Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kilgore Company makes and sells a single product. Kilgore incurred the following costs in its most recent fiscal year: Cost Items Appearing on the

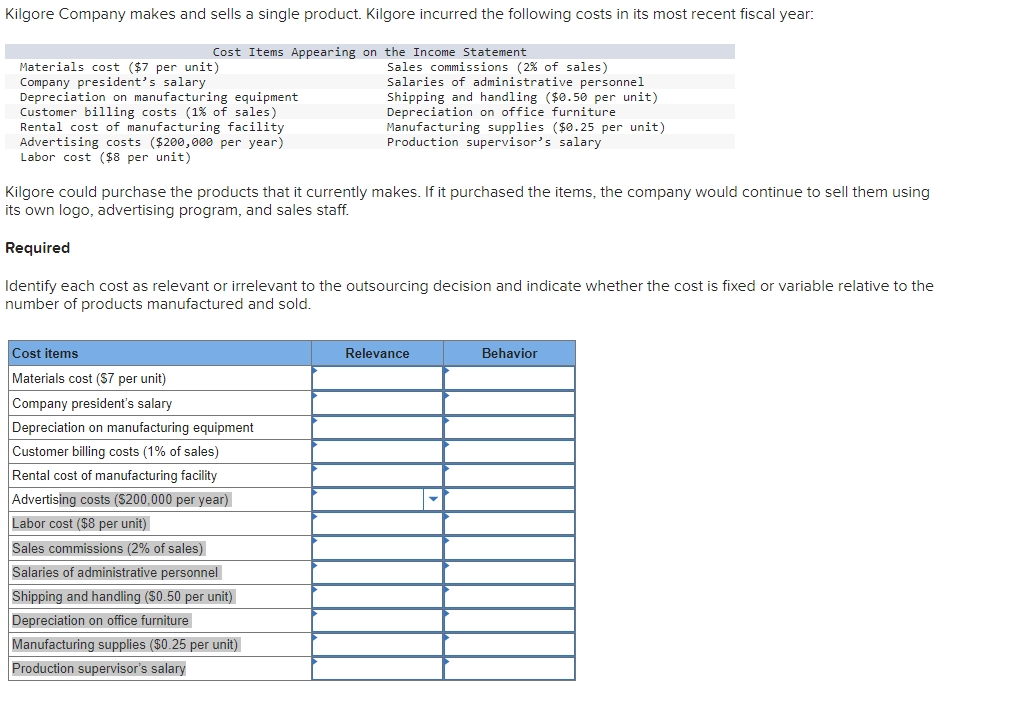

Kilgore Company makes and sells a single product. Kilgore incurred the following costs in its most recent fiscal year: Cost Items Appearing on the Income Statement Materials cost ($7 per unit) Company president's salary Depreciation on manufacturing equipment Customer billing costs (1% of sales) Rental cost of manufacturing facility Sales commissions (2% of sales) Salaries of administrative personnel Shipping and handling ($0.50 per unit) Depreciation on office furniture Manufacturing supplies ($0.25 per unit) Production supervisor's salary Advertising costs ($200,000 per year) Labor cost ($8 per unit) Kilgore could purchase the products that it currently makes. If it purchased the items, the company would continue to sell them using its own logo, advertising program, and sales staff. Required Identify each cost as relevant or irrelevant to the outsourcing decision and indicate whether the cost is fixed or variable relative to the number of products manufactured and sold. Cost items Materials cost ($7 per unit) Company president's salary Depreciation on manufacturing equipment Customer billing costs (1% of sales) Rental cost of manufacturing facility Advertising costs ($200,000 per year) Labor cost ($8 per unit) Sales commissions (2% of sales) Salaries of administrative personnel Shipping and handling ($0.50 per unit) Depreciation on office furniture Manufacturing supplies ($0.25 per unit) Production supervisor's salary Relevance Behavior

Step by Step Solution

★★★★★

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer Kilgore Company Outsourcing Cost Analysis Heres a breakdown of each cost items relevance and behavior for the outsourcing decision Cost Items R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e2f569d8ef_959897.pdf

180 KBs PDF File

663e2f569d8ef_959897.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started