Question

Keypad (Pty) Ltd is a Cape Town based company which manufactures and markets a range of electronic security devices. A recent innovation, which has been

Keypad (Pty) Ltd is a Cape Town based company which manufactures and markets a range of electronic security devices. A recent innovation, which has been fully researched in terms of the market potential for a new security device is being evaluated by the company. The financial accountant seems to have prepared schedules and lists of additional information, all of which is correct, but seems a little confused about how to use the information and perform the calculations required by management. You are asked to help.

1. Due to fast changing technology, the life of the new project is estimated at three years.

2. The cost of the marketing survey was R120,000.

3. The cost of new machinery required for the project will be R5 million.

4. None of the existing machinery will be sold or scrapped if the new machine is purchased. The new machinery will have a residual value of R1.1 million at the end of the project.

5. The new product is expected to cannibalise (take away) the pre-tax cash flows from another product of R15,000 per month over the next three years.

6. Working capital of R400,000 will be required on commencement of the project.

7. Accounting depreciation calculated on a straight line basis over the estimated life of the project whilst for tax purposes the SA Revenue Service will allow the section 12C wear and tear allowance on the 40%:20%:20%:20% basis

8. Sales for 2015 to 2017 will be R5.5million, R6.5 million, and R7.5 million respectively. The company maintains a consistent mark-up and cost of sales will be 40% of sales. Other costs (including fixed costs) will be 45% of sales. Included in the other costs are accounting depreciation and fixed costs allocated from Head Office amounting to R440,000 per annum for each of the next 3 years.

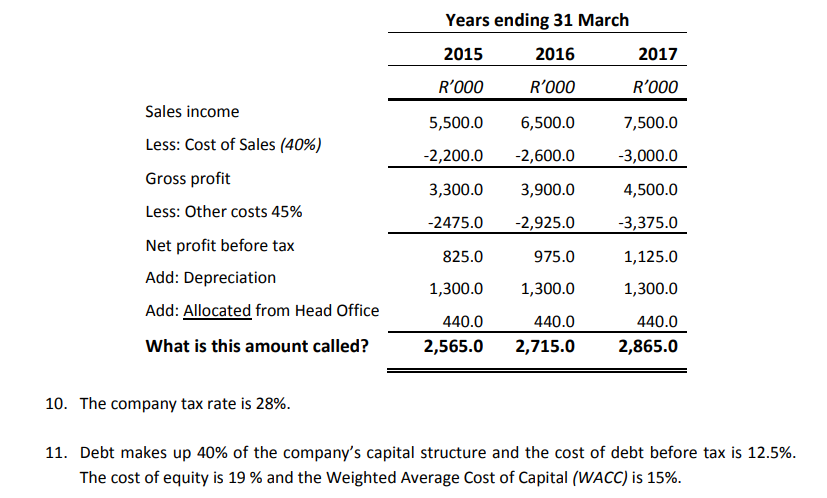

9. The financial accountant has consulted a textbook and started preparing the following schedule (which is correct) but did not know what to call the final result was (marked ???) or how to use it.

REQUIRED: 1. Calculate the Net Present Value (NPV) of the project and advise the company on this basis whether it should undertake the project. (Note: Items omitted from the NPV calculation on the basis that they do not represent cash flows should be clearly identified). Present your answer in an appropriate schedule working in thousands of rands (R000). Show all workings.

10. The company tax rate is 28%. 11. Debt makes up 40% of the company's capital structure and the cost of debt before tax is 12.5%. The cost of equity is 19% and the Weighted Average Cost of Capital (WACC) is 15%. 10. The company tax rate is 28%. 11. Debt makes up 40% of the company's capital structure and the cost of debt before tax is 12.5%. The cost of equity is 19% and the Weighted Average Cost of Capital (WACC) is 15%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started