Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Key Company collected $6,500 in October 1 of 2018 for 5 months of service which would take place from October of 2018 through February of

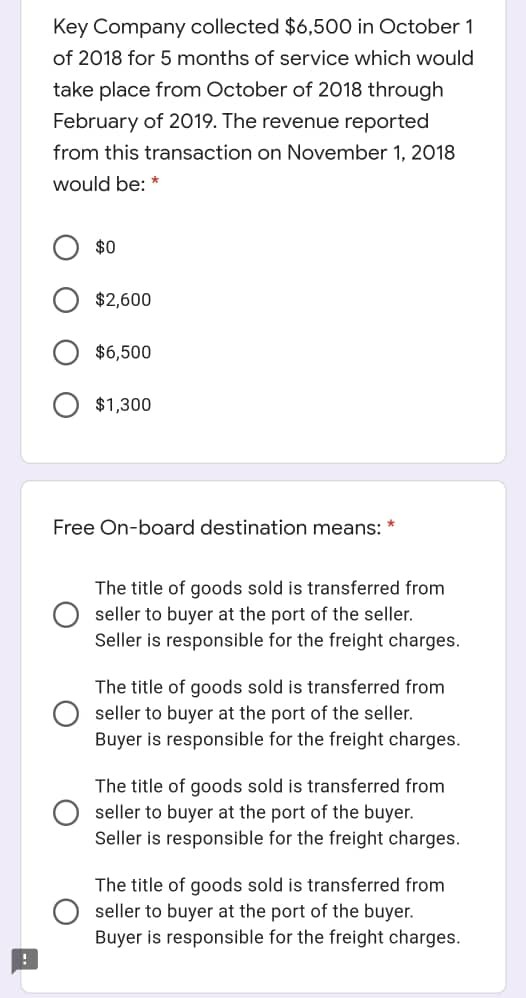

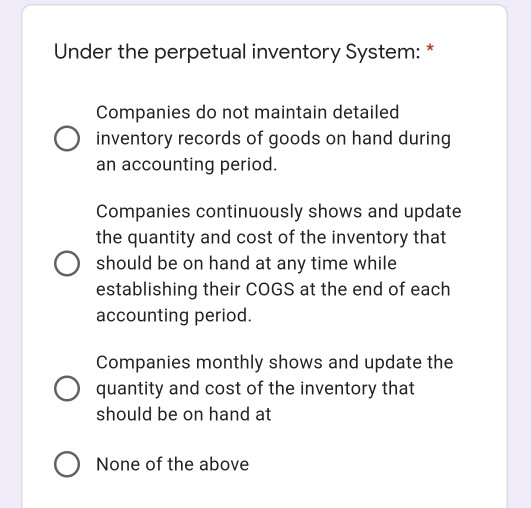

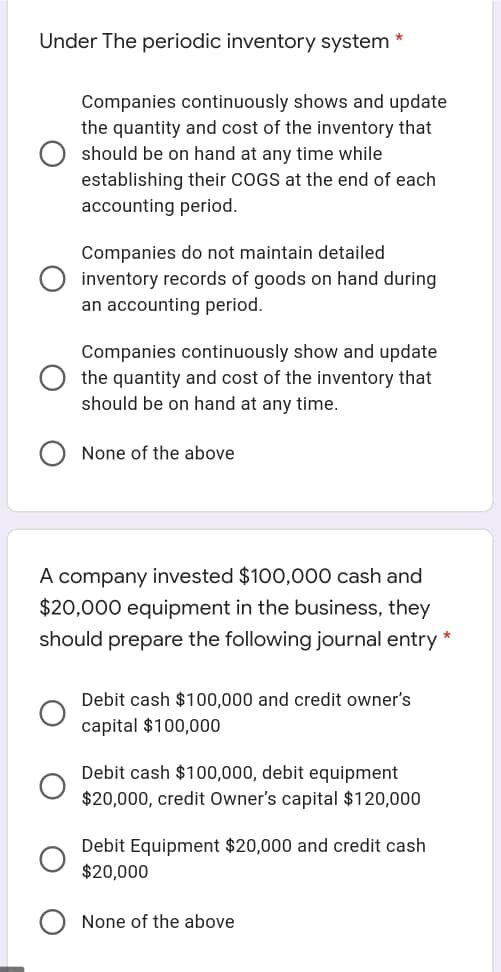

Key Company collected $6,500 in October 1 of 2018 for 5 months of service which would take place from October of 2018 through February of 2019. The revenue reported from this transaction on November 1, 2018 would be: * $0 $2,600 $6,500 $1,300 Free On-board destination means: The title of goods sold is transferred from seller to buyer at the port of the seller. Seller is responsible for the freight charges. The title of goods sold is transferred from seller to buyer at the port of the seller. Buyer is responsible for the freight charges. The title of goods sold is transferred from seller to buyer at the port of the buyer. Seller is responsible for the freight charges. The title of goods sold is transferred from seller to buyer at the port of the buyer. Buyer is responsible for the freight charges. Under the perpetual inventory System: * Companies do not maintain detailed inventory records of goods on hand during an accounting period. Companies continuously shows and update the quantity and cost of the inventory that should be on hand at any time while establishing their COGS at the end of each accounting period. Companies monthly shows and update the quantity and cost of the inventory that should be on hand at None of the above Under The periodic inventory system * Companies continuously shows and update the quantity and cost of the inventory that should be on hand at any time while establishing their COGS at the end of each accounting period. Companies do not maintain detailed inventory records of goods on hand during an accounting period. Companies continuously show and update the quantity and cost of the inventory that should be on hand at any time. None of the above A company invested $100,000 cash and $20,000 equipment in the business, they should prepare the following journal entry * Debit cash $100,000 and credit owner's capital $100,000 Debit cash $100,000, debit equipment $20,000, credit Owner's capital $120,000 Debit Equipment $20,000 and credit cash $20,000 None of the above EMC company hired a secretary- receptionist at a salary of $3,000 per month. What is the entry to be prepared? Debit Salaries expense $3,000 and Credit Cash $3,000 No entry Debit Salaries expense $3,000 and Credit Salaries payable $3,000 Debit Salaries payable $3,000 and Credit cash $3,000 BEDCO purchased office equipment for $120,000 from IKEA by paying 30% cash and 70% on account. The journal entry in IKEA's books will include * Debit Account Receivable for $84,000 Credit Account Payable for $84,000 Credit Note Payable for $84,000 O None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started