of the notes. The market prices of the notes will depend on many factors, including, among others, the following: - ratings on our debt securities assigned by rating agencies; - the prevailing interest rates being paid by other companies similar to us; - our results of operations, financial condition and prospects; and - the condition of the financial markets. The condition of the financial markets and prevailing interest rates have fluctuated in the past and are likely to fluctuate in the future, which could have an adverse effect on the market prices of the notes. Rating agencies continually review the ratings they have assigned to companies and debt securities. Negative changes in the ratings assigned to us or our debt securities could have an adverse effect on the market prices of the notes. S7 USE OF PROCEEDS The net proceeds from the sale of the notes will be used for general corporate purposes, which may include funding for working capital, eapital expenditures, repurchases of our capital stock and acquisitions. CAPITALIZATION The following sets forth our capitalization on a consolidated basis as of June 30, 2010. We have presented our capitalization en both an actual and an as adjusted basis to reflect the issuance and sale of the notes offered hereby, but not the application of the net proceeds from the issuanee and sale of the notes. See "Use of Proceeds." You should read the following table along with our financial statements and the accompanying notes to those statements, together with the information set forth under "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our Annual Report on Form 10-K for the fiscal year ended June 30, 2010, which is incerporated by reference in the accompanying prospectus. See "Where You Can Find More Information." (1) Consists of commercial paper notes. RATIO OF EARNINGS TO FIXED CHARGES The following table sets forth the historical ratio of our eamings to our fixed charges for the periods indicated. Ratio of eamings to fixed charges (1) (1) For purposes of calculating the ratio of camings to fixed charges, earnings represents camings from continuing operations before income taxes and before income (losses) from equity method investments plus: (a) fixed charges, and (b) cash distributions from eyuity method invesinents. Fixed charges include: (a) interest expense, whether expensed or capitalized; abd (b) the portion of operating rental expense which management believes is representative of the interest component of rent expense. DESCRIPTION OF THE NOTES The following description of the particular terms and conditions of the notes supplements the description of the general terms and conditions of the debt securities set forth under "Description of the Debt Securities" in the accompanying prospectus. Capitalized terms used but not defined in this prospectus supplement have the meanings assigned in the accompanying prospectus or the indenture referred to below. General The notes will be issued in four series of debt securities under the indenture, dated as of May 18, 2009, between us and The Bank of New York Mellon Trust Company, N.A., as trustee, as supplemented by a supplemental indenture to be dated as of September 27,2010 , between us and the trustee. The indenture is more fully described in the accompanying prospectus. The following description of the specific terms and conditions of the notes supplements, and to the extent inconsistent therewith replaces, the description of the general terms and conditions of the debt securities set forth in the accompanying prospectus. The 2013 notes initially will be limited to $1,000,000,000 aggregate principal amount. The 2015 notes initially will be limited to $1,750,000,000 aggregate principal amount. The 2020 notes initially will be limited to $1,000,000,000 aggregate principal amount. The 2040 notes initially will be limited to $1,000,000,000 aggregate principal amount. We may issue additional notes of each series without the consent of the holders of that series of notes, but we will not issue such additional notes unless they are fungible for U.S. federal income tax purposes with the relevant series of notes offered hereby. The notes will be our senior unsecured obligations and will rank equally with our other unsecured and unsubordinated debt from time to time outstanding. The maturity date of the 2013 notes will be September 27, 2013. The maturity date of the 2015 notes will be September 25,2015. The maturity date of the 2020 notes will be October 1, 2020. The maturity date of the 2040 notes will be October 1,2040. The notes will be subject to legal defeasance and covenant defeasance as provided under "Description of the Debt Securities - Discharge, Defeasance and Covenant Defeasance" in the accompanying prospectus. The notes will be issued in a form of one or more fully registered global securities, without coupons, in denominations of $2,000 in principal amount and integral multiples of $1,000 in excess thereof. The notes will not be redeemable prior to maturity and will not benefit from any sinking fund. Interest and Principal The notes will bear interest from September 27, 2010 at the annual fixed rates set forth on the cover of this prospectus supplement. We will pay interest on the 2013 notes semi-annually on March 27 and September 27 of each year, beginning on March 27, 2011, and on the maturity date for the 2013 notes (each an "interest payment date" with respect to the 2013 notes). We will pay interest on the 2015 notes semi-annually on March 25 and September 25 of each year, beginning on March 25, 2011, and on the maturity date for the 2015 notes (each an "interest payment date" with respect to the 2015 notes). We will pay interest on the 2020 notes semi-annually on April 1 and October 1 of each year, beginning on April 1, 2011, and on the maturity date for the 2020 notes (each an "interest payment date" with respect to the 2020 notes). We will pay interest on the 2040 notes semi-annually on April I and October 1 of each year, beginning on April I, 2011, and on the maturity date for the 2040 notes (each an "interest payment date" with respect to the 2040 notes). We will pay interest on the notes to the persons in whose names the notes are registered at the close of business on March 15 and September 15, as the case may be (in each S- 9 case, whether or not a business day) immediately preceding the related interest payment date for the applicable series of notes. Interest on the notes will be computed on the basis of a 360-day year composed of twelve 30 -day months. We will pay the principal of and interest on each note to the registered holder in U.S. dollars in immediately available funds. Payment will be made upon presentation of the notes at the office or agency we maintain for this purpose in the Borough of Manhattan, The City of New York, currently at the trustee's office located at 101 Barclay Street, 8W, New York, New York 10286, Attention: Corporate Trust Administration; provided, however, that payment of interest may be made at our option by check mailed to the registered holder on the record date at such address as shall appear in the security register or by wire transfer of immediately available funds to an account specified in writing by such holder to us and the trustee prior to the relevant record date. Notwithstanding anything to the contrary in this prospectus supplement or the accompanying prospectus, so long as the notes are in book-entry form, we will make payments of principal and interest through the trustee to DTC. Interest payable on any interest payment date for a series of notes or the maturity date for that series of notes will be the amount of interest accrued from, and including, the next preceding interest payment date for that series of notes in respect of which interest has been paid or duly provided for (or from and including the original issue date, if no interest has been paid or duly provided for with respect to the notes of that series) to, but excluding, such interest payment date or maturity date, as the case may be. If any interest payment date falls on a day that is not a business day, the interest payment will be made on the next succeeding business day, and we will not be liable for any additional interest as a result of the delay in payment. If a maturity date falls on a day that is not a business day, the related payment of principal and interest will be made on the next succeeding business day, and no interest will accrue on the amounts so payable for the period from and after such date to the next succeeding business day. The term "business day" means any day, other than a Saturday or a Sunday, that is not a day on which banking institutions are authorized or obligated by law or executive order to close in New York City. Book-Entry; Delivery and Form; Global Securities Each series of notes will be issued in the form of one or more global securities, in definitive, fully registered form without interest coupons, each of which we refer to as a "global security. " Each such global security will be deposited with the trustee as custodian for DTC and registered in the name of a nominee of DTC in New York, New York for the accounts of participants in DTC. We will not issue certificated securities to you for the notes you purchase, except in the limited circumstances described below, Each global security will be issued to DTC, which will keep a computerized record of its participants whose clients have purchased and beneficially own notes of a particular series. Each participant will then keep a record of its clients who have purchased and beneficially own notes of a particular series. Unless it is exchanged in whole or in part for a certificated security, a global security may not be transferred. DTC, its nominee and their successors may, however, transfer a global security as a whole to one another, and these transfers are required to be recorded on our records or a register to be maintained by the trustee. Additional information conceming book-entry procedures, as well as DTC, Euroclear Bank SA/NV, as operator of the Euroclear System, or Euroclear, and Clearstream Banking, societe anonyme , or Clearstream, is set forth under "Description of the Debt Securities - Book-Entry; Delivery and Form; Global Securities" in the accompanying prospectus. Beneficial interests in a global security will be shown on, and transfers of beneficial interests in the global securities will be made only through, records maintained by DTC and its participants. When you purchase S10 rripotiblity of the purticipunts and ase of DTC, the trwitee ot eur enapany Credt tor the astes will appear ce ihe eeat day tharppeas limek. berween rwo DTC paricipune. sat stitenctin date Suber. Trates, Faying Agset and Sreurity Avgiatrar CERTAIN U.S. FEDERAL INCOME AND ESTATE TAX CONSEQUENCES TO NON-U.S. HOLDERS The following is a summary of certain U.S. federal income and estate tax consequences of the purchase, ownership and disposition of the notes as of the date hereof. Except where noted, this summary addresses only notes that are held as capital assets by a non-U.S. holder who acquires the notes upon original issuance at their initial offering price (as determined for U,S. federal income tax purposes). A "non-U.S. holder" means a holder of the notes (other than a partnership) that is not for U.S. federal income tax purposes any of the following: - an individual citizen or resident of the United States; - a corporation (or any other entity treated as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the United States, any state thereof or the District of Columbia; - an estate the income of which is subject to U.S. federal income taxation regardless of its source; or - a trust if it (1) is subject to the primary supervision of a court within the United States and one or more U.S. persons have the authority to control all substantial decisions of the trust or (2) has a valid election in effect under applicable United States Treasury regulations to be treated as a U.S. person. This summary is based upon provisions of the Internal Revenue Code of 1986, as amended (the "Code"), and regulations, rulings and judicial decisions as of the date hereof. Those authorities may be changed, perhaps retroactively, so as to result in U.S. federal income and estate tax consequences different from those summarized below. This summary does not address all aspects of U.S. federal income and estate taxes and does not deal with foreign, state, local or other tax considerations that may be relevant to non-U.S. holders in light of their personal circumstances. In addition, it does not represent a detailed description of the U.S. federal income and estate tax consequences applicable to you if you are subject to special treatment under the U.S. federal income tax laws (including if you are a U.S. expatriate, "controlled foreign corporation," "passive foreign investment company" or a partnership or other pass-through entity for U.S. federal income tax purposes). We cannot assure you that a change in law will not alter significantly the tax considerations that we describe in this summary. If a partnership holds the notes, the tax treatment of a partner will generally depend upon the status of the partner and the activities of the partnership. If you are a partner of a partnership holding the notes, you should consult your tax advisors. If you are considering the purchase of notes, you should consult your own tax advisors concerning the particular U.S. federal income, alternative minimum and estate tax consequences to you of the ownership of the notes, as well as the consequences to you arising under the laws of any other taxing jurisdiction. U.S. Federal Withholding Tax The 30% U.S. federal withholding tax will not apply to any payment of interest on the notes under the "portfolio interest rule"; provided that: - you do not actually (or constructively) own 10\% or more of the total combined voting power of all classes of our voting stock within the meaning of the Code and applicable U.S. Treasury regulations; S-13 anoss though certain foreige intarmediaries and stisf the certificesion requerenents of applicable US. Trearapy tegulatiom. applikale incume tas neewy; er is effoctively ceenectad witi your condect af a trale or tasiaess in ihe Hhad Stases (as decusod belaw under U.S. Fedenal Incone Tan) estange, ectirmeat of obler dipinibin of a note. U.8. Federal incene Tax eentain odier coschices are met. U.S. Fideral Kutate Tax metien Ibluicinath Infermatioa Reperting and Auskup Withbeldieg vtalenere dewetibed ibere in be formb bulkt peint inder 'US. Federal Whitholding Tax." you oturo estebliat as exiagtion. UNDERWRITING We and the underwriters named below have entered into an underwriting agreement relating to the offer and sale of the notes. In the underwriting agreement, we have agreed to sell to each underwriter severally, and each underwriter has agreed severally to purchase from us, the principal amount of notes that appears opposite the name of that underwriter below: The underwriting agreement provides that the underwriters are obligated to purchase all of the notes if any are purchased. The underwriting agreement also provides that if an underwriter defaults, the purchase commitments of non-defaulting underwriters may be increased or the offering of notes may be terminated. The underwriters propose to offer each series of notes directly to the public at the public offering prices described on the cover page of this prospectus supplement and to certain dealers at the public offering price less a concession not to exceed 0.100% of the principal amount of the 2013 notes, 0.200% of the principal amount of the 2015 notes, 0.300% of the principal amount of the 2020 notes and 0.500% of the principal amount of the 2040 notes. The underwriters may allow, and dealers may reallow, a concession not to exceed 0.025% of the principal amount of the 2013 notes, 0.025% of the principal amount of the 2015 notes, 0.200% of the principal amount of the 2020 notes or 0.250% of the principal amount of the 2040 notes on sales to other dealers. After the initial offering of the notes of each series, the underwriters may change the public offering prices and concessions. We have agreed to indemnify the underwriters against certain liabilities, including liabilities under the Securities Act of 1933 , as amended, or to contribute to payments the underwriters may be required to make in respect of those liabilities. The underwriters are offering the notes, subject to prior sale, when, as and if issued to and aceepted by them, subject to approval of legal matters by their counsel, including the validity of the notes, and other conditions contained in the underwriting agreement, such as the receipt by the underwriters of an officer's certificate and legal opinions. The underwriters reserve the right to withdraw, cancel or modify offers to the public and to reject orders in whole or in part. UNDERWRITING We and the underwriters named below have entered into an underwriting agreement relating to the offer and sale of the notes. In the underwriting agreement, we have agreed to sell to each underwriter severally, and each underwriter has agreed severally to purchase from us, the principal amount of notes that appears opposite the name of that underwriter below: The underwriting agreement provides that the underwriters are obligated to purchase all of the notes if any are purchased. The underwriting agreement also provides that if an underwriter defaults, the purchase commitments of non-defaulting underwriters may be increased or the offering of notes may be terminated. The underwriters propose to offer each series of notes directly to the public at the public offering prices described on the cover page of this prospectus supplement and to certain dealers at the public offering price less a concession not to exceed 0.100% of the principal amount of the 2013 notes, 0.200% of the principal amount of the 2015 notes, 0.300% of the principal amount of the 2020 notes and 0.500% of the principal amount of the 2040 notes. The underwriters may allow, and dealers may reallow, a concession not to exceed 0.025% of the principal amount of the 2013 notes, 0.025% of the principal amount of the 2015 notes, 0.200% of the principal amount of the 2020 notes or 0.250% of the principal amount of the 2040 notes on sales to other dealers. After the initial offering of the notes of each series, the underwriters may change the public offering prices and concessions. We have agreed to indemnify the underwriters against certain liabilities, including liabilities under the Securities Act of 1933 , as amended, or to contribute to payments the underwriters may be required to make in respect of those liabilities. The underwriters are offering the notes, subject to prior sale, when, as and if issued to and aceepted by them, subject to approval of legal matters by their counsel, including the validity of the notes, and other conditions contained in the underwriting agreement, such as the receipt by the underwriters of an officer's certificate and legal opinions. The underwriters reserve the right to withdraw, cancel or modify offers to the public and to reject orders in whole or in part. Relevant Member State prior to the publication of a prospectus in relation to the notes which has been approved by the competent authority in that Relevant Member State or, where appropriate, approved in another Relevant Member State and notified to the competent authority in that Relevant Member State, all in accordance with the Prospectus Directive, except that it may, with effect from and including the Relevant Implementation Date, make an offer of notes to the public in that Relevant Member State at any time: (1) to legal entities that are authorized or regulated to operate in the financial markets or, if not so authorized or regulated, whose corporate purpose is solely to invest in securities; (2) to any legal entity that has two or more of (a) an average of at least 250 employees during the last financial year; (b) a total balance sheet of more than 43,000,000; and (c) an annual net turnover of more than 50,000,000, as shown in its last annual or consolidated accounts; or (3) in any other circumstances that do not require the publication by us of a prospectus pursuant to Article 3 of the Prospectus Directive. For the purpose of this provision, the expression an "offer of notes to the public" in relation to any notes in any Relevant Member State means the communication in any form and by any means of sufficient information on the terms of the offer and the notes to be offered so as to enable an investor to decide to purchase or subscribe the notes, as the same may be varied in that Relevant Member State by any measure implementing the Prospectus Directive in that Relevant Member State, and the expression "Prospectus Directive" means Directive 2003/71/EC and includes any relevant implementing measure in each Relevant Member State. United Kingdom Each underwriter has represented and agreed that: (i) it has only communicated or caused to be communicated and will only communicate or cause to be communicated an invitation or inducement to engage in investment activity (within the meaning of Section 21 of the Financial Services and Markets Act 2000 (the "FSMA")) received by it in connection with the issue or sale of any notes in circumstances in which Section 21(1) of the FSMA does not apply to us; and (ii) it has complied and will comply with all applicable provisions of the FSMA with respect to anything done by it in relation to any notes in, from or otherwise involving the United Kingdom. Hong Kong The notes may not be offered or sold by means of any document other than (i) in circumstances which do not constitute an offer to the public within the meaning of the Companies Ordinance (Cap.32, Laws of Hong Kong), or (ii) to "professional investors" within the meaning of the Securities and Futures Ordinance (Cap.571, Laws of Hong Kong) and any rules made thereunder, or (iii) in other circumstances which do not result in the document being a "prospectus" within the meaning of the Companies Ordinance (Cap.32, Laws of Hong Kong), and no advertisement, invitation or document relating to the notes may be issued or may be in the possession of any person for the purpose of issue (in each case whether in Hong Kong or elsewhere), which is directed at, or the contents of which are likely to be accessed or read by, the public in Hong Kong (except if permitted to do so under the laws of Hong Kong) other than with respect to notes which are or are intended to be disposed of only to persons outside Hong Kong or only to "professional investors" within the meaning of the Securities and Futures Ordinance (Cap. 571, Laws of Hong Kong) and any rules made thereunder. S-18 Sopae which irander. Sinsepere the trensere of (3) the trataler is by qperatice of las Ditsr Mulationsipe and an affiliate of Ilurdays Capital foc. is a docuncnation agmot ender that choda appomont. 514 Inthicretin Hical. MtAtTkRs Corporatima. Simpien Thacher of Barlett 1.1P frum time to time perfocma lefal iervicen for in. We may, from time to time, offer to sell debt securities in one or more offerings. This prospectus deseribes some of the general terms and conditions that may apply to these securities. We will provide the specific terms and conditions of these securities in prospectus supplements to this prospectus. We may offer and sell these debt securities to or through one or more underwriters, dealers and agents or directly to purchasers, on a continuous or delayed basis. Investing in our debt securities involves risks. You should consider the risk factors deseribed in any accompanying prospectus supplement or any documents we incorporate by reference. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prespectus. Any representation to the contrary is a criminal offense. You should rely only on the information contained or incorporated by reference in this prospectus, in any accompanying prospectus supplement or in any free writing prospectus filed by us with the Securities and Exchange Commission, or the SEC. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. You should not assume that the information contained or incorporated by reference in this prospectus and any prospectus supplement or in any such free writing prospectus is accurate as of any date other than the respective dates thereof. Our business, financial condition, results of operations and prespects may have changed since those dates. We are not making an offer to sell these debt securities in any jurisdiction where the offer or sale is not permitted. ABOUT THIS PROSPECTUS This prospectus is part of a registration statement that we filed with the SEC under the Securities Act of 1933, as amended, or the Securities Act, utilizing a "shelf" registration process. Under this shelf registration process, we may, from time to time, sell in one or more offerings any of our debt securities described in this prospectus. This prospectus provides you with a general description of the debt securities that we may offer. Each time we sell debt securities, we will provide a prospectus supplement that will contain specific information about the terms of that offering, including the specific amounts, prices and terms of the securities offered. The prospectus supplement may also add, update or change information contained in this prospectus. You should carefully read both this prospectus and any prospectus supplement together with additional information described below under the heading "Where You Can Find More Information." References in this prospectus to "Microsoft," "we," "us" and "our" and all similar references are to Microsoft Corporation and its consolidated subsidiaries, unless otherwise stated or the context otherwise requires. However, in the "Description of the Debt Securities" section of this prospectus, references to "we," "us" and "our" are to Microsoft Corporation (parent company only) and not to any of its subsidiaries. FORWAKD-LOOKING STATEMENTS Gollowing factork: - challesges to Mineotets brainese model: - inienue conpotition in all of Microsef's murketic - Clains that Maorowe has inirnged be intellectual popaty rights of echern, - Mikroseft's ability te attract and retin aakmod cmplaynesc - delags in product development and ratatod modect rolhese nbodules: - unakicipund ta liabilities - Mecroedf'sability so implenent operating teat tructes that align with recuee gowit. aii A drailed diccussion of thon an edter rids and uncertuitigs that codld cane actual Nedlts and cvech to diffic materially from OUR COMPANY Our mission is to enable people and businesses throughout the world to realize their full potential. Since the company was founded in 1975, we have worked to achieve this mission by creating technology that transforms the way people work, play, and communicate. We develop and market software, services, hardware, and solutions that we believe deliver new opportunities, greater convenience, and enhanced value to people's lives. We do business throughout the world and have offices in more than 100 countries. We are a corporation incorporated under the laws of the State of Washington. Our principal executive offices are located at One Microsoft Way, Redmond, Washington 980526399, and our main telephone number is (425) 882-8080. RATIO OF EARNINGS TO FIXED CHARGES The following table sets forth the historical ratio of our earnings to our fixed charges for the periods indicated. Ratio of earnings to fixed charges (1) (1) For purposes of calculating the ratio of earnings to fixed charges, earnings represents earnings from continuing operations before income taxes and before income (losses) from equity method investments plus: (a) fixed charges; and (b) cash distributions from equity method investments. Fixed charges include: (a) interest expense, whether expensed or capitalized; and (b) the portion of operating rental expense which management believes is representative of the interest component of rent expense. USE OF PROCEEDS Except as otherwise set forth in the applicable prospectus supplement, we intend to use the net proceeds from sales of the debt securities for general corporate purposes, which may include funding for working capital, capital expenditures, repurchases of our capital stock and acquisitions. DESCRIPTION OF THE DEBT SECURITIES We have summarized below general terms and conditions of the debt securities that we will offer and sell pursuant to this prospectus. When we offer to sell a particular series of debt securities, we will describe the specific terms and conditions of the series in a prospectus supplement to this prospectus. We will also indicate in the applicable prospectus supplement whether the general terms and conditions described in this prospectus apply to the series of debt securities. In addition, the terms and conditions of the debt securities of a series may be different in one or more respects from the terms and conditions described below. If so, those differences will be described in the applicable prospectus supplement. We may, but need not, describe any additional or different terms and conditions of such debt securities in an annual report on Form 10-K, a quarterly report on Form 10-Q or a current report on Form 8-K filed with the SEC, the information in which would be incorporated by reference in this prospectus and such report will be identified in the applicable prospectus supplement. We will issue the debt securities in one or more series under an indenture between us and The Bank of New York Mellon Trust Company, N.A., as trustee. The following summary of provisions of the indenture does not purport to be complete and is subject to, and qualified in its entirety by reference to, all of the provisions of the indenture, including definitions therein of certain terms, This summary may not contain all of the information that you may find useful. The terms and conditions of the debt securities of each series will be set forth in those debt securities and in the indenture. For a comprehensive description of any series of debt securities being offered to you pursuant to this prospectus, you should read both this prospectus and the applicable prospectus supplement. We have filed the indenture as an exhibit to the registration statement of which this prospectus forms a part. A form of each debt security, reflecting the specific terms and provisions of that series of debt securities, will be filed with the SEC in connection with each offering and will be incorporated by reference in the registration statement of which this prospectus forms a part. You may obtain a copy of the indenture and any form of debt security that has been filed in the manner described under "Where You Can Find More Information," Capitalized terms used and not defined in this summary have the meanings specified in the indenture. For purposes of this section of this prospectus, references to "we," "us" and "our" are to Microsoft Corporation (parent company only) and not to any of its subsidiaries. References to the "applicable prospectus supplement" are to the prospectus supplement to this prospectus that describes the specific terms and conditions of a series of debt securities. General We may offer the debt securities from time to time in as many distinct series as we may determine. All debt securities will be our senior unsecured obligations. The indenture does not limit the amount of debt securities that we may issue under that indenture. We may, without the consent of the holders of the debt securities of any series, issue additional debt securities ranking equally with, and otherwise similar in all respects to, the debt securities of the series (except for the public offering price and the issue date) so that those additional debt securities will be consolidated and form a single series with the debt securities of the series previously offered and sold. The debt securities of each series will be issued in fully registered form without interest coupons. We currently anticipate that the debt securities of each series offered and sold pursuant to this prospectus will be issued as global debt securities as described under "-Book-Entry; Delivery and Form; Global Securities" and will trade in book-entry form only. Debt securities denominated in U.S. dollars will be issued in denominations of $2,000 and any integral multiple of $1,000 in excess thereof, unless otherwise specified in the applicable prospectus supplement. If the 2 Iable of Centents debt securities of a series are denominated in a foreign or composite currency, the applicable prospectus supplement will specify the denomination or denominations in which those debt securities will be issued. Unless otherwise specified in the applicable prospectus supplement, we will repay the debt securities of each series at 100% of their principal amount, together with acerued and unpaid interest thereon at maturity, except if those debt securities have been previously redeemed or purchased and cancelled. Unless otherwise specified in the applicable prospectus supplement, the debt securities of each series will not be listed on any securities exchange. Provisions of Indenture The indenture provides that debt securities may be issued under it from time to time in one or more series. For each series of debt securities, this prospectus and the applicable prospectus supplement will describe the following terms and conditions of that series of debt securities: - the title of the series: - the maximum aggregate principal amount, if any, established for debt securities of the series; - the person to whom any interest on a debt security of the series will be payable, if other than the person in whose name that debt security (or one or more predecessor debt securities) is registered at the close of business on the regular record date for such interest; - the date or dates on which the principal of any debt securities of the series will be payable or the method used to deternine of extend those dates; - the rate or rates at which any debt securities of the series will bear interest, if any, the date or dates from which any such interest will acerue, the interest payment dates on which any such interest will be payable and the regular record date for any such interest payable on any interest payment date; - the place or places where the principal of and premium, if any. and interest on any debt securities of the series will be payable and the manner in which any payment may be made; - the period or periods within which, the price or prices at which and the terms and conditions upon which any debt securities of the series may be redeemed, in whole or in part, at our option and, if other than by a board resolution, the manner in which any election by us to redeem the debt securities will be evidenced; - our obligation or righ, if any, to redeem or purchase any debt securities of the series pursuant to any sinking fund or at the option of the holder thereof and the period or periods within which, the price or prices at which and the terms and conditions upon which any debt securities of the series will be redeemed or purchased, in whole or in part, pursuant to sach obligation: - if other than denominations of $2,000 and any integral multiple of $1,000 in excess thereof, the denominations in which any debt securities of the series will be issuable; - if the amount of principal of or premium, if any, or interest on any debt securities of the series may be determined with reference to a financial or economic measure or index or pursuant to a formula, the manner in which such amounts will be determined; - if other than U.S. dollars, the currency, currencies or currency units in which the principal of or premium, if any, or interest on any debt securities of the series will be payable and the manner of determining the equivalent thereof in U.S. dollars for any purpose; 3 General In the applicable prospectus supplement, we will designate the debt securities of a series as being either debt securities bearing interest at a fixed rate of interest or debt securities bearing interest at a floating rate of interest. Each debt security will begin to acerue interest from the date on which it is originally issued. Interest on each such debt security will be payable in arrears on the interest payment dates set forth in the applicable prospectus supplement and as otherwise described below and at maturity or, if earlier, the redemption date deseribed below. Interest will be payable to the holder of record of the debt securities at the close of business on the record date for each interest payment date, which record dates will be specified in such prospectus supplement. As used in the indenture, the term "business day" means, with respect to debt securities of a series, any day, other than a Saturday or Sunday, that is not a day on which banking institutions are authorized or obligated by law or executive order to close in the place where the principal of and premium, if any, and interest on the debt securities of that series are payable. Fixed Rate Debt Securities If the debt securities of a series being offered will bear interest at a fixed rate of interest, the debt securities of that series will bear interest at the annual interest rate specified on the cover page of the applicable prospectus supplement. Interest on those debt securities will be payable semi-annually in arrears on the interest payment dates for those debt securities. If the maturity date, the redemption date or an interest payment date is not a business day, we will pay principal, premium, if any, the redemption price, if any, and interest on the next succeeding business day, and no interest will acerue from and after the relevant maturity date, redemption date or interest payment date to the date of that payment. Unless otherwise specified in the applicable prospectus supplement, interest on the fixed rate debt securities will be computed on the basis of a 360-day year of twelve 30-day months. Floating Rate Debr Securities If the debt securities of a series being offered will bear interest at a floating rate of interest, the debt securities of that series will bear interest during each relevant interest period at the rate determined as set forth in the applicable prospectus supplement and as otherwise set forth below. Each floating rate debt security will have an interest rate basis or formula. Unless otherwise specified in the applicable prospectus supplement, we will base that formula on the London Interbank Offered Rate ("LIBOR") for the LIBOR Currency. The "LIBOR Currency" means the currency specified in the applicable prospectus supplement as to which LIBOR will be calculated or, if no such currency is specified in the applicable prospectus supplement, U.S. dollars. In the applicable prospectus supplement, we will indicate any spread or spread multiplier to be applied in the interest rate formula to determine the interest rate applicable in any interest period. Unless otherwise specified in the applicable prospectus supplement, interest will be computed on the basis of the actual number of days during the relevant interest period and a 360-day year. The floating rate debt securities may have a maximum or minimum rate limitation. In no event, however, will the rate of interest on the debt securities be higher than the maximum rate of interest permitted by New York law as that law may be modified by U.S. laws of general application. The applicable prospectus supplement will identify the calculation agent for each series of floating rate debt securities, which will compute the interest accruing on the debt securities. Table of Centents If any interest payment date for the debt securities of a series bearing interest at a floating rate based on L.BOR (other than the maturity date or the redemption date, if any) would otherwise be a day that is not a business day, then the interest payment date will be postponed to the following date which is a business day, unless that business day falls in the next suceeeding calendar month, in which case the interest payment date will be the immediately preceding business day. If the maturity date or the redemption date, if any, is not a business day. we will pay principal, premium, if any, the redemption price, if any, and interest on the next succeeding business day, and no interest will accrue from and after the maturity date or the redemption date, if any, to the date of that payment. The calculation agent will reset the rate of interest on the debt securities of a series bearing interest at a floating rate based on L.IBOR on each interest payment date. If any of the interest reset dates for the debt securities is not a business day, then that interest reset date will be postponed to the next succeeding business day, unless that day is in the next suceeeding calendar month. in which case, the interest reset date will be the immediately preceding business day. The interest rate set for the debt securities on a particular interest reset date will remain in effect during the interest period commencing on that interest reset date. Each interest period will be the period from and including the interest reset date to, but excluding the next interest reset date or until the maturity date or redemption date, if any, of the debt securities, as the case may be. The calculation agent will detemine the interest rate applicable to the debt securities bearing interest at a floating rate based on LIBOR on the interest detemination date, which will be the second London banking day immediately preceding the interest reset date. The interest rate determined on an interest detemination date will become effective on and as of the next interest reset date. The interest determination date for the interest period commencing on date of issuance of the debt securities will be specified in the applicable prospectus supplement. As used in this prospectus, "London banking day" means any day on which dealings in deposits in the LIBOR Currency are transacted in the London interbank market. If the debt securities bear interest at a floating rate based on LIBOR, the calculation agent will determine LIBOR according to the following provisions: (a) With respect to any interest determination date, LIBOR will be the rate (expressed as a percentage per annum) for deposits in U.S. dollars having a maturity of the Index Maturity commencing on the relevant interest reset date that appears on Reuters Page LIBOR0I as of 11:00a.m. (London time) on that interest determination date. If no such rate appears, LIBOR for that interest determination date will be determined in aceordance with the following clasue (b). (b) With respect to an interest determination date on which no rate appears on Reuters Page L.IBOR0I, as specified in the preceding clause (a), the calculation agent will request the principal London offices of each of four major reference banks in the London interbank market (which may include affiliates of underwriters or the trustee), as selected by us, to provide the calculation agent with its offered quotation (expressed as a percentage per annum) for deposits in U.S, dollars for the Index Maturity, commencing on the relevant interest reset date, to prime banks in the London interbank market at approximately 11:00 a.m. (London time) on that interest determination date and in a principal amount that is representative for a single transaction in U.S. dollars in that market at that time, If at least two quotations are provided. then LIBOR on that interest determination date will be the arithmetic mean of those quotations. If fewer than two quotations are provided, then LIBOR on the interest determination date will be the arithmetic mean of the rates quoted at approximately 11:00 a,m. (New York City time), on the interest determination date by three major banks in New York City (which may be affiliates of underwriters) selected by us for loans in U.S. dollars to leading European banks, having an Index Maturity, commencing on the relevant interest reset date, and in a principal amount that is representative for a single transaction in U.S. dollars in that market at that time. 6 If at least two such rates are so provided, LIBOR on the interest determination date will be the arithmetic mean of such rates. If fewer than two such rates are so provided, LIBOR on the interest determination date will be LIBOR in effect with respect to the immediately preceding interest determination date. "Reuters Page LIBOR0I" means the display that appears on Reuters (or any successor service) on page LIBOR0I (or any page as may replace such page on such service) for the purpose of displaying London interbank offered rates of major banks for U.S. dollars. "Index Maturity" means the period to maturity of the debt securities with respect to which the related interest rate basis or formula will be calculated. For example, the Index Maturity may be one month, three months, six months or one year. All percentages resulting from any calculation will be rounded, if necessary, to the nearest one hundred-thousandth of a percentage point with five one millionths of a percentage point rounded upwards ( e.g. , 4.876545% (or .04876545 ) would be rounded to 4.87655% (or .0487655 )), and all U.S. dollar amounts used in or resulting from such calculation will be rounded to the nearest cent (with one-half cent being rounded upward). The calculation agent will promptly notify the trustee of each determination of the interest rate. The calculation agent will also notify the trustee of the interest rate, the interest amount, the interest period and the interest payment date related to each interest reset date as soon as such information becomes available. The trustee will make such information available to the holders of the relevant debt securities upon request. The calculation agent's determination of any interest rate, and its calculation of the amount of interest for any interest period, will be final and binding in the absence of manifest error. So long as any floating rate debt securities are outstanding, we will at all times maintain a calculation agent.