Answered step by step

Verified Expert Solution

Question

1 Approved Answer

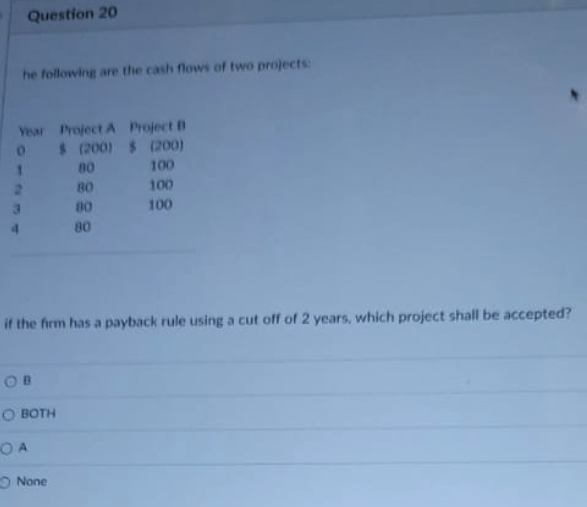

Kindly answer all, thanks! Question 20 he following are the cash flows of two projects Yew Project A Project 0 (200) $ (200) 80 100

Kindly answer all, thanks!

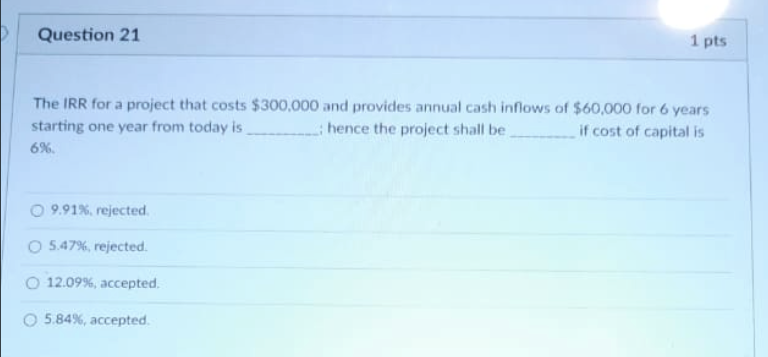

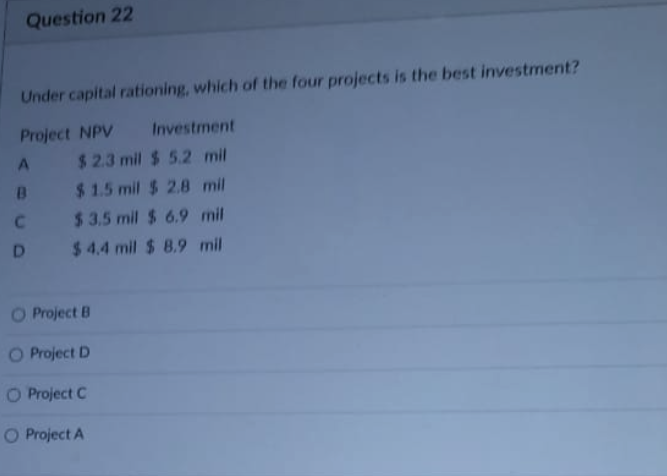

Question 20 he following are the cash flows of two projects Yew Project A Project 0 (200) $ (200) 80 100 2 BO 100 3 00 100 80 if the firm has a payback rule using a cut off of 2 years, which project shall be accepted? None Question 21 1 pts The IRR for a project that costs $300,000 and provides annual cash inflows of $60,000 for 6 years starting one year from today is hence the project shall be if cost of capitalis 6% 9.91%, rejected 5.47%, rejected 12.09%, accepted 5.84%, accepted Question 22 Under capital rationing, which of the four projects is the best investment? Project NPV Investment A $2.3 mil $ 5.2 mil B $1.5 mil $ 2.8 mil $3,5 mil $ 6.9 mil D $ 4,4 mil $ 8.9 mil Project B O Project D O Project Project AStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started