Answered step by step

Verified Expert Solution

Question

1 Approved Answer

kind of confused dont know how to common size the income statement or balance sheet. also adjusting the spreadsheets Since the firm does not yet

kind of confused dont know how to common size the income statement or balance sheet. also adjusting the spreadsheets

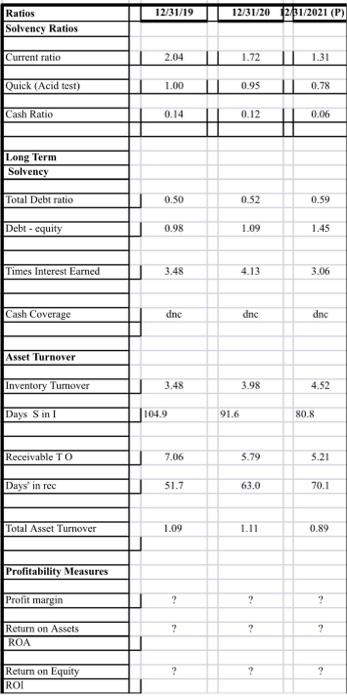

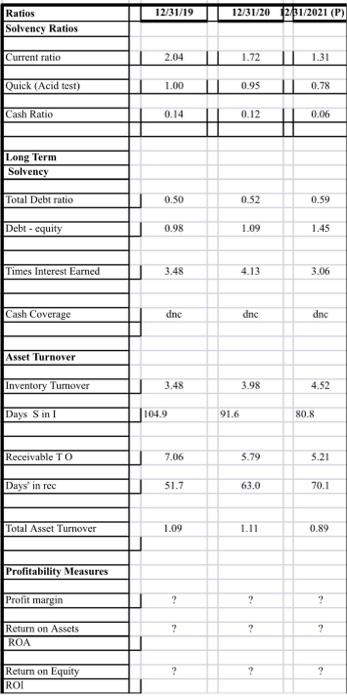

Since the firm does not yet pay a cash dividend return to the investor must come from selling stock in the future. Paying a dividend is not out of the picture, but has not been done up to now. He has also asked you to look at the logic and correctness of the statements. Does anything seem to be missing, or is all ok? How does the cash from operations look and the new working capital too? After doing a thorough analysis (including ratios for each year and comparison to industry), what issues do you see related to the financial analysis? Does the 25% growth seem realistic and achievable? What comments and recommendations do you offer Lucky? What decisions do you think Mr. DeLarr will need to address? REQUIREMENT: To complete the analysis it is necessary for you to "common size the income statement and balance sheet. You will need to adjust the spreadsheets to do that. Use care! Prepare a memorandum to Mr. DeLarr to explain the issues and your recommendation. Include any appropriate discussion about risk and future growth too. Answer the questions above in the memorandum. Cite appropriate financial references too to support your recommendation. Add a paragraph to suggest what can possibly be considered to increase the sales and Net Profit. Cite specific actions. 12/31/19 12/31/20 12.51/2021 (P) Ratios Solvency Ratios Current ratio 2.04 1.72 1.31 Quick (Acid test) 1.00 0.95 0.78 Cash Ratio 0.14 0.12 0.06 Long Term Solvency Total Debt ratio 0.50 0.52 0.59 Debt-equity 0.98 1.09 1.45 Times Interest Earned 3.48 4.13 3.06 Cash Coverage dne dne dnc Asset Turnover Inventory Tumover 3.48 3.98 4.52 Days Sin! 104.9 91.6 80.8 Receivable TO 7.06 5.79 5.21 Days in rec 51.7 63.0 70.1 Total Asset Turnover 1.09 1.11 0.89 Profitability Measures Profit margin 2 ? ? ? ? ? Retum on Assets ROA ? ? ? Return on Equity ROI Since the firm does not yet pay a cash dividend return to the investor must come from selling stock in the future. Paying a dividend is not out of the picture, but has not been done up to now. He has also asked you to look at the logic and correctness of the statements. Does anything seem to be missing, or is all ok? How does the cash from operations look and the new working capital too? After doing a thorough analysis (including ratios for each year and comparison to industry), what issues do you see related to the financial analysis? Does the 25% growth seem realistic and achievable? What comments and recommendations do you offer Lucky? What decisions do you think Mr. DeLarr will need to address? REQUIREMENT: To complete the analysis it is necessary for you to "common size the income statement and balance sheet. You will need to adjust the spreadsheets to do that. Use care! Prepare a memorandum to Mr. DeLarr to explain the issues and your recommendation. Include any appropriate discussion about risk and future growth too. Answer the questions above in the memorandum. Cite appropriate financial references too to support your recommendation. Add a paragraph to suggest what can possibly be considered to increase the sales and Net Profit. Cite specific actions. 12/31/19 12/31/20 12.51/2021 (P) Ratios Solvency Ratios Current ratio 2.04 1.72 1.31 Quick (Acid test) 1.00 0.95 0.78 Cash Ratio 0.14 0.12 0.06 Long Term Solvency Total Debt ratio 0.50 0.52 0.59 Debt-equity 0.98 1.09 1.45 Times Interest Earned 3.48 4.13 3.06 Cash Coverage dne dne dnc Asset Turnover Inventory Tumover 3.48 3.98 4.52 Days Sin! 104.9 91.6 80.8 Receivable TO 7.06 5.79 5.21 Days in rec 51.7 63.0 70.1 Total Asset Turnover 1.09 1.11 0.89 Profitability Measures Profit margin 2 ? ? ? ? ? Retum on Assets ROA ? ? ? Return on Equity ROI

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started