Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kim and David were both born in 1965 and would like to understand how much they would receive from Social Security (in today's dollars) if

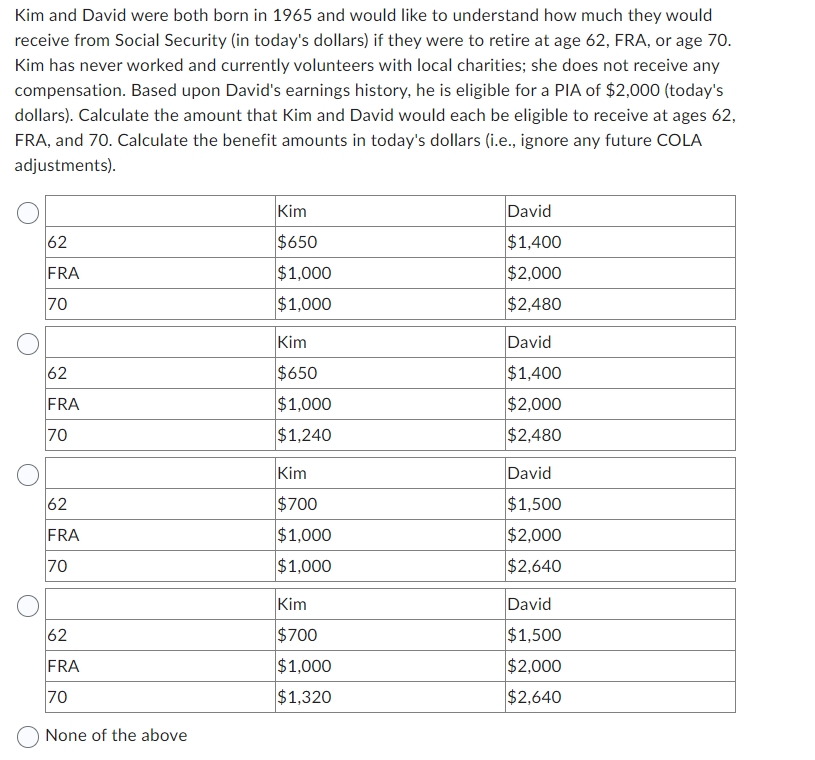

Kim and David were both born in 1965 and would like to understand how much they would receive from Social Security (in today's dollars) if they were to retire at age 62, FRA, or age 70. Kim has never worked and currently volunteers with local charities; she does not receive any compensation. Based upon David's earnings history, he is eligible for a PIA of \$2,000 (today's dollars). Calculate the amount that Kim and David would each be eligible to receive at ages 62 , FRA, and 70. Calculate the benefit amounts in today's dollars (i.e., ignore any future COLA adjustments). IvUIIe UI lite duUve Kim and David were both born in 1965 and would like to understand how much they would receive from Social Security (in today's dollars) if they were to retire at age 62, FRA, or age 70. Kim has never worked and currently volunteers with local charities; she does not receive any compensation. Based upon David's earnings history, he is eligible for a PIA of \$2,000 (today's dollars). Calculate the amount that Kim and David would each be eligible to receive at ages 62 , FRA, and 70. Calculate the benefit amounts in today's dollars (i.e., ignore any future COLA adjustments). IvUIIe UI lite duUve

Kim and David were both born in 1965 and would like to understand how much they would receive from Social Security (in today's dollars) if they were to retire at age 62, FRA, or age 70. Kim has never worked and currently volunteers with local charities; she does not receive any compensation. Based upon David's earnings history, he is eligible for a PIA of \$2,000 (today's dollars). Calculate the amount that Kim and David would each be eligible to receive at ages 62 , FRA, and 70. Calculate the benefit amounts in today's dollars (i.e., ignore any future COLA adjustments). IvUIIe UI lite duUve Kim and David were both born in 1965 and would like to understand how much they would receive from Social Security (in today's dollars) if they were to retire at age 62, FRA, or age 70. Kim has never worked and currently volunteers with local charities; she does not receive any compensation. Based upon David's earnings history, he is eligible for a PIA of \$2,000 (today's dollars). Calculate the amount that Kim and David would each be eligible to receive at ages 62 , FRA, and 70. Calculate the benefit amounts in today's dollars (i.e., ignore any future COLA adjustments). IvUIIe UI lite duUve Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started