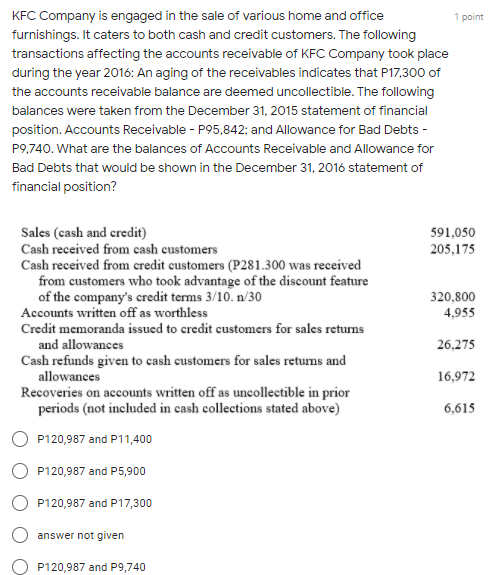

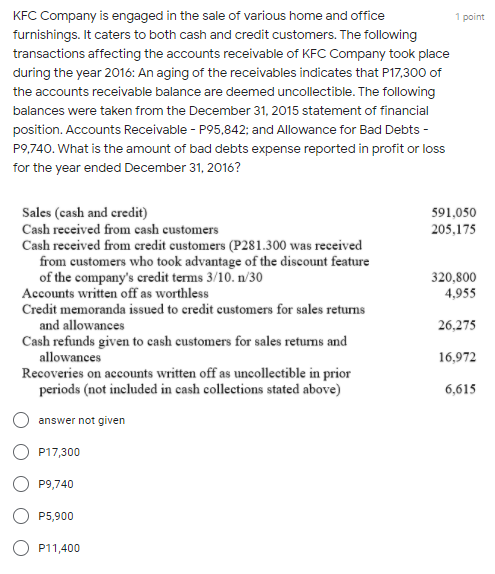

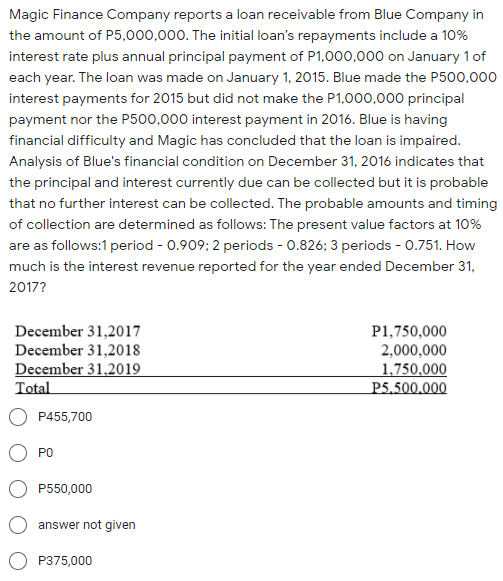

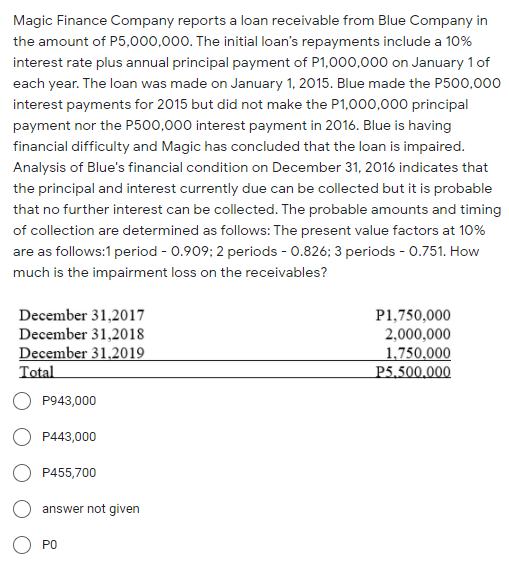

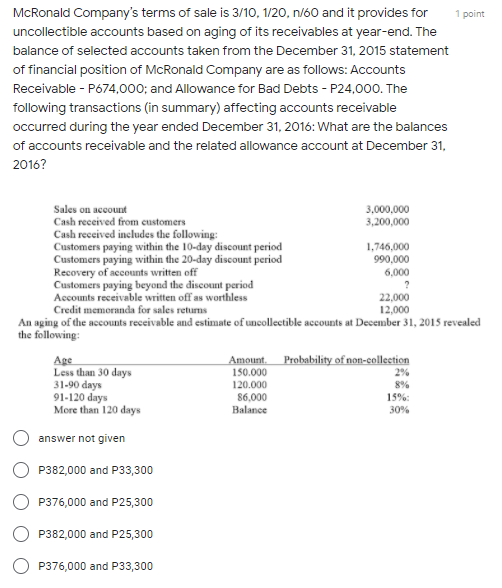

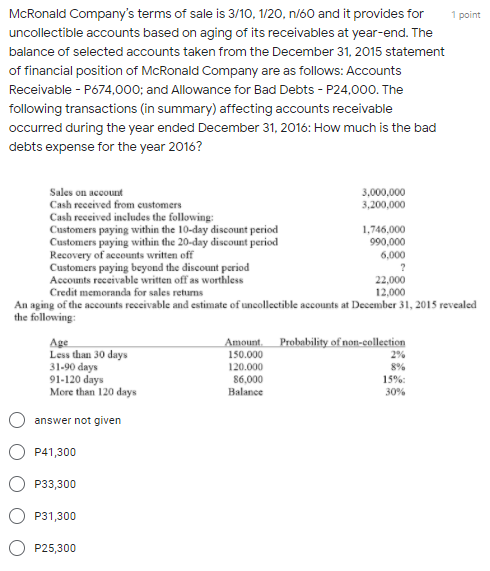

KFC Company is engaged in the sale of various home and office 1 point furnishings. It caters to both cash and credit customers. The following transactions affecting the accounts receivable of KFC Company took place during the year 2016: An aging of the receivables indicates that P17,300 of the accounts receivable balance are deemed uncollectible. The following balances were taken from the December 31, 2015 statement of financial position. Accounts Receivable - P95,842; and Allowance for Bad Debts - P9,740. What are the balances of Accounts Receivable and Allowance for Bad Debts that would be shown in the December 31, 2016 statement of financial position? Sales (cash and credit) 591,050 Cash received from cash customers 205,175 Cash received from credit customers (P281.300 was received from customers who took advantage of the discount feature of the company's credit terms 3/10. n/30 320,800 Accounts written off as worthless 4,955 Credit memoranda issued to credit customers for sales returns and allowances 26,275 Cash refunds given to cash customers for sales returns and allowances 16,972 Recoveries on accounts written off as uncollectible in prior periods (not included in cash collections stated above) 6,615 O P120,987 and P11,400 O P120,987 and P5,900 O P120,987 and P17,300 O answer not given O P120,987 and P9,740KFC Company is engaged in the sale of various home and office 1 point furnishings. It caters to both cash and credit customers. The following transactions affecting the accounts receivable of KFC Company took place during the year 2016: An aging of the receivables indicates that P17,300 of the accounts receivable balance are deemed uncollectible. The following balances were taken from the December 31, 2015 statement of financial position. Accounts Receivable - P95,842; and Allowance for Bad Debts - P9,740. What is the amount of bad debts expense reported in profit or loss for the year ended December 31, 2016? Sales (cash and credit) 591,050 Cash received from cash customers 205,175 Cash received from credit customers (P281.300 was received from customers who took advantage of the discount feature of the company's credit terms 3/10. n/30 320,800 Accounts written off as worthless 4.955 Credit memoranda issued to credit customers for sales returns and allowances 26,275 Cash refunds given to cash customers for sales returns and allowances 16,972 Recoveries on accounts written off as uncollectible in prior periods (not included in cash collections stated above) 6,615 O answer not given O P17,300 O P9,740 O P5,900 P11,400Magic Finance Company reports a loan receivable from Blue Company in the amount of P5,000,000. The initial loan's repayments include a 10% interest rate plus annual principal payment of P1,000,000 on January 1 of each year. The loan was made on January 1, 2015. Blue made the P500,000 interest payments for 2015 but did not make the P1,000,000 principal payment nor the P500,000 interest payment in 2016. Blue is having financial difficulty and Magic has concluded that the loan is impaired. Analysis of Blue's financial condition on December 31, 2016 indicates that the principal and interest currently due can be collected but it is probable that no further interest can be collected. The probable amounts and timing of collection are determined as follows: The present value factors at 10% are as follows:1 period - 0.909: 2 periods - 0.826: 3 periods - 0.751. How much is the interest revenue reported for the year ended December 31, 2017? December 31,2017 P1,750,000 December 31,2018 2,000,000 December 31,2019 1,750,000 Total P5.500.000 O P455,700 PO O P550,000 O answer not given O P375,000Magic Finance Company reports a loan receivable from Blue Company in the amount of P5,000,000. The initial loan's repayments include a 10% interest rate plus annual principal payment of P1,000,000 on January 1 of each year. The loan was made on January 1, 2015. Blue made the P500,000 interest payments for 2015 but did not make the P1,000,000 principal payment nor the P500,000 interest payment in 2016. Blue is having financial difficulty and Magic has concluded that the loan is impaired. Analysis of Blue's financial condition on December 31, 2016 indicates that the principal and interest currently due can be collected but it is probable that no further interest can be collected. The probable amounts and timing of collection are determined as follows: The present value factors at 10% are as follows:1 period - 0.909: 2 periods - 0.826: 3 periods - 0.751. How much is the impairment loss on the receivables? December 31,2017 P1,750,000 December 31,2018 2,000,000 December 31,2019 1,750,000 Total P5.500.000 P943,000 O P443,000 O P455,700 O answer not given O POMcRonald Company's terms of sale is 3/10, 1/20, n/60 and it provides for 1 point uncollectible accounts based on aging of its receivables at year-end. The balance of selected accounts taken from the December 31, 2015 statement of financial position of McRonald Company are as follows: Accounts Receivable - P674,000; and Allowance for Bad Debts - P24,000. The following transactions (in summary) affecting accounts receivable occurred during the year ended December 31, 2016: What are the balances of accounts receivable and the related allowance account at December 31, 2016? Sales on account 3.000,000 Cash received from customers 3,200,000 Cash received includes the following: Customers paying within the 10-day discount period 1,746,000 Customers paying within the 20-day discount period 990,000 Recovery of accounts written off 6.000 Customers paying beyond the discount period Accounts receivable written off as worthless 22,000 Credit memoranda for sales returns 12,000 An aging of the accounts receivable and estimate of uncollectible accounts at December 31, 2015 revealed the following: Age Amount. Probability of non-collection Less than 30 days 150.000 2%% 31-90 days 120.000 8% 91-120 days 86,000 15%: More than 120 days Balance 30% O answer not given O P382,000 and P33,300 O P376,000 and P25,300 O P382,000 and P25,300 P376,000 and P33,300McRonald Company's terms of sale is 3/10, 1/20, n/60 and it provides for 1 point uncollectible accounts based on aging of its receivables at year-end. The balance of selected accounts taken from the December 31, 2015 statement of financial position of McRonald Company are as follows: Accounts Receivable - P674,000; and Allowance for Bad Debts - P24,000. The following transactions (in summary) affecting accounts receivable occurred during the year ended December 31, 2016: How much is the bad debts expense for the year 2016? Sales on account 3,000.000 Cash received from customers 3,200,000 Cash received includes the following: Customers paying within the 10-day discount period 1,746,000 Customers paying within the 20-day discount period 990,000 Recovery of accounts written off 6,000 Customers paying beyond the discount period 7 Accounts receivable written off as worthless 22,000 Credit memoranda for sales returns 12,000 An aging of the accounts receivable and estimate of uncollectible accounts at December 31, 2015 revealed the following: Age Amount. Probability of non-collection Less than 30 days 150.000 2%% 31-90 days 120.000 91-120 days 86,000 15%: More than 120 days Balance 30% O answer not given O P41,300 O P33,300 O P31,300 O P25,300