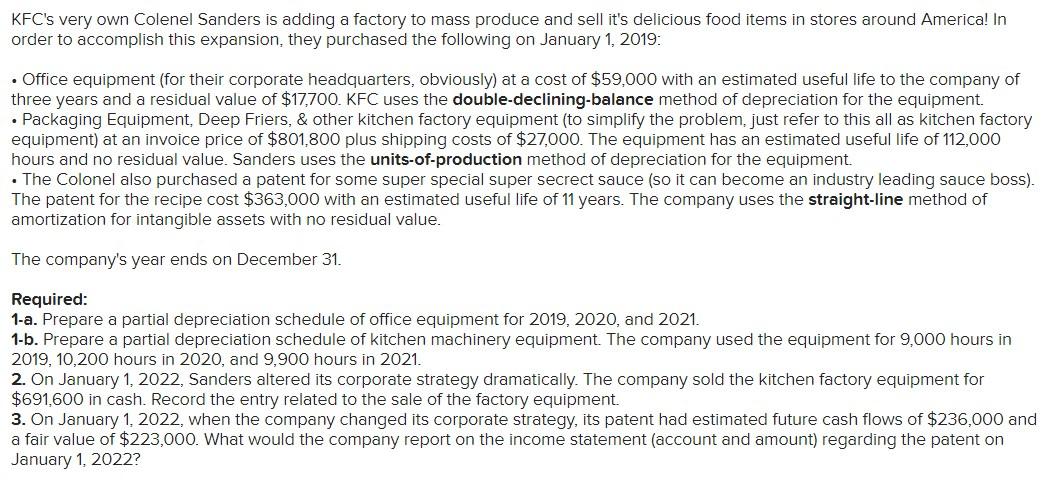

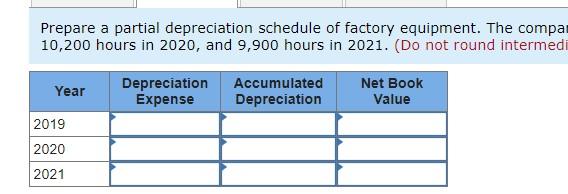

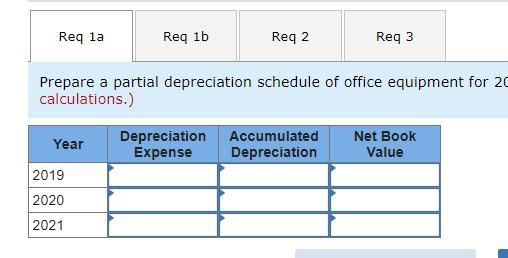

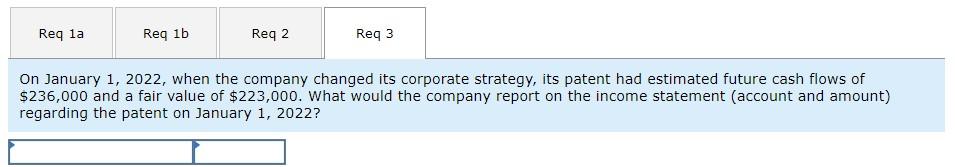

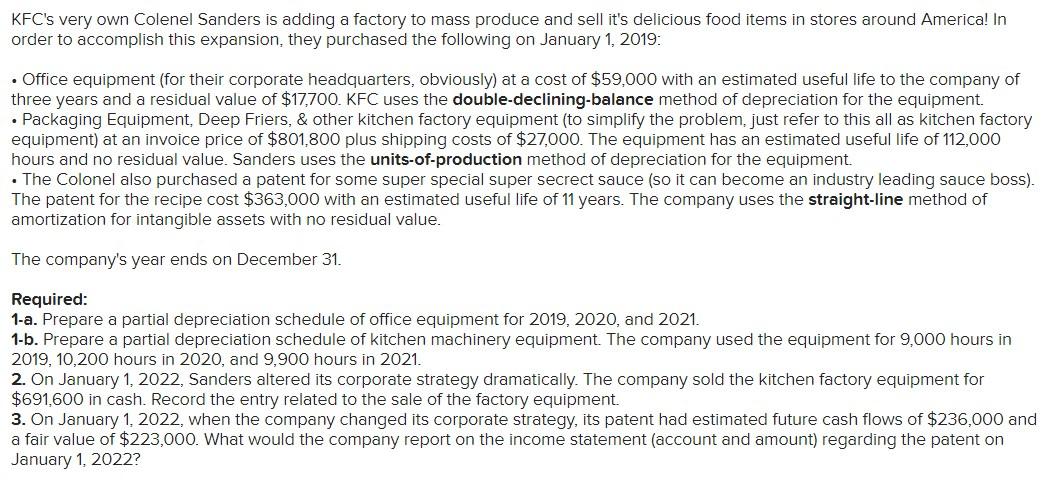

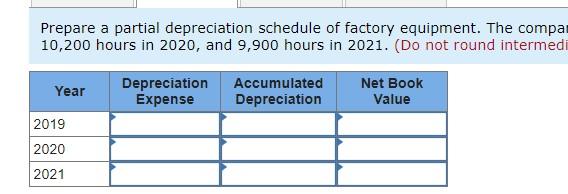

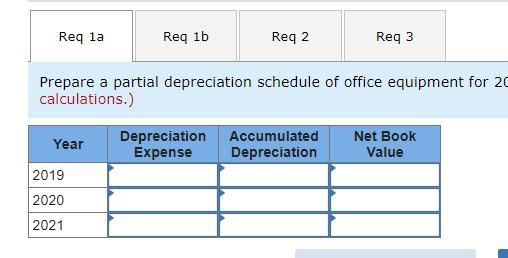

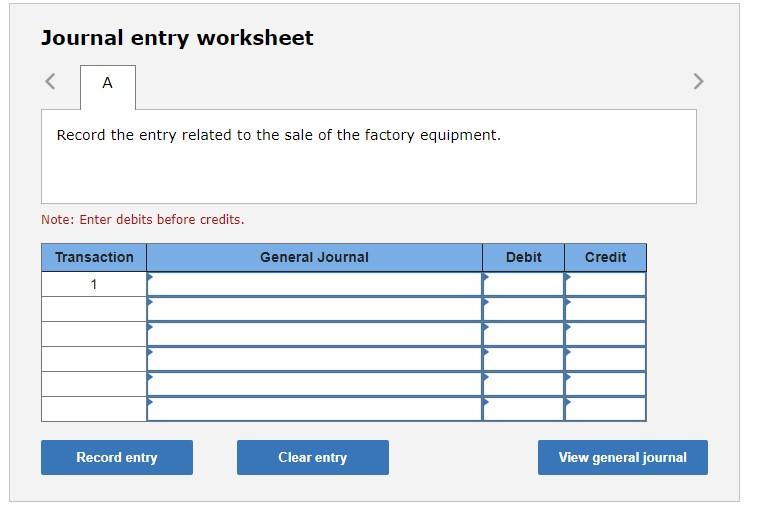

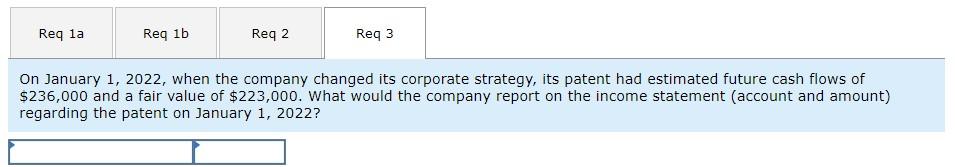

KFC's very own Colenel Sanders is adding a factory to mass produce and sell it's delicious food items in stores around America! In order to accomplish this expansion, they purchased the following on January 1, 2019: Office equipment (for their corporate headquarters, obviously) at a cost of $59,000 with an estimated useful life to the company of three years and a residual value of $17,700. KFC uses the double-declining-balance method of depreciation for the equipment. Packaging Equipment, Deep Friers, & other kitchen factory equipment (to simplify the problem, just refer to this all as kitchen factory equipment) at an invoice price of $801.800 plus shipping costs of $27,000. The equipment has an estimated useful life of 112,000 hours and no residual value. Sanders uses the units-of-production method of depreciation for the equipment The Colonel also purchased a patent for some super special super secrect sauce (so it can become an industry leading sauce boss). The patent for the recipe cost $363,000 with an estimated useful life of 11 years. The company uses the straight-line method of amortization for intangible assets with no residual value. The company's year ends on December 31. Required: 1-a. Prepare a partial depreciation schedule of office equipment for 2019, 2020, and 2021. 1-b. Prepare a partial depreciation schedule of kitchen machinery equipment. The company used the equipment for 9,000 hours in 2019, 10,200 hours in 2020, and 9,900 hours in 2021. 2. On January 1, 2022, Sanders altered its corporate strategy dramatically. The company sold the kitchen factory equipment for $691,600 in cash. Record the entry related to the sale of the factory equipment 3. On January 1, 2022, when the company changed its corporate strategy, its patent had estimated future cash flows of $236,000 and a fair value of $223,000. What would the company report on the income statement (account and amount) regarding the patent on January 1, 2022? Prepare a partial depreciation schedule of factory equipment. The compa 10,200 hours in 2020, and 9,900 hours in 2021. (Do not round intermedi Year Depreciation Expense Accumulated Depreciation Net Book Value 2019 2020 2021 Req la Req 1b Req2 Req3 Prepare a partial depreciation schedule of office equipment for 20 calculations.) Year Depreciation Expense Accumulated Depreciation Net Book Value 2019 2020 2021 Journal entry worksheet