kindly answer asap . u guys are not responding these days

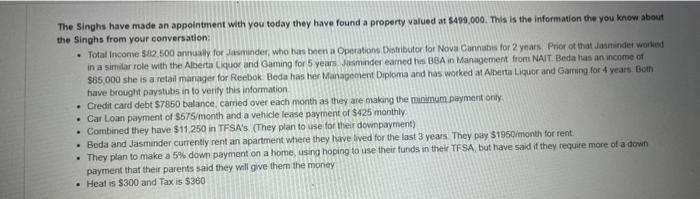

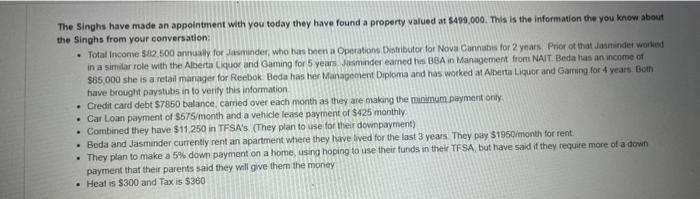

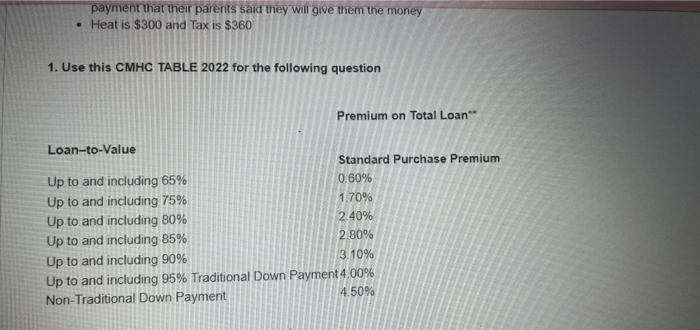

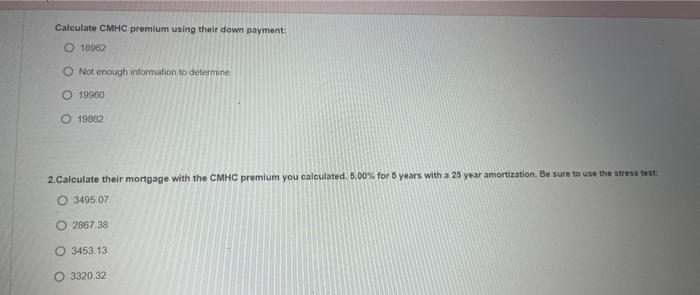

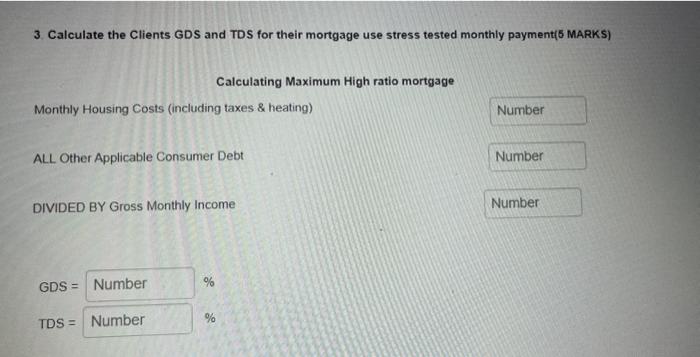

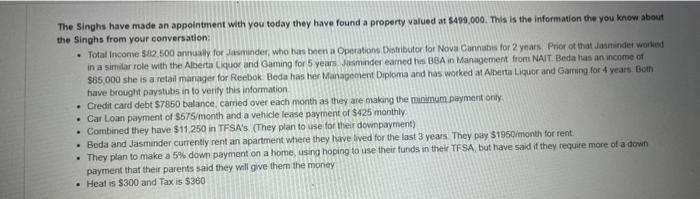

The Singhs have made an appointment with you today they have found a property valued at 5400.000. This is the information the you know about the Singhs from your conversation: in a similar role with the Aberta Liquor and Gaming for 5 years. Heamnder earned has BEA in Management fromi NAIT. Beda has an income of 585,000 she is a retail manager for Reebok. Beda has her Manapement Dipioma and has wocked al Alberta Liquor and Garing for 4 years. Boin have brought paystubs in to verify this information - Credit card debt $7850 balance, carried over each month as they are makaing the minimum payment oniy - Car Loan payment of $575 month and a vehicle lease payment of $425 monthly - Combined they have $11,250 in TFSA's (They plan to use for tiver downpayment) - Beda and Jasminder currently rent an apartment whete they have lived for the last 3 yeas They pay 3195q intonth for tent. - They plan to make a 5% down payment on a home, using hoping to use their funds in their TF SA, but have said it they require more of a down payment that their parents said they will give thern the money - Heat is $300 and Tax is $360 payment that their parents said they will give them the money - Heat is $300 and Tax is $360 1. Use this CMHC TABLE 2022 for the following question Calculate CMHC premium using their down payment: 18962 Not enough information to determine 19960 19882 2.Calculate their mortgage with the CMHC premium you calculated. 5.00% for 5 years with a 25 year amortization. Be sure to use the stress test: 3495.07 286738 3453.13 3320.32 3. Calculate the Clients GDS and TDS for their mortgage use stress tested monthly payment( 5 MARKS) Calculating Maximum High ratio mortgage Monthly Housing Costs (including taxes \& heating) ALL Other Applicable Consumer Debt DIVIDED BY Gross Monthly Income 4. What documentation do you require as the lender(4 marks) The Singhs have made an appointment with you today they have found a property valued at 5400.000. This is the information the you know about the Singhs from your conversation: in a similar role with the Aberta Liquor and Gaming for 5 years. Heamnder earned has BEA in Management fromi NAIT. Beda has an income of 585,000 she is a retail manager for Reebok. Beda has her Manapement Dipioma and has wocked al Alberta Liquor and Garing for 4 years. Boin have brought paystubs in to verify this information - Credit card debt $7850 balance, carried over each month as they are makaing the minimum payment oniy - Car Loan payment of $575 month and a vehicle lease payment of $425 monthly - Combined they have $11,250 in TFSA's (They plan to use for tiver downpayment) - Beda and Jasminder currently rent an apartment whete they have lived for the last 3 yeas They pay 3195q intonth for tent. - They plan to make a 5% down payment on a home, using hoping to use their funds in their TF SA, but have said it they require more of a down payment that their parents said they will give thern the money - Heat is $300 and Tax is $360 payment that their parents said they will give them the money - Heat is $300 and Tax is $360 1. Use this CMHC TABLE 2022 for the following question Calculate CMHC premium using their down payment: 18962 Not enough information to determine 19960 19882 2.Calculate their mortgage with the CMHC premium you calculated. 5.00% for 5 years with a 25 year amortization. Be sure to use the stress test: 3495.07 286738 3453.13 3320.32 3. Calculate the Clients GDS and TDS for their mortgage use stress tested monthly payment( 5 MARKS) Calculating Maximum High ratio mortgage Monthly Housing Costs (including taxes \& heating) ALL Other Applicable Consumer Debt DIVIDED BY Gross Monthly Income 4. What documentation do you require as the lender(4 marks)