Answered step by step

Verified Expert Solution

Question

1 Approved Answer

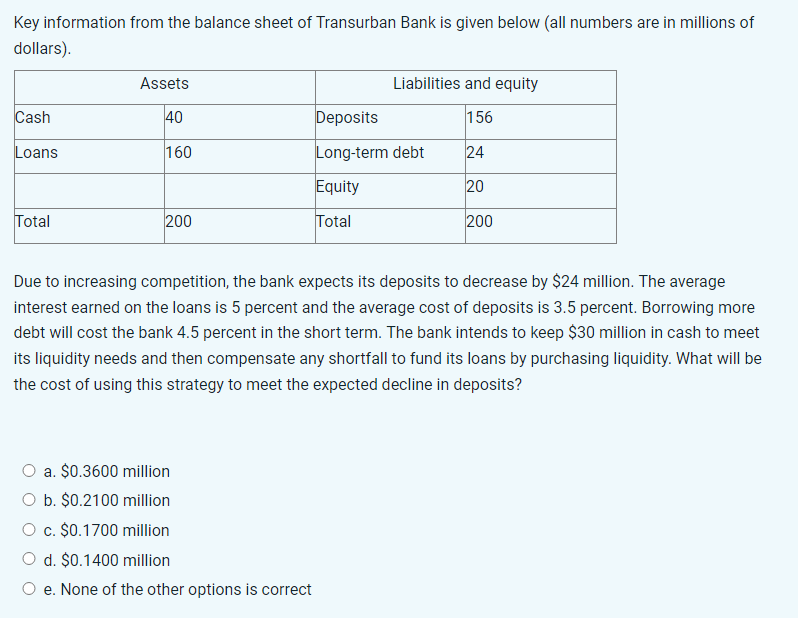

Key information from the balance sheet of Transurban Bank is given below (all numbers are in millions of dollars). Due to increasing competition, the bank

Key information from the balance sheet of Transurban Bank is given below (all numbers are in millions of dollars). Due to increasing competition, the bank expects its deposits to decrease by \\( \\$ 24 \\) million. The average interest earned on the loans is 5 percent and the average cost of deposits is 3.5 percent. Borrowing more debt will cost the bank 4.5 percent in the short term. The bank intends to keep \\( \\$ 30 \\) million in cash to meet its liquidity needs and then compensate any shortfall to fund its loans by purchasing liquidity. What will be the cost of using this strategy to meet the expected decline in deposits? a. \\( \\$ 0.3600 \\) million b. \\( \\$ 0.2100 \\) million c. \\( \\$ 0.1700 \\) million d. \\$0.1400 million e. None of the other options is correct

Key information from the balance sheet of Transurban Bank is given below (all numbers are in millions of dollars). Due to increasing competition, the bank expects its deposits to decrease by \\( \\$ 24 \\) million. The average interest earned on the loans is 5 percent and the average cost of deposits is 3.5 percent. Borrowing more debt will cost the bank 4.5 percent in the short term. The bank intends to keep \\( \\$ 30 \\) million in cash to meet its liquidity needs and then compensate any shortfall to fund its loans by purchasing liquidity. What will be the cost of using this strategy to meet the expected decline in deposits? a. \\( \\$ 0.3600 \\) million b. \\( \\$ 0.2100 \\) million c. \\( \\$ 0.1700 \\) million d. \\$0.1400 million e. None of the other options is correct Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started