Answered step by step

Verified Expert Solution

Question

1 Approved Answer

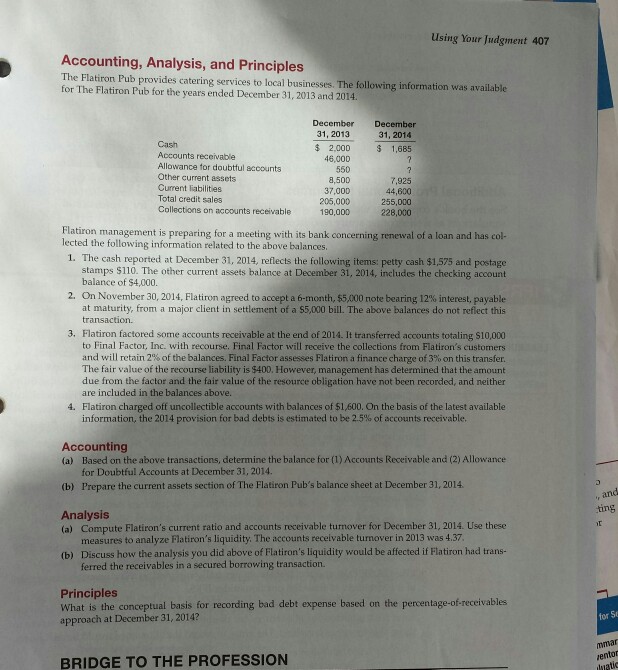

kies I need help with this problem Using Your Judgment 407 Accounting, Analysis, and Principles The Flatiron Pub provides catering services to local businesses for

kies

I need help with this problem

Using Your Judgment 407 Accounting, Analysis, and Principles The Flatiron Pub provides catering services to local businesses for The Flatiron Pub for the years ended December 31, 2013 and 2014. Tor Te lation lb te omtin wes aiall.e 31, 2013 31, 2014 Cash Accounts receivable Allowance for doubtful accounts Other current assets Current liabilities Total credit sales Collections on accounts receivable $ 2,000 1,685 46,000 550 8,500 37,000 205,000 7,925 44,600 255,000 228,000 Flatiron management is preparing for a meeting with its bank concerning renewal of a loan and has col- lected the following information related to the above balances 1. The cash reported at December 31, 2014, reflects the following items: petty cash $1,575 and postage stamps $110. The other current assets balance at December 31, 2014, includes the checking account balance of $4,000. On November 30, 2014, Flatiron agreed to accept a 6-month, 55 000 note bearing 12% interest payable at maturity, from a major client in settlement of a $5,000 bill. The above balances do not reflect this transaction. 2 3. Flatiron factored some accounts receivable at the end of 2014. It transferred accounts totaling $10,000 to Final Factor, Inc. with recourse. Final Factor will receive the collections from Flatiron's customers and will retain 2% of the balances. Final Factor assesses Flatiron a finance charge of 3% on this transfer. The fair value of the recourse liability is $400. However, management has determined that the amount due from the factor and the fair value of the resource obligation have not been recorded, and neither are included in the balances above. 4. Flatiron charged off uncollectible accounts with balances of $1,600. On the basis of the latest available information, the 2014 provision for bad debts is estimated to be 2.5% of accounts receivable. Accounting (a) Based on the above transactions, determine the balance for (1) Accounts Receivable and (2) Allowance for Doubtful Accounts at December 31, 2014. (b) Prepare the current assets section of The Flatiron Pub's balance sheet at December 31, 2014. , an ting Analysis (a) Compute Flatiron's current ratio and accounts receivable tunover for December 31, 2014. Use these measures to analyze Flatiron's liquidity. The accounts receivable turnover in 2013 was 4.37 (b) Discuss how the analysis you did above of Flatiron's liquidity would be affected if Flatiron had trans- ferred the receivables in a secured borrowing transaction. Principles What is the conceptual basis for recording bad debt expense based on the percentage-of-receivables approach at December 31, 2014? for S mmar ento BRIDGE TO THE PROFESSIONStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started