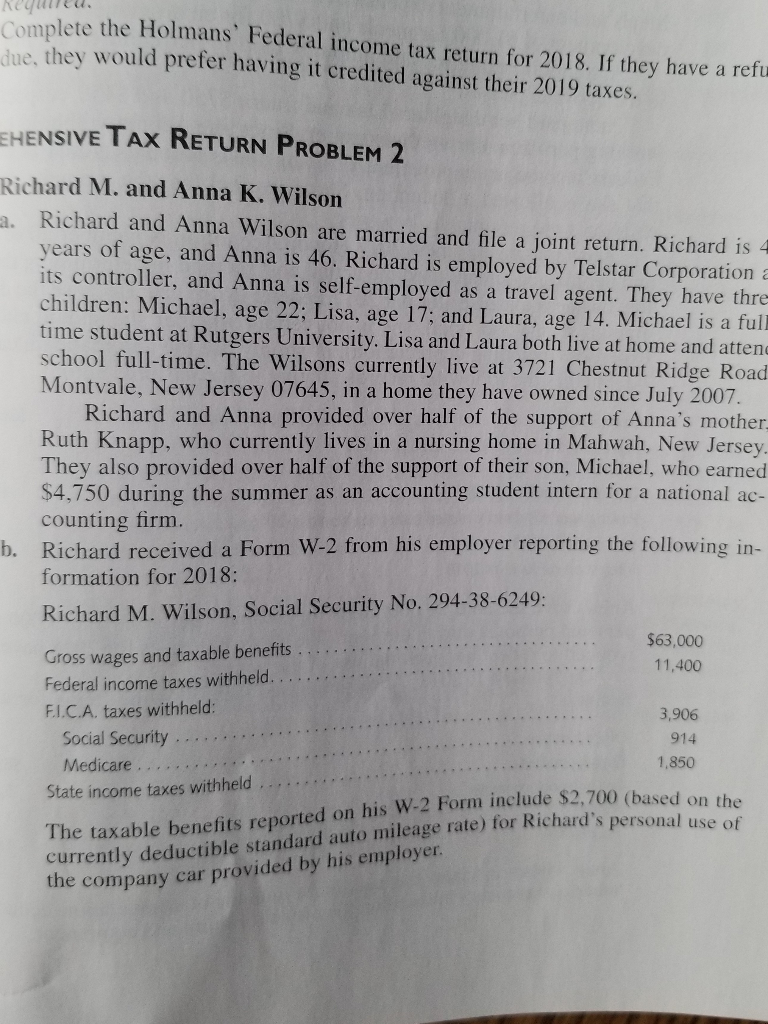

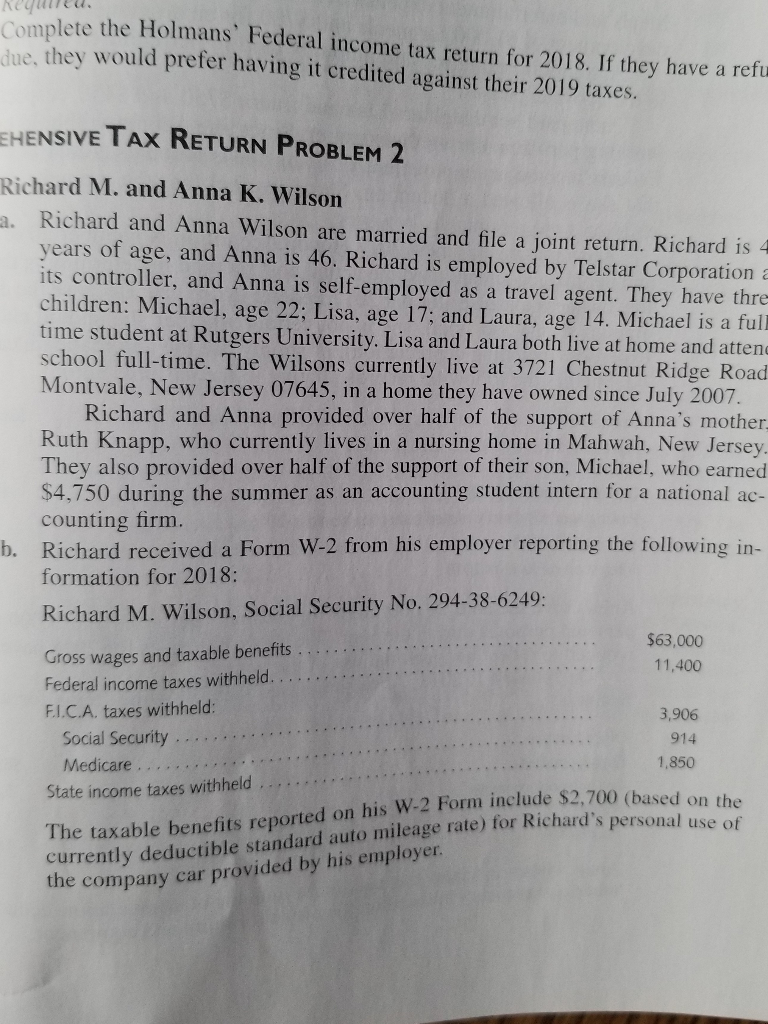

Keywneu. Complete the Holmans Federal income tax return for 2018. If they have a refu due, they would prefer having it credited against their 2019 taxes. EHENSIVE TAX RETURN PROBLEM 2 Richard M. and Anna K. Wilson a. Richard and Anna Wilson are married and file a joint return. Richard is 4 years of age, and Anna is 46. Richard is employed by Telstar Corporation a its controller, and Anna is self-employed as a travel agent. They have thre children: Michael, age 22; Lisa, age 17; and Laura, age 14. Michael is a full time student at Rutgers University. Lisa and Laura both live at home and attend school full-time. The Wilsons currently live at 3721 Chestnut Ridge Road Montvale, New Jersey 07645, in a home they have owned since July 2007. Richard and Anna provided over half of the support of Anna's mother Ruth Knapp, who currently lives in a nursing home in Mahwah, New Jersey. They also provided over half of the support of their son, Michael, who earned $4,750 during the summer as an accounting student intern for a national ac- counting firm. b. Richard received a Form W-2 from his employer reporting the following in formation for 2018: Richard M. Wilson, Social Security No. 294-38-6249: $63,000 Gross wages and taxable benefits 11,400 Federal income taxes withheld.... FI.C.A. taxes withheld: 3,906 Social Security ...... 914 Medicare ....... 1,850 State income taxes withheld. leage rate) for Richard's personal use of The taxable benefits reported on his W-2 Form include $2,700 (based currently deductible standard auto mileage rate) for Richard's the company car provided by his employer. Keywneu. Complete the Holmans Federal income tax return for 2018. If they have a refu due, they would prefer having it credited against their 2019 taxes. EHENSIVE TAX RETURN PROBLEM 2 Richard M. and Anna K. Wilson a. Richard and Anna Wilson are married and file a joint return. Richard is 4 years of age, and Anna is 46. Richard is employed by Telstar Corporation a its controller, and Anna is self-employed as a travel agent. They have thre children: Michael, age 22; Lisa, age 17; and Laura, age 14. Michael is a full time student at Rutgers University. Lisa and Laura both live at home and attend school full-time. The Wilsons currently live at 3721 Chestnut Ridge Road Montvale, New Jersey 07645, in a home they have owned since July 2007. Richard and Anna provided over half of the support of Anna's mother Ruth Knapp, who currently lives in a nursing home in Mahwah, New Jersey. They also provided over half of the support of their son, Michael, who earned $4,750 during the summer as an accounting student intern for a national ac- counting firm. b. Richard received a Form W-2 from his employer reporting the following in formation for 2018: Richard M. Wilson, Social Security No. 294-38-6249: $63,000 Gross wages and taxable benefits 11,400 Federal income taxes withheld.... FI.C.A. taxes withheld: 3,906 Social Security ...... 914 Medicare ....... 1,850 State income taxes withheld. leage rate) for Richard's personal use of The taxable benefits reported on his W-2 Form include $2,700 (based currently deductible standard auto mileage rate) for Richard's the company car provided by his employer