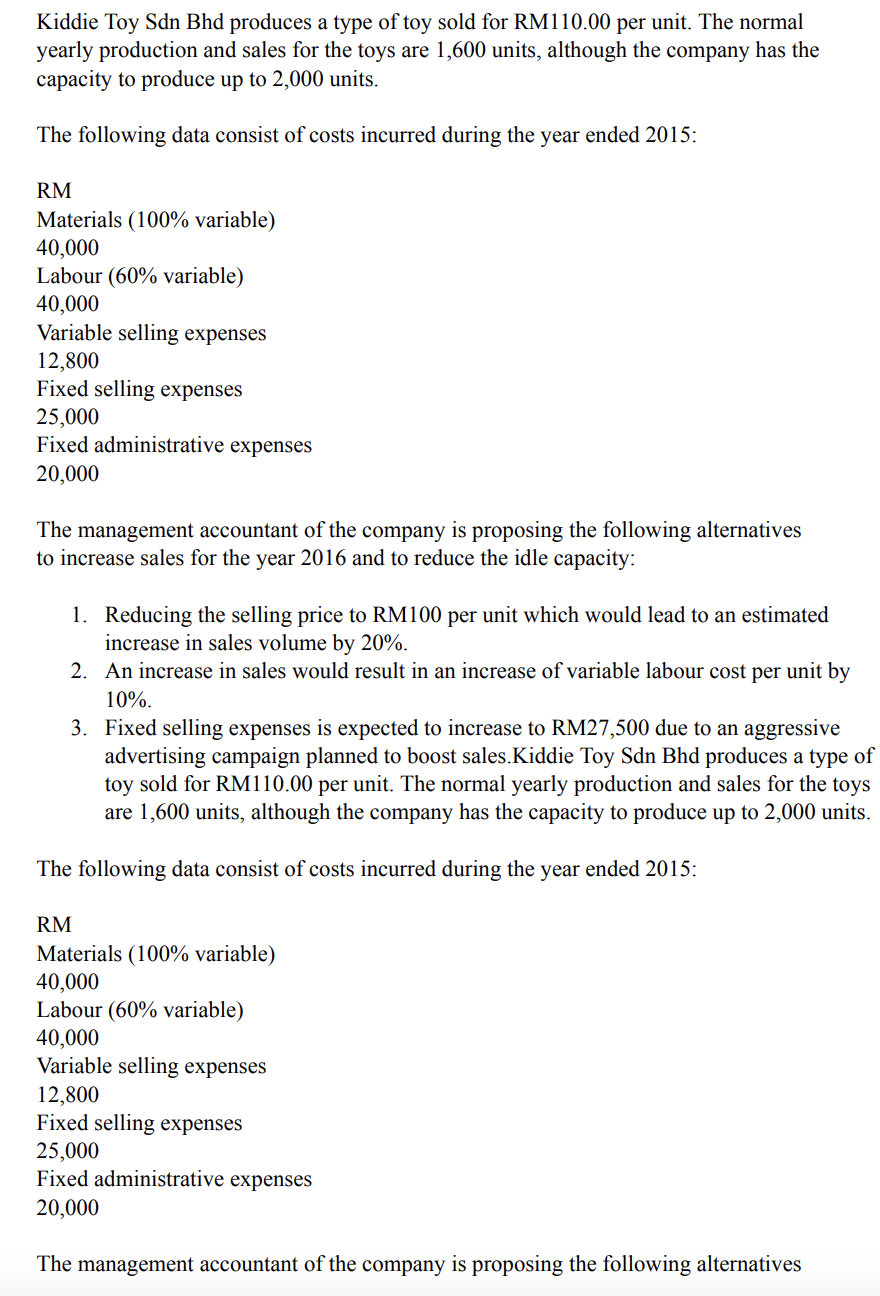

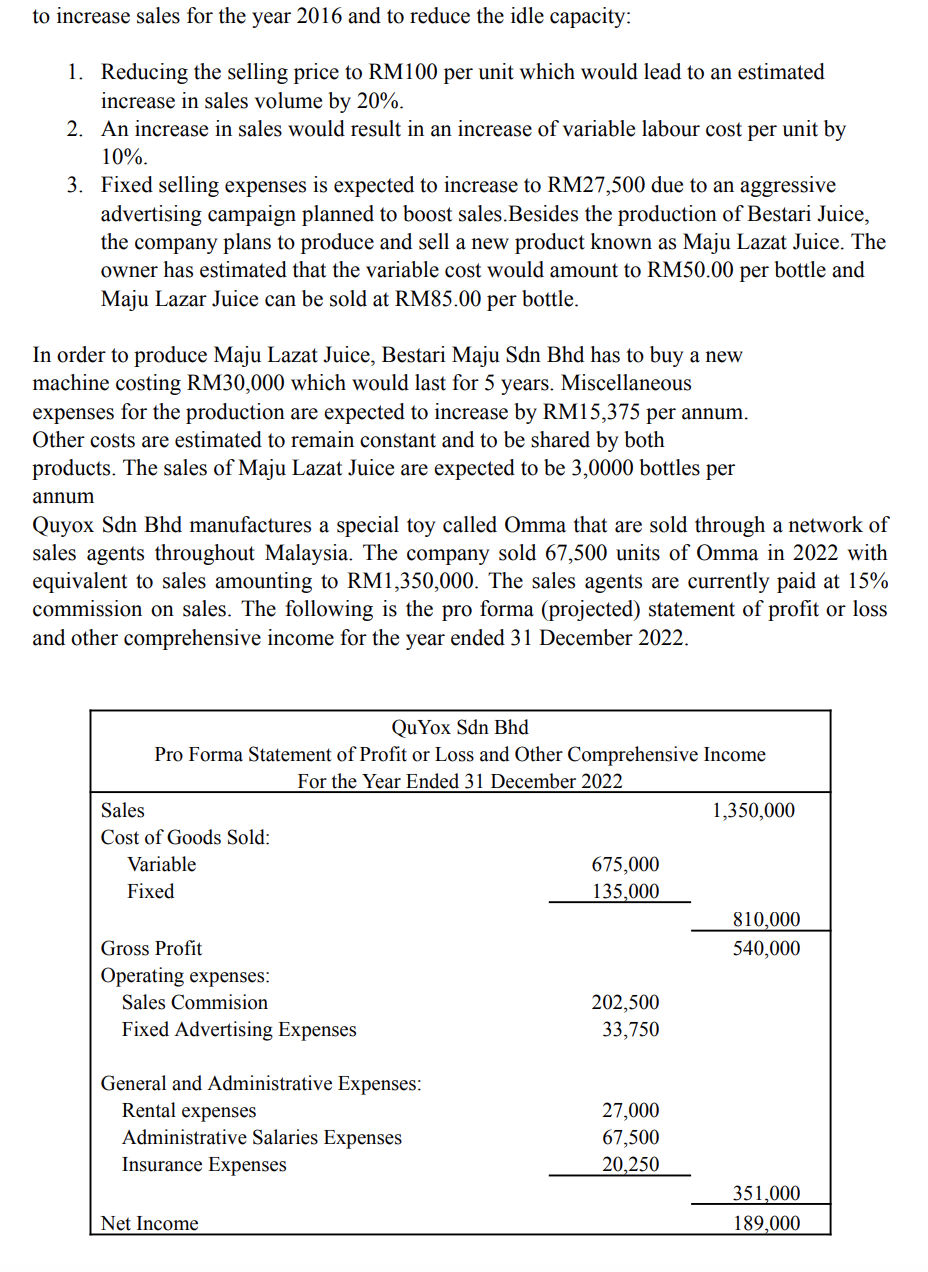

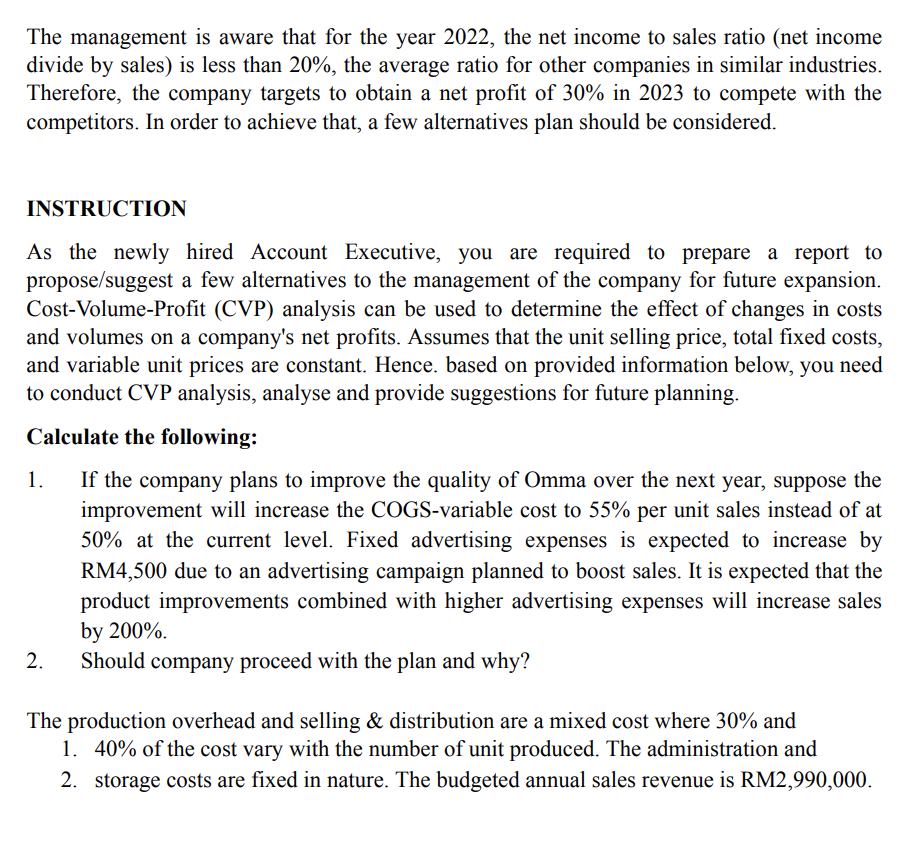

Kiddie Toy Sdn Bhd produces a type of toy sold for RM110.00 per unit. The normal yearly production and sales for the toys are 1,600 units, although the company has the capacity to produce up to 2,000 units. The following data consist of costs incurred during the year ended 2015: RM Materials ( 100% variable) 40,000 Labour ( 60% variable) 40,000 Variable selling expenses 12,800 Fixed selling expenses 25,000 Fixed administrative expenses 20,000 The management accountant of the company is proposing the following alternatives to increase sales for the year 2016 and to reduce the idle capacity: 1. Reducing the selling price to RM 100 per unit which would lead to an estimated increase in sales volume by 20%. 2. An increase in sales would result in an increase of variable labour cost per unit by 10%. 3. Fixed selling expenses is expected to increase to RM27,500 due to an aggressive advertising campaign planned to boost sales.Kiddie Toy Sdn Bhd produces a type of toy sold for RM110.00 per unit. The normal yearly production and sales for the toys are 1,600 units, although the company has the capacity to produce up to 2,000 units. The following data consist of costs incurred during the year ended 2015: RM Materials (100\% variable) 40,000 Labour (60% variable) 40,000 Variable selling expenses 12,800 Fixed selling expenses 25,000 Fixed administrative expenses 20,000 The management accountant of the company is proposing the following alternatives to increase sales for the year 2016 and to reduce the idle capacity: 1. Reducing the selling price to RM100 per unit which would lead to an estimated increase in sales volume by 20%. 2. An increase in sales would result in an increase of variable labour cost per unit by 10%. 3. Fixed selling expenses is expected to increase to RM27,500 due to an aggressive advertising campaign planned to boost sales.Besides the production of Bestari Juice, the company plans to produce and sell a new product known as Maju Lazat Juice. The owner has estimated that the variable cost would amount to RM50.00 per bottle and Maju Lazar Juice can be sold at RM85.00 per bottle. In order to produce Maju Lazat Juice, Bestari Maju Sdn Bhd has to buy a new machine costing RM30,000 which would last for 5 years. Miscellaneous expenses for the production are expected to increase by RM15,375 per annum. Other costs are estimated to remain constant and to be shared by both products. The sales of Maju Lazat Juice are expected to be 3,0000 bottles per annum Quyox Sdn Bhd manufactures a special toy called Omma that are sold through a network of sales agents throughout Malaysia. The company sold 67,500 units of Omma in 2022 with equivalent to sales amounting to RM1,350,000. The sales agents are currently paid at 15% commission on sales. The following is the pro forma (projected) statement of profit or loss and other comprehensive income for the year ended 31 December 2022. The management is aware that for the year 2022, the net income to sales ratio (net income divide by sales) is less than 20%, the average ratio for other companies in similar industries. Therefore, the company targets to obtain a net profit of 30% in 2023 to compete with the competitors. In order to achieve that, a few alternatives plan should be considered. INSTRUCTION As the newly hired Account Executive, you are required to prepare a report to propose/suggest a few alternatives to the management of the company for future expansion. Cost-Volume-Profit (CVP) analysis can be used to determine the effect of changes in costs and volumes on a company's net profits. Assumes that the unit selling price, total fixed costs, and variable unit prices are constant. Hence. based on provided information below, you need to conduct CVP analysis, analyse and provide suggestions for future planning. Calculate the following: 1. If the company plans to improve the quality of Omma over the next year, suppose the improvement will increase the COGS-variable cost to 55% per unit sales instead of at 50% at the current level. Fixed advertising expenses is expected to increase by RM4,500 due to an advertising campaign planned to boost sales. It is expected that the product improvements combined with higher advertising expenses will increase sales by 200%. 2. Should company proceed with the plan and why? The production overhead and selling & distribution are a mixed cost where 30% and 1. 40% of the cost vary with the number of unit produced. The administration and 2. storage costs are fixed in nature. The budgeted annual sales revenue is RM2,990,000