Answered step by step

Verified Expert Solution

Question

1 Approved Answer

KHU, YU, and COHTLER operate under the name of KHUYUCOHT LTD. a partnership with a complex profit and loss sharing agreement. The average capital balance

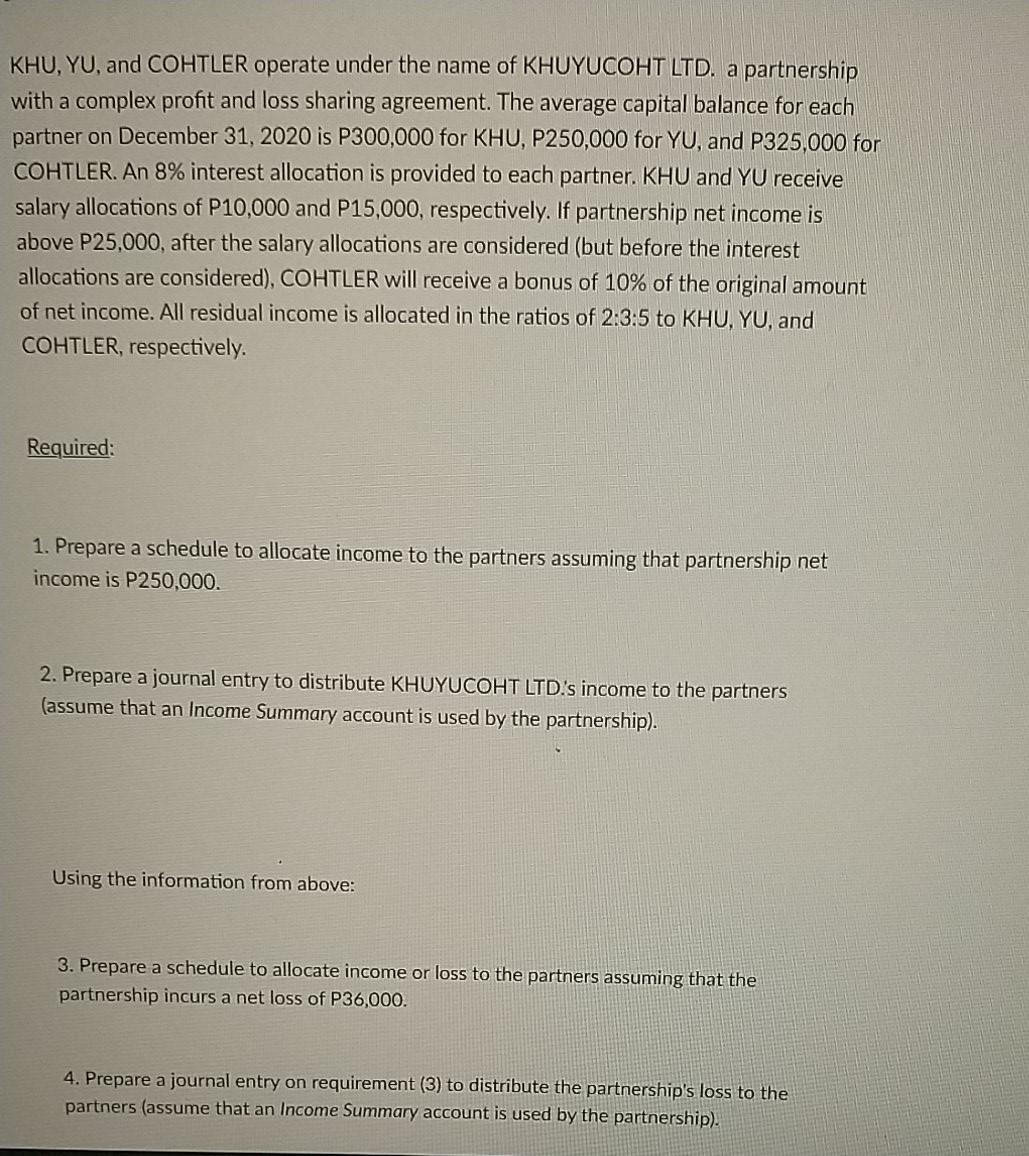

KHU, YU, and COHTLER operate under the name of KHUYUCOHT LTD. a partnership with a complex profit and loss sharing agreement. The average capital balance for each partner on December 31, 2020 is P300,000 for KHU, P250,000 for YU, and P325,000 for COHTLER. An 8% interest allocation is provided to each partner. KHU and YU receive salary allocations of P10,000 and P15,000, respectively. If partnership net income is above P25,000, after the salary allocations are considered (but before the interest allocations are considered), COHTLER will receive a bonus of 10% of the original amount of net income. All residual income is allocated in the ratios of 2:3:5 to KHU, YU, and COHTLER, respectively. Required: 1. Prepare a schedule to allocate income to the partners assuming that partnership net income is P250,000. 2. Prepare a journal entry to distribute KHUYUCOHT LTD.s income to the partners (assume that an Income Summary account is used by the partnership). Using the information from above: 3. Prepare a schedule to allocate income or loss to the partners assuming that the partnership incurs a net loss of P36,000. 4. Prepare a journal entry on requirement (3) to distribute the partnership's loss to the partners (assume that an Income Summary account is used by the partnership)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started