Answered step by step

Verified Expert Solution

Question

1 Approved Answer

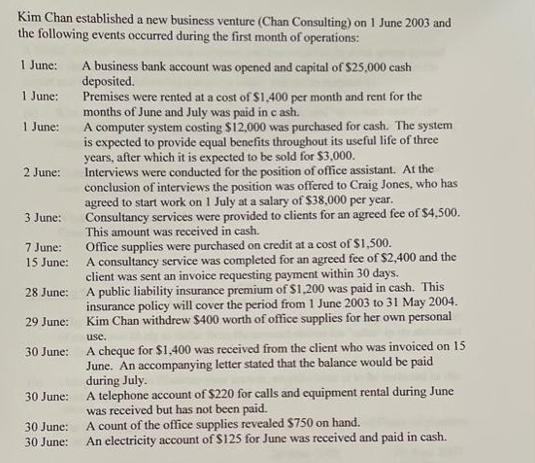

Kim Chan established a new business venture (Chan Consulting) on 1 June 2003 and the following events occurred during the first month of operations:

Kim Chan established a new business venture (Chan Consulting) on 1 June 2003 and the following events occurred during the first month of operations: 1 June: 1 June: 1 June: 2 June: 3 June: 7 June: 15 June: 28 June: 29 June: 30 June: 30 June: 30 June: 30 June: A business bank account was opened and capital of $25,000 cash deposited. Premises were rented at a cost of $1,400 per month and rent for the months of June and July was paid in cash. A computer system costing $12,000 was purchased for cash. The system is expected to provide equal benefits throughout its useful life of three years, after which it is expected to be sold for $3,000. Interviews were conducted for the position of office assistant. At the conclusion of interviews the position was offered to Craig Jones, who has agreed to start work on 1 July at a salary of $38,000 per year. Consultancy services were provided to clients for an agreed fee of $4,500. This amount was received in cash. Office supplies were purchased on credit at a cost of $1,500. A consultancy service was completed for an agreed fee of $2,400 and the client was sent an invoice requesting payment within 30 days. A public liability insurance premium of $1,200 was paid in cash. This insurance policy will cover the period from 1 June 2003 to 31 May 2004. Kim Chan withdrew $400 worth of office supplies for her own personal use. A cheque for $1,400 was received from the client who was invoiced on 15 June. An accompanying letter stated that the balance would be paid during July. A telephone account of $220 for calls and equipment rental during June was received but has not been paid. A count of the office supplies revealed $750 on hand. An electricity account of $125 for June was received and paid in cash. REQUIRED: Record each transaction for the month ended 30 June 2021.

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Based on the provided information I will record each transaction for the month ended 30 June 2023 Ju...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started