Question

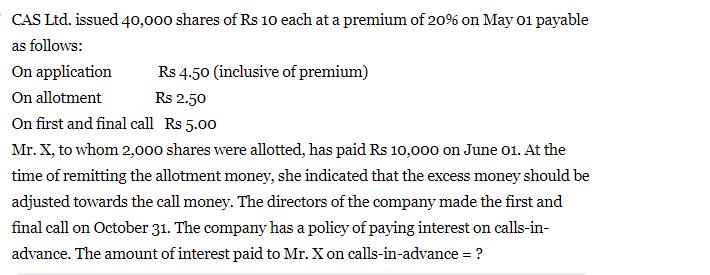

CAS Ltd. issued 40,000 shares of Rs 10 each at a premium of 20% on May 01 payable as follows: Rs 4.50 (inclusive of

CAS Ltd. issued 40,000 shares of Rs 10 each at a premium of 20% on May 01 payable as follows: Rs 4.50 (inclusive of premium) Rs 2.50 On first and final call Rs 5.00 Mr. X, to whom 2,000 shares were allotted, has paid Rs 10,000 on June 01. At the time of remitting the allotment money, she indicated that the excess money should be adjusted towards the call money. The directors of the company made the first and final call on October 31. The company has a policy of paying interest on calls-in- advance. The amount of interest paid to Mr. X on calls-in-advance = ? On application On allotment

Step by Step Solution

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Mr X has paid Rs 10000 as the allotment money on June ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting

Authors: Jonathan E. Duchac, James M. Reeve, Carl S. Warren

23rd Edition

978-0324662962

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App