Question

Kim bought a $1200 face value bond, which has a 3% coupon rate. Its current price is $900 and its price is expected to

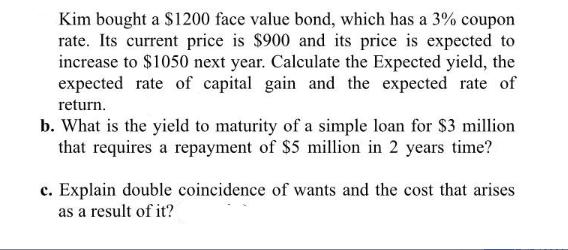

Kim bought a $1200 face value bond, which has a 3% coupon rate. Its current price is $900 and its price is expected to increase to $1050 next year. Calculate the Expected yield, the expected rate of capital gain and the expected rate of return. b. What is the yield to maturity of a simple loan for $3 million that requires a repayment of $5 million in 2 years time? c. Explain double coincidence of wants and the cost that arises as a result of it?

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Expected yield Annual coupon payment Current price Annual coupon payment Face value Coupon rate 1200 3 36 Current price 900 Expected yield 36 900 Ex...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

The Economics of Money Banking and Financial Markets

Authors: Frederic S. Mishkin

11th edition

133836797, 978-0133836790

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App