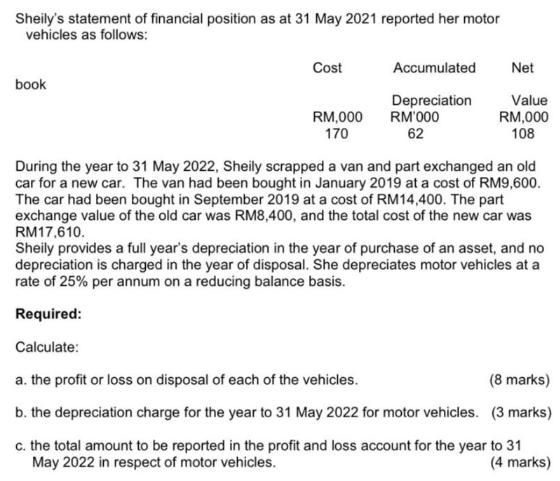

Sheily's statement of financial position as at 31 May 2021 reported her motor vehicles as follows: book Cost RM,000 170 Accumulated Depreciation RM'000 62

Sheily's statement of financial position as at 31 May 2021 reported her motor vehicles as follows: book Cost RM,000 170 Accumulated Depreciation RM'000 62 Net Value RM,000 108 During the year to 31 May 2022, Sheily scrapped a van and part exchanged an old car for a new car. The van had been bought in January 2019 at a cost of RM9,600. The car had been bought in September 2019 at a cost of RM14,400. The part exchange value of the old car was RM8,400, and the total cost of the new car was RM17,610. Sheily provides a full year's depreciation in the year of purchase of an asset, and no depreciation is charged in the year of disposal. She depreciates motor vehicles at a rate of 25% per annum on a reducing balance basis. Required: Calculate: a. the profit or loss on disposal of each of the vehicles. (8 marks) (3 marks) b. the depreciation charge for the year to 31 May 2022 for motor vehicles. c. the total amount to be reported in the profit and loss account for the year to 31 May 2022 in respect of motor vehicles. (4 marks)

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

A Under the reducing balance method depreciation is computed as book value times the depreciation ra...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started