Key points from 2.4

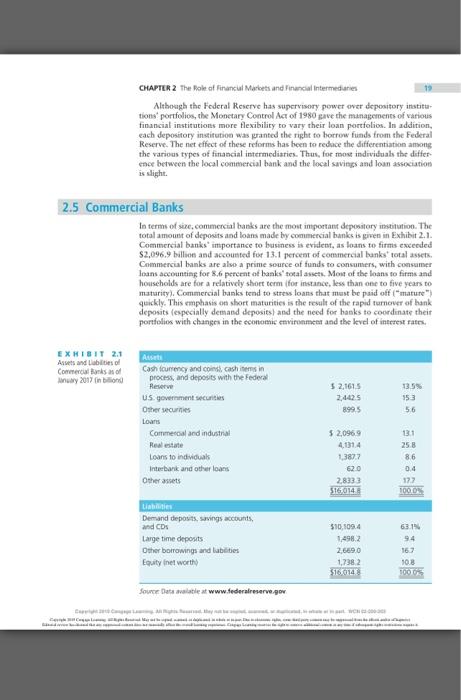

PART 1 Financal lostututiond mecuritics, which may he sold directly to the general public throngh investment bumkers. (The process of issuing and selliag securities through investasent bankers is cowered in Chapeer 3,4 Once the securities are created, they may be subsequently bought and sold ("traded"), A secood important purpose of financial markets is the creation of markets in existing securities. These "sccondary" markets, however, do not transfer funds to the users of funds; they transter owaeiship of securities among varioes investork Sellers trade their secunities for cash, and buyers rrade cash for the securicies, (Secondary markets are aot limited to financial assets. The markets for land or antigues are secondary markets. No new assers are created; tbere is only the transfet of ounctship of an cxisting asset.) Trading in existing sccuritics through secondary markits such as the New York Stock Exchange receives substantial coverase in the financial press and is covered in Chapter 4 . direct Transfer Through Financial Intermediaries When new securities are issued, funds are directly transierred from savers to firms. While the ultimate effect is the same, the transfer through fintacial intermediarics is less direct. The funds are inirially lent to the intermediary, and the intermediary subseguently lends the funds ro the ulnimate asers. To obeain the funds, the financial intermediaries create claime on chemuches. This creation of claims is an impoetant drstinction. An iavestacat banker facilitates an initial sale; secarities beokers and secondary markets facilitate subsequent sales. Investment bankers, brokers, and securities exchanges do not create claims on themselves. They are not financial inter medtaries bot rather function as middlemen who facilirate the buving and selling of new and existing securities. When a saver deposits funds in a financial intermediary sach as a bank, that individual receives a claim on the bank (the account) and not on the firm (or individual or government) to whom the hank lends the funds. If the saver had lent the funda directly to the sltimate users and they failed, the saver would sustain a loss. This loss may not occur if the saver lends the money to a financial intermediary. If a finascial intermediary makes a bad loan, the saver does noe sestain the loss unkess the finascial intermediary fails. Even then the saver may noe sustain a loss if the deposits are insared. The combination of the intermediary's diversificd portiotio of loans and the insurance of deposits has made financial intermediaries a primary haven for the savings of many risk-averse investors. WDiversification is an important topic in finance and is corered at leneth in Chapter 8 on the analvais of risk.) To rap these savings, a variery of intermediaries has evolved. These inclade pommercial banks, thrift institutions (savings and loan associations, mutual saviegs banks, and credit umions), and lafe insurance companics. Many savers are probably not aware of the differences amons these financial intermedianes. They offer similar services asd pay virtually the same rate of interest on deposits. This hlurring of the dastinctions asong the various financial intermediaries is the result of changes in the regulatory environment. Under the Depository Institurions Dercgulation and Monetary Control Act of 1980 imore commonly reterred to as the Monctary Control Act of 1980), all dopository institutions (conmercial bankis. savings and loan associations, mutual savings hanks, and credit unions) became sohject to the repulation of the Federal Reserve. The Federal Reserve's powers extead to the rypes of acconts these institutions may offer and the amount that the various depository instirutions mast hold in reserve against their deposirs. CHAPILk 2 the bole of Financial Marbets and Financial Intermed anes 19 Although the Federal Reserve has supervisory power over depository institations'. porfololios, the Monctary Control Aet of 1980 gave the managernents of various financial institutions more tlexibiliry to vary their loan portfolios. In addition, each depository institution was janted the ripht fo borrow funds from the Federal Reserve. The net effect of these reforms has been to redoce the differentiation among the various types of funancial intermediaries. Thus, for mose indrviduals the difference between the local comtercial bank and the local savings and loan absociation is slipht. 2.5 Commercial Banks In terms of sive; commercial banks are the most important depository imaitution. The total amount of depocits and loans made by commercial banks is giren in Exhibit 2 . . Commertial banks" importance to business is evidenf, as loans to firms encecded \$2,096,9 billoe and accouzed for 13.1 percest of comsenerial banks' rotal assets. Commercial banks are also a prime source-of funds to consumers, with consumer loans accounaing for 8.6 percent ot baaks" toeal awset. Moid of the loans to firms and houscholds are for a relatively stoet term (for instance, less than one to five years to matarity). Commercial banks tend to stress loans that mest be paid off ("mature") quikily. This emphasis ot short maturitics is the result of the rapid ramover of hank deposits (copecially demand deposits) and the need for hasks to coordinate their portiolios with shangen in the sconotaic emviruntmest and ahe kvel of intrret fates. Fx is t I 2.1 Assets and Lubilties of Comerereal kynis as of Mnsay 201 f in biligha Sounce Data analatie at ww. federalreserve.gor