Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kimball Master Budget project - Need Income Statement and Balance Sheet numbers please Kimball Hills Co. is a computer retail store. They prepare the master

Kimball Master Budget project - Need Income Statement and Balance Sheet numbers please

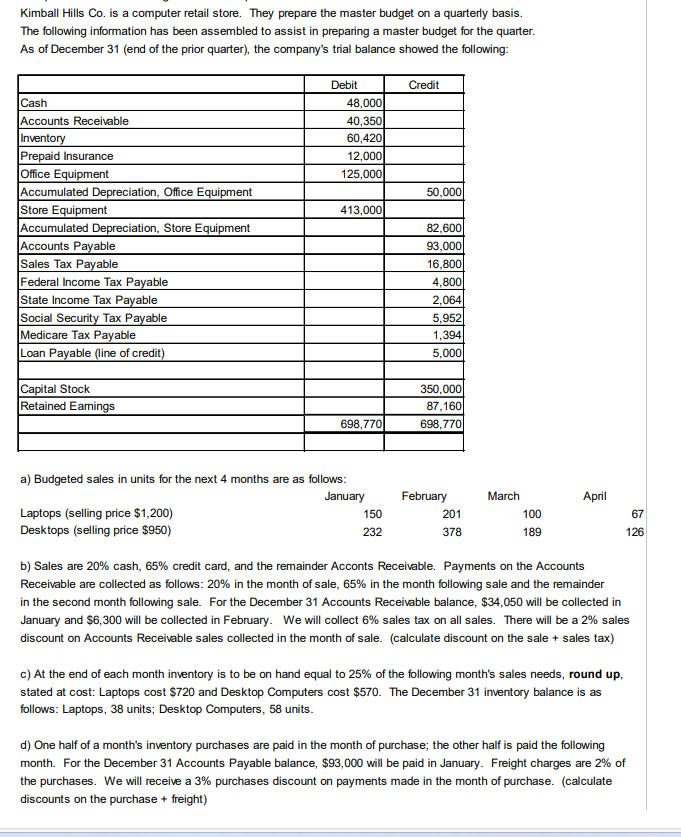

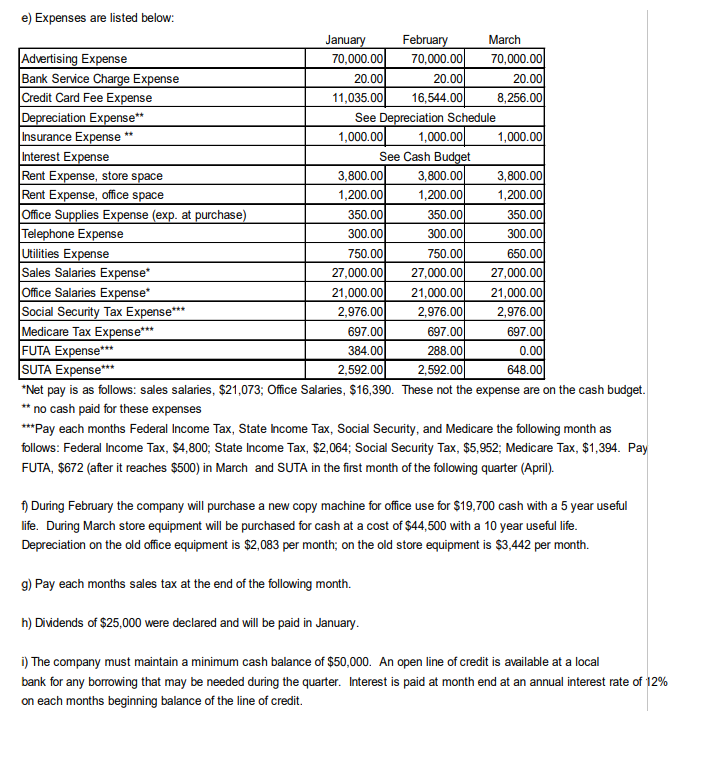

Kimball Hills Co. is a computer retail store. They prepare the master budget on a quarterly basis. The following information has been assembled to assist in preparing a master budget for the quarter. As of December 31 (end of the prior quarter), the company's trial balance showed the following: a) Budgeted sales in units for the next 4 months are as follows: 67 126 b) Sales are 20% cash, 65% credit card, and the remainder Acconts Receivable. Payments on the Accounts Receivable are collected as follows: 20% in the month of sale, 65% in the month following sale and the remainder in the second month following sale. For the December 31 Accounts Receivable balance, $34,050 will be collected in January and $6,300 will be collected in February. We will collect 6% sales tax on all sales. There will be a 2% sales discount on Accounts Receivable sales collected in the month of sale. (calculate discount on the sale + sales tax) c) At the end of each month inventory is to be on hand equal to 25% of the following month's sales needs, round up, stated at cost: Laptops cost $720 and Desktop Computers cost $570. The December 31 inventory balance is as follows: Laptops, 38 units; Desktop Computers, 58 units. d) One half of a month's inventory purchases are paid in the month of purchase; the other half is paid the following month. For the December 31 Accounts Payable balance, $93,000 will be paid in January. Freight charges are 2% of the purchases. We will receive a 3% purchases discount on payments made in the month of purchase. (calculate discounts on the purchase + freight) e) Expenses are listed below: *Net pay is as follows: sales salaries, $21,073; Office Salaries, $16,390. These not the expense are on the cash budget. no cash paid for these expenses ***Pay each months Federal Income Tax, State Income Tax, Social Security, and Medicare the following month as follows: Federal Income Tax, \$4,800; State Income Tax, \$2,064; Social Security Tax, \$5,952; Medicare Tax, \$1,394. Pay FUTA, \$672 (after it reaches \$500) in March and SUTA in the first month of the following quarter (April). f) During February the company will purchase a new copy machine for office use for $19,700 cash with a 5 year useful life. During March store equipment will be purchased for cash at a cost of $44,500 with a 10 year useful life. Depreciation on the old office equipment is $2,083 per month; on the old store equipment is $3,442 per month. g) Pay each months sales tax at the end of the following month. h) Dividends of $25,000 were declared and will be paid in January. i) The company must maintain a minimum cash balance of $50,000. An open line of credit is available at a local bank for any borrowing that may be needed during the quarter. Interest is paid at month end at an annual interest rate of 12% on each months beginning balance of the line of credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started