Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kim Ltd acquired on 1 July 2019 all the issued shares (cum div.) of David Ltd for $33 000. At this date, the equity of

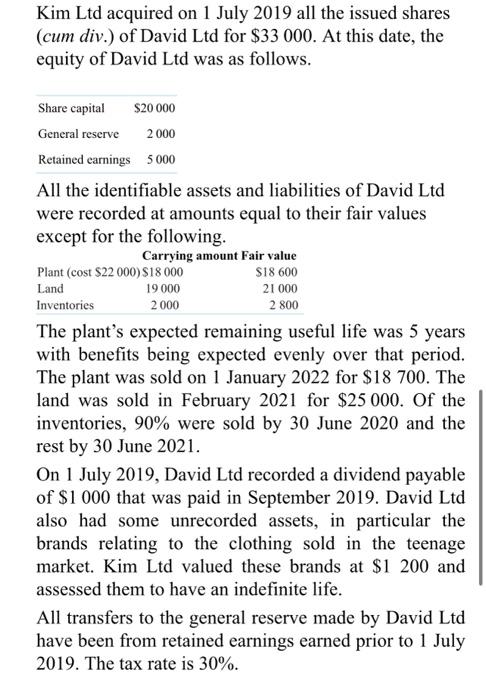

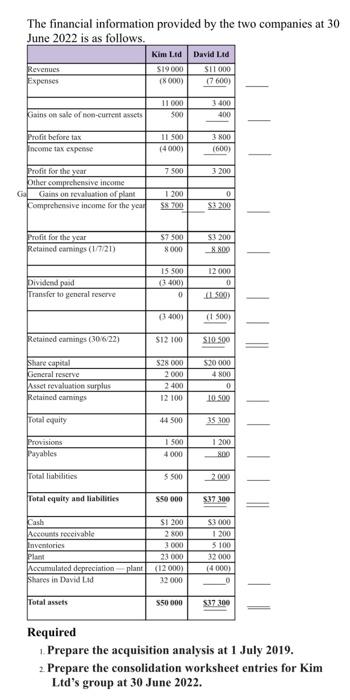

Kim Ltd acquired on 1 July 2019 all the issued shares (cum div.) of David Ltd for $33 000. At this date, the equity of David Ltd was as follows. Share capital General reserve Retained earnings $20 000 2 000 5 000 All the identifiable assets and liabilities of David Ltd were recorded at amounts equal to their fair values except for the following. Carrying amount Fair value $18 600 21 000 2 800 Plant (cost $22 000) $18 000 Land 19 000 Inventories 2000 The plant's expected remaining useful life was 5 years with benefits being expected evenly over that period. The plant was sold on 1 January 2022 for $18 700. The land was sold in February 2021 for $25 000. Of the inventories, 90% were sold by 30 June 2020 and the rest by 30 June 2021. On 1 July 2019, David Ltd recorded a dividend payable of $1 000 that was paid in September 2019. David Ltd also had some unrecorded assets, in particular the brands relating to the clothing sold in the teenage market. Kim Ltd valued these brands at $1 200 and assessed them to have an indefinite life. All transfers to the general reserve made by David Ltd have been from retained earnings earned prior to 1 July 2019. The tax rate is 30%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started