Answered step by step

Verified Expert Solution

Question

1 Approved Answer

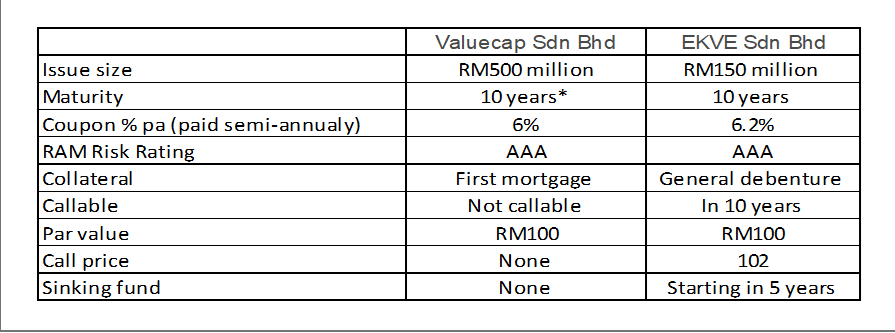

Kim is considering either one of the newly issued 10-year corporate bonds shown in the table below: The Valuecap bond is extendible at the discretion

Kim is considering either one of the newly issued 10-year corporate bonds shown in the table below:

The Valuecap bond is extendible at the discretion of the bondholder for an additional five (5) years and both the above bonds are selling at par value and the current yield for each bond is equal to its coupon rate.

Required:

- If market interest rates decline by 100 basis points (i.e., 1%), calculate the effect of this decline on the price of each bond.

- If interest rates are expected to fall, evaluate if Robert should select the Valuecap or the EKVE bond?

- What would be the effect be, if any, of an increase in the volatility of interest rates on the prices of each bond?

- As can be seen above, although both bond have the same credit rating, suggest two reasons that might explain the lower coupon rate on the Valuecap bond.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started