Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kiana lives in a country where two goods are produced and consumed. Her preferences over these two goods can be described by her utility function

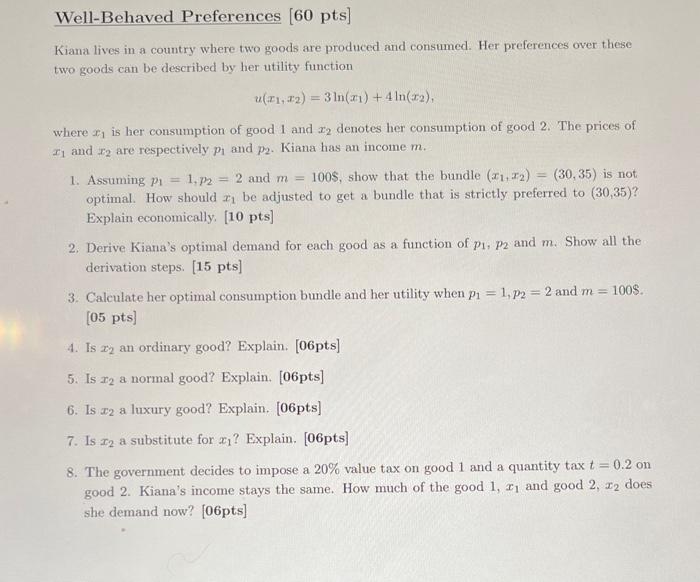

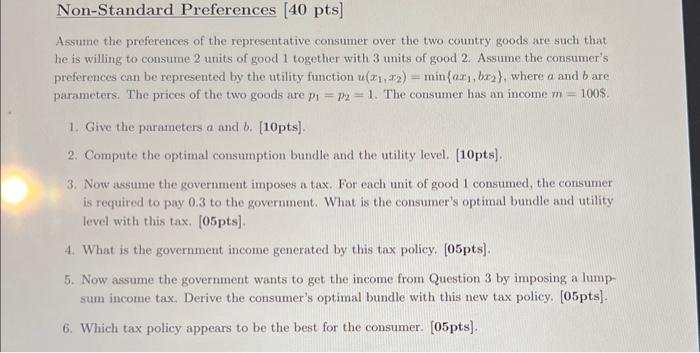

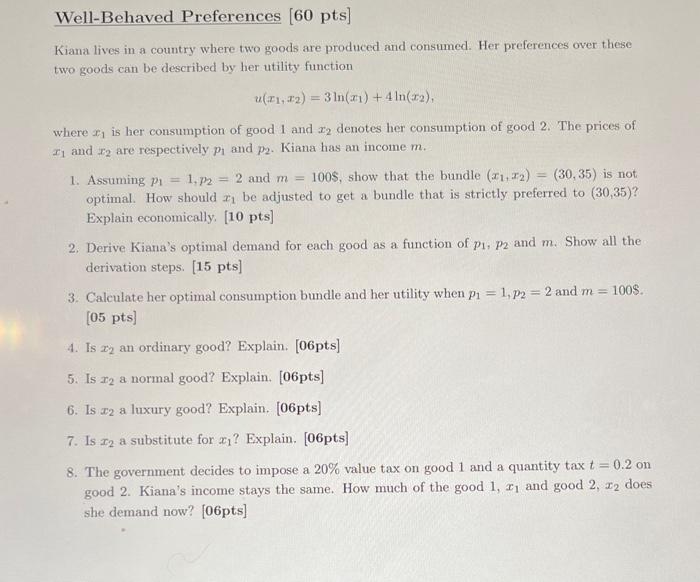

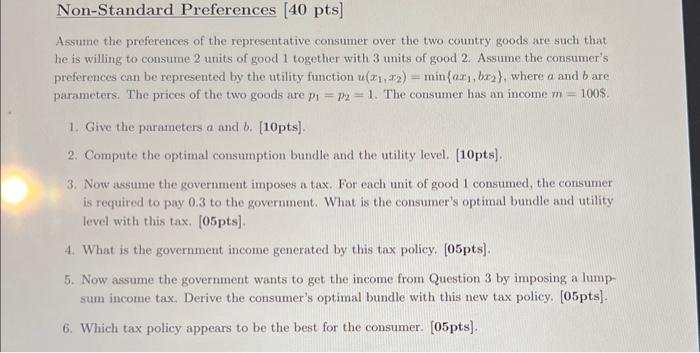

Kiana lives in a country where two goods are produced and consumed. Her preferences over these two goods can be described by her utility function u(x1,x2)=3ln(x1)+4ln(x2), where x1 is her consumption of good 1 and x2 denotes her consumption of good 2 . The prices of x1 and x2 are respectively p1 and p2. Kiana has an income m. 1. Assuming p1=1,p2=2 and m=100$, show that the bundle (x1,x2)=(30,35) is not: optimal. How should x1 be adjusted to get a bundle that is strictly preferred to (30,35) ? Explain economically. [10 pts] 2. Derive Kiana's optimal demand for each good as a function of p1,p2 and m. Show all the derivation steps. [15 pts] 3. Calculate her optimal consumption bundle and her utility when p1=1,p2=2 and m=100$. [05 pts] 4. Is x2 an ordinary good? Explain. [06pts] 5. Is x2 a normal good? Explain. [06pts] 6. Is x2 a luxury good? Explain. [06pts] 7. Is x2 a substitute for x1 ? Explain. [06pts] 8. The government decides to impose a 20% value tax on good 1 and a quantity tax t=0.2 on good 2. Kiana's income stays the same. How much of the good 1,x1 and good 2,x2 does she demand now? [06pts] Assume the preferences of the representative consumer over the two country goods are such that he is willing to consume 2 units of good 1 together with 3 units of good 2. Assume the consumer's preferences can be represented by the utility function u(x1,x2)=min{ax1,bx2}, where a and b are parameters. The prices of the two goods are p1=p2=1. The consumer has an income m=100$. 1. Give the parameters a and b. [10pts]. 2. Compute the optimal consumption bundle and the utility level. [10pts]. 3. Now assume the government imposes a tax. For each unit of good 1 consumed, the consumer is required to pay 0.3 to the government. What is the consumer's optimal bundle and utility level with this tax. [05pts]. 4. What is the government income generated by this tax policy. [05pts]. 5. Now assume the government wants to get the income from Question 3 by imposing a lumpsum income tax. Derive the consumer's optimal bundle with this new tax policy. [05pts]. 6. Which tax policy appears to be the best for the consumer. [05pts]. Kiana lives in a country where two goods are produced and consumed. Her preferences over these two goods can be described by her utility function u(x1,x2)=3ln(x1)+4ln(x2), where x1 is her consumption of good 1 and x2 denotes her consumption of good 2 . The prices of x1 and x2 are respectively p1 and p2. Kiana has an income m. 1. Assuming p1=1,p2=2 and m=100$, show that the bundle (x1,x2)=(30,35) is not: optimal. How should x1 be adjusted to get a bundle that is strictly preferred to (30,35) ? Explain economically. [10 pts] 2. Derive Kiana's optimal demand for each good as a function of p1,p2 and m. Show all the derivation steps. [15 pts] 3. Calculate her optimal consumption bundle and her utility when p1=1,p2=2 and m=100$. [05 pts] 4. Is x2 an ordinary good? Explain. [06pts] 5. Is x2 a normal good? Explain. [06pts] 6. Is x2 a luxury good? Explain. [06pts] 7. Is x2 a substitute for x1 ? Explain. [06pts] 8. The government decides to impose a 20% value tax on good 1 and a quantity tax t=0.2 on good 2. Kiana's income stays the same. How much of the good 1,x1 and good 2,x2 does she demand now? [06pts] Assume the preferences of the representative consumer over the two country goods are such that he is willing to consume 2 units of good 1 together with 3 units of good 2. Assume the consumer's preferences can be represented by the utility function u(x1,x2)=min{ax1,bx2}, where a and b are parameters. The prices of the two goods are p1=p2=1. The consumer has an income m=100$. 1. Give the parameters a and b. [10pts]. 2. Compute the optimal consumption bundle and the utility level. [10pts]. 3. Now assume the government imposes a tax. For each unit of good 1 consumed, the consumer is required to pay 0.3 to the government. What is the consumer's optimal bundle and utility level with this tax. [05pts]. 4. What is the government income generated by this tax policy. [05pts]. 5. Now assume the government wants to get the income from Question 3 by imposing a lumpsum income tax. Derive the consumer's optimal bundle with this new tax policy. [05pts]. 6. Which tax policy appears to be the best for the consumer. [05pts]

Kiana lives in a country where two goods are produced and consumed. Her preferences over these two goods can be described by her utility function u(x1,x2)=3ln(x1)+4ln(x2), where x1 is her consumption of good 1 and x2 denotes her consumption of good 2 . The prices of x1 and x2 are respectively p1 and p2. Kiana has an income m. 1. Assuming p1=1,p2=2 and m=100$, show that the bundle (x1,x2)=(30,35) is not: optimal. How should x1 be adjusted to get a bundle that is strictly preferred to (30,35) ? Explain economically. [10 pts] 2. Derive Kiana's optimal demand for each good as a function of p1,p2 and m. Show all the derivation steps. [15 pts] 3. Calculate her optimal consumption bundle and her utility when p1=1,p2=2 and m=100$. [05 pts] 4. Is x2 an ordinary good? Explain. [06pts] 5. Is x2 a normal good? Explain. [06pts] 6. Is x2 a luxury good? Explain. [06pts] 7. Is x2 a substitute for x1 ? Explain. [06pts] 8. The government decides to impose a 20% value tax on good 1 and a quantity tax t=0.2 on good 2. Kiana's income stays the same. How much of the good 1,x1 and good 2,x2 does she demand now? [06pts] Assume the preferences of the representative consumer over the two country goods are such that he is willing to consume 2 units of good 1 together with 3 units of good 2. Assume the consumer's preferences can be represented by the utility function u(x1,x2)=min{ax1,bx2}, where a and b are parameters. The prices of the two goods are p1=p2=1. The consumer has an income m=100$. 1. Give the parameters a and b. [10pts]. 2. Compute the optimal consumption bundle and the utility level. [10pts]. 3. Now assume the government imposes a tax. For each unit of good 1 consumed, the consumer is required to pay 0.3 to the government. What is the consumer's optimal bundle and utility level with this tax. [05pts]. 4. What is the government income generated by this tax policy. [05pts]. 5. Now assume the government wants to get the income from Question 3 by imposing a lumpsum income tax. Derive the consumer's optimal bundle with this new tax policy. [05pts]. 6. Which tax policy appears to be the best for the consumer. [05pts]. Kiana lives in a country where two goods are produced and consumed. Her preferences over these two goods can be described by her utility function u(x1,x2)=3ln(x1)+4ln(x2), where x1 is her consumption of good 1 and x2 denotes her consumption of good 2 . The prices of x1 and x2 are respectively p1 and p2. Kiana has an income m. 1. Assuming p1=1,p2=2 and m=100$, show that the bundle (x1,x2)=(30,35) is not: optimal. How should x1 be adjusted to get a bundle that is strictly preferred to (30,35) ? Explain economically. [10 pts] 2. Derive Kiana's optimal demand for each good as a function of p1,p2 and m. Show all the derivation steps. [15 pts] 3. Calculate her optimal consumption bundle and her utility when p1=1,p2=2 and m=100$. [05 pts] 4. Is x2 an ordinary good? Explain. [06pts] 5. Is x2 a normal good? Explain. [06pts] 6. Is x2 a luxury good? Explain. [06pts] 7. Is x2 a substitute for x1 ? Explain. [06pts] 8. The government decides to impose a 20% value tax on good 1 and a quantity tax t=0.2 on good 2. Kiana's income stays the same. How much of the good 1,x1 and good 2,x2 does she demand now? [06pts] Assume the preferences of the representative consumer over the two country goods are such that he is willing to consume 2 units of good 1 together with 3 units of good 2. Assume the consumer's preferences can be represented by the utility function u(x1,x2)=min{ax1,bx2}, where a and b are parameters. The prices of the two goods are p1=p2=1. The consumer has an income m=100$. 1. Give the parameters a and b. [10pts]. 2. Compute the optimal consumption bundle and the utility level. [10pts]. 3. Now assume the government imposes a tax. For each unit of good 1 consumed, the consumer is required to pay 0.3 to the government. What is the consumer's optimal bundle and utility level with this tax. [05pts]. 4. What is the government income generated by this tax policy. [05pts]. 5. Now assume the government wants to get the income from Question 3 by imposing a lumpsum income tax. Derive the consumer's optimal bundle with this new tax policy. [05pts]. 6. Which tax policy appears to be the best for the consumer. [05pts]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started