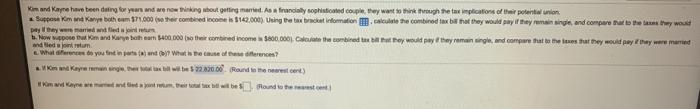

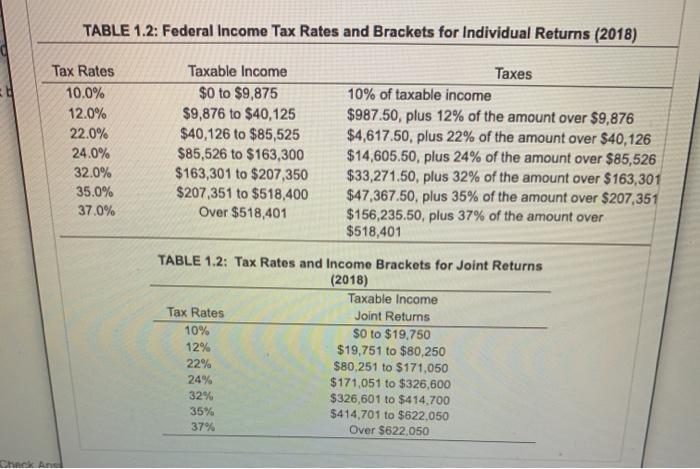

Kim and Kapre have been doing for years and we now thinking about getting married. As a financially sophisticated couple, they want to think through the amplifions of their potention Support Kim Kanye both am 17.000 (her combed comes 8149.000) Using the box bracket information culte the combined tax bw that they would say if they remains and compared to the they w pay they are dedim .woote in and any bath earn $400.000 her combined income a $800,000), Coloration the combined tur bil hat tey would pay they remain single, and compare that to the lines that they would say they were manied What is you intins ( What is the ofference? Kaya nga 32.00.00 Round to the newest cent TABLE 1.2: Federal Income Tax Rates and Brackets for Individual Returns (2018) Tax Rates 10.0% 12.0% 22.0% 24.0% 32.0% 35.0% 37.0% Taxable Income $0 to $9,875 $9,876 to $40,125 $40,126 to $85,525 $85,526 to $163,300 $ 163,301 to $207,350 $207,351 to $518,400 Over $518,401 Taxes 10% of taxable income $987.50, plus 12% of the amount over $9,876 $4,617.50, plus 22% of the amount over $40,126 $14,605.50, plus 24% of the amount over $85,526 $33,271.50, plus 32% of the amount over $163,301 $47,367.50, plus 35% of the amount over $207,351 $156,235.50, plus 37% of the amount over $518,401 TABLE 1.2: Tax Rates and Income Brackets for Joint Returns (2018) Taxable income Tax Rates Joint Returns 10% $0 to $19.750 12% $19,751 to $80,250 22% $80,251 to $171,050 24% $171,051 to $326,600 32% $326,601 to $414.700 35% $414,701 to $622,050 37% Over $622,050 Kim and Kapre have been doing for years and we now thinking about getting married. As a financially sophisticated couple, they want to think through the amplifions of their potention Support Kim Kanye both am 17.000 (her combed comes 8149.000) Using the box bracket information culte the combined tax bw that they would say if they remains and compared to the they w pay they are dedim .woote in and any bath earn $400.000 her combined income a $800,000), Coloration the combined tur bil hat tey would pay they remain single, and compare that to the lines that they would say they were manied What is you intins ( What is the ofference? Kaya nga 32.00.00 Round to the newest cent TABLE 1.2: Federal Income Tax Rates and Brackets for Individual Returns (2018) Tax Rates 10.0% 12.0% 22.0% 24.0% 32.0% 35.0% 37.0% Taxable Income $0 to $9,875 $9,876 to $40,125 $40,126 to $85,525 $85,526 to $163,300 $ 163,301 to $207,350 $207,351 to $518,400 Over $518,401 Taxes 10% of taxable income $987.50, plus 12% of the amount over $9,876 $4,617.50, plus 22% of the amount over $40,126 $14,605.50, plus 24% of the amount over $85,526 $33,271.50, plus 32% of the amount over $163,301 $47,367.50, plus 35% of the amount over $207,351 $156,235.50, plus 37% of the amount over $518,401 TABLE 1.2: Tax Rates and Income Brackets for Joint Returns (2018) Taxable income Tax Rates Joint Returns 10% $0 to $19.750 12% $19,751 to $80,250 22% $80,251 to $171,050 24% $171,051 to $326,600 32% $326,601 to $414.700 35% $414,701 to $622,050 37% Over $622,050