Answered step by step

Verified Expert Solution

Question

1 Approved Answer

kindly answer the questions in 5 mins it's urgent Prodigal Retirement Inc. is considering a new project that will cost $500,000 initially. The project is

kindly answer the questions in 5 mins it's urgent

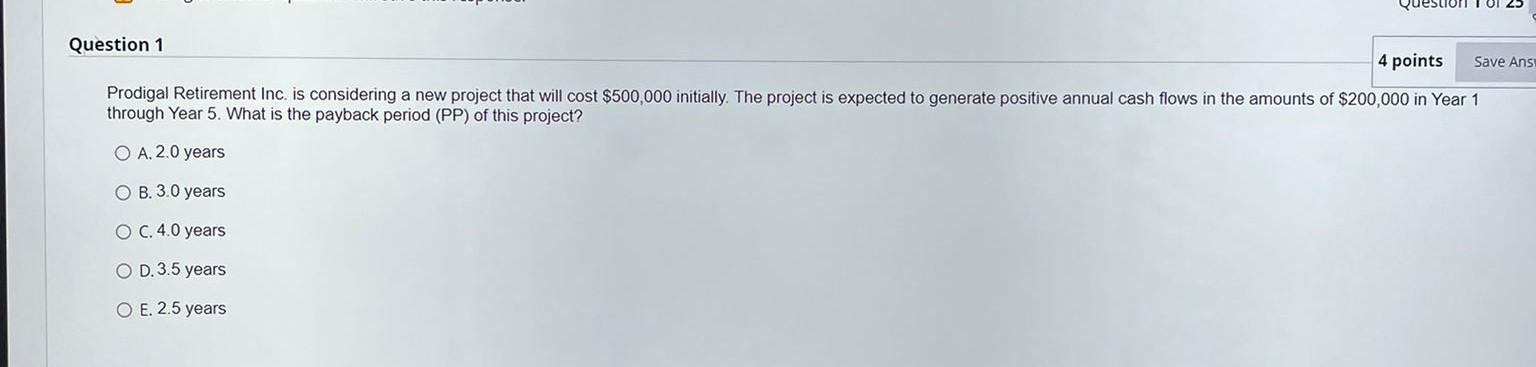

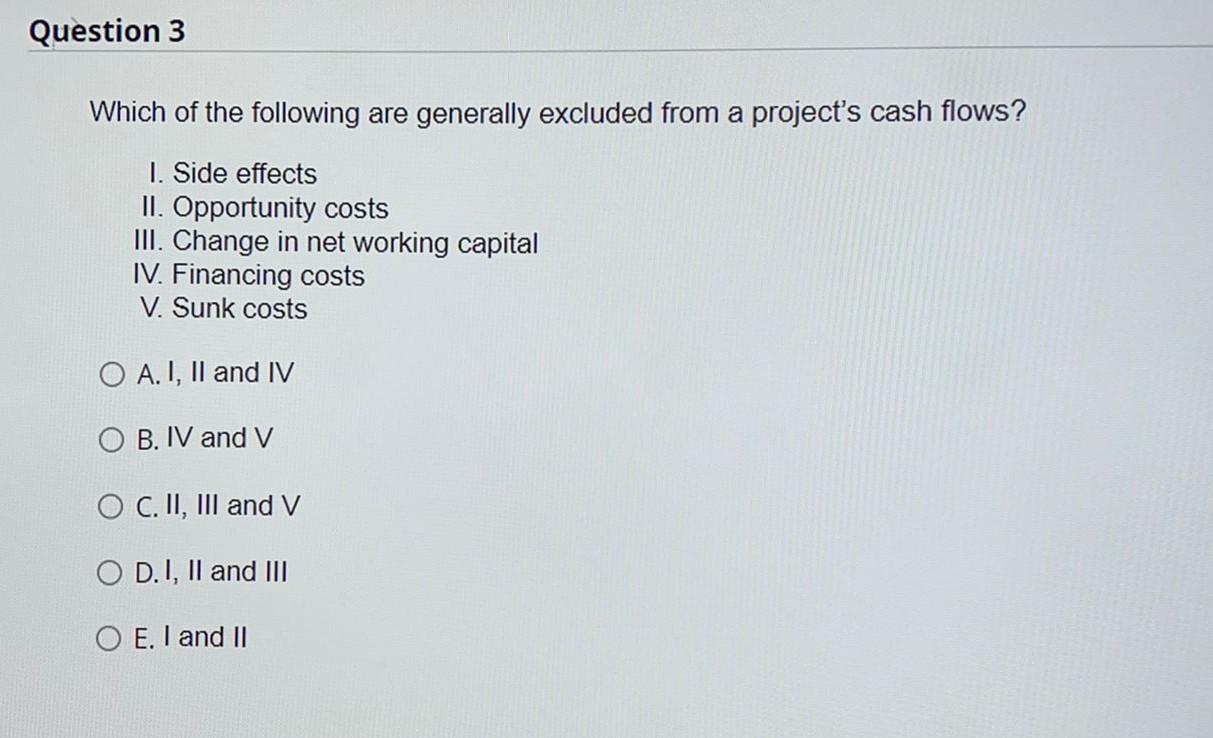

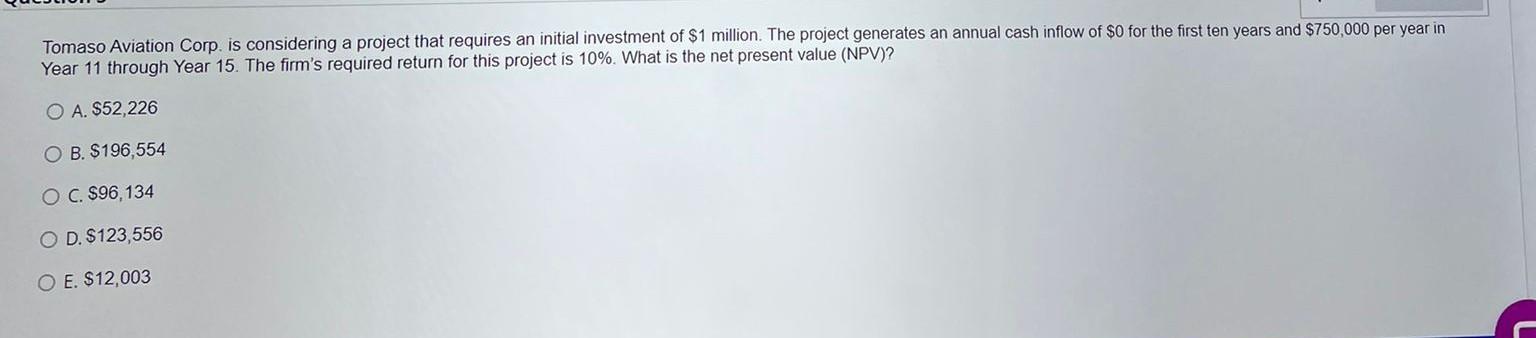

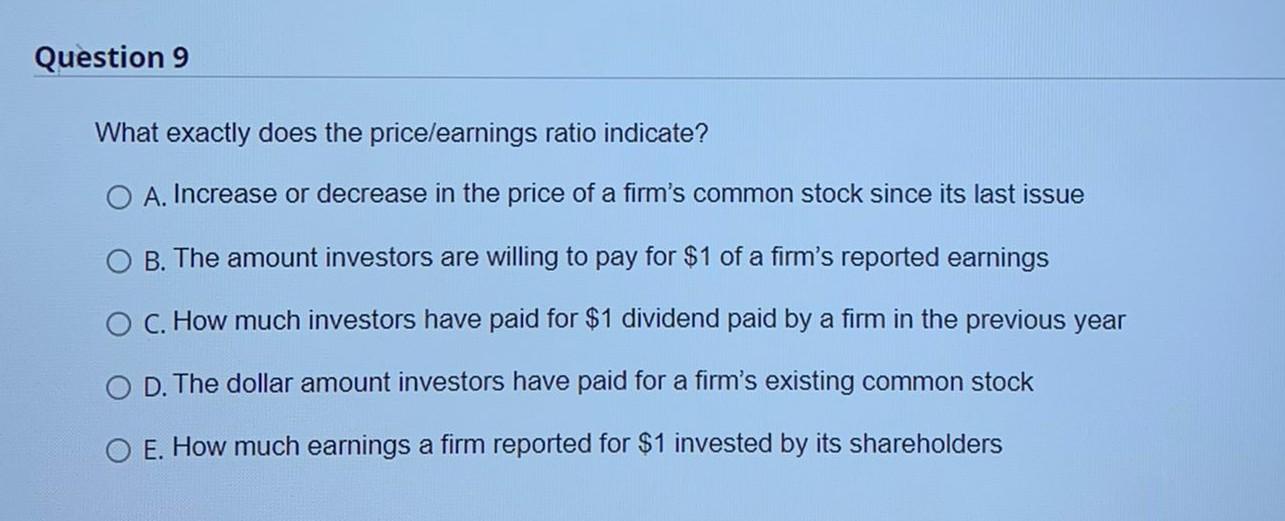

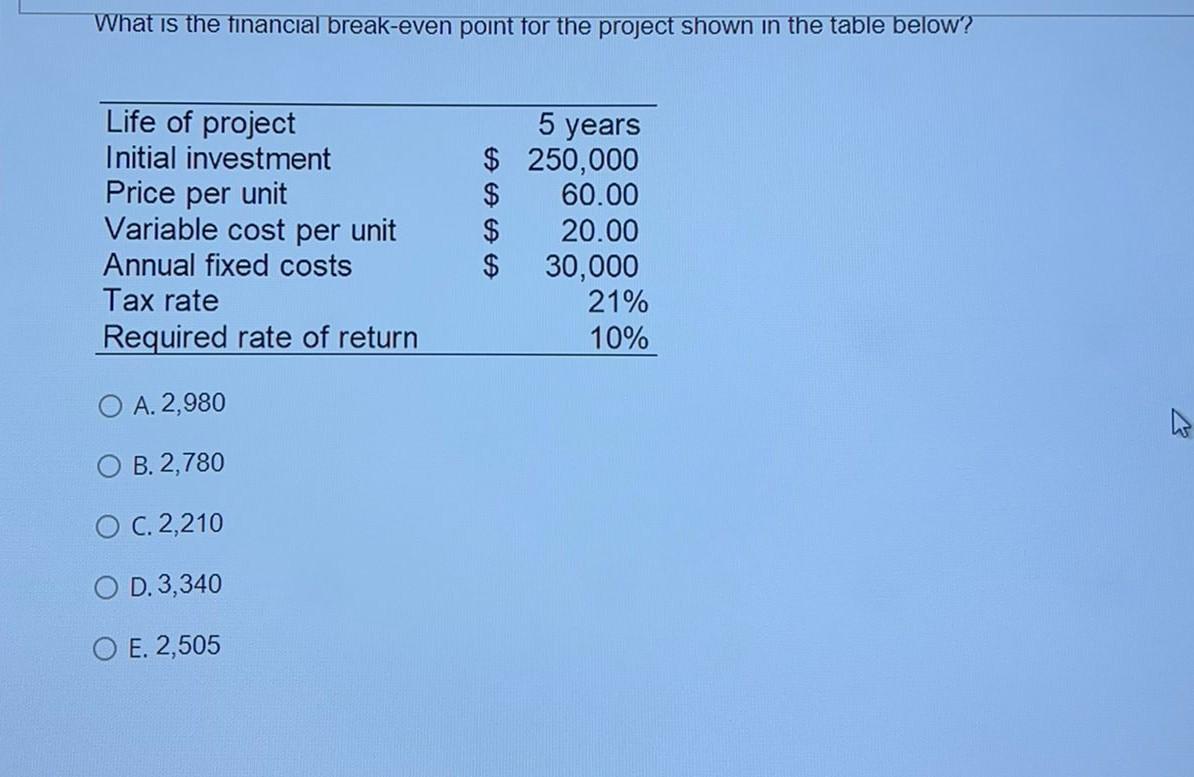

Prodigal Retirement Inc. is considering a new project that will cost $500,000 initially. The project is expected to generate positive annual cash flows in the amounts of $200,000 in Year 1 through Year 5 . What is the payback period (PP) of this project? A. 2.0 years B. 3.0 years C. 4.0 years D. 3.5 years E. 2.5 years Which of the following are generally excluded from a project's cash flows? I. Side effects II. Opportunity costs III. Change in net working capital IV. Financing costs V. Sunk costs A. I, II and IV B. IV and V C. II, III and V D. I, II and III E. I and II Year 11 through Year 15. The firm's required return for this project is 10%. What is the net present value (NPV)? A. $52,226 B. $196,554 C. $96,134 D. $123,556 E. $12,003 What exactly does the pricelearnings ratio indicate? A. Increase or decrease in the price of a firm's common stock since its last issue B. The amount investors are willing to pay for $1 of a firm's reported earnings C. How much investors have paid for $1 dividend paid by a firm in the previous year D. The dollar amount investors have paid for a firm's existing common stock E. How much earnings a firm reported for $1 invested by its shareholders What is the financial break-even point for the project shown in the table below? A. 2,980 B. 2,780 C. 2,210 D. 3,340 E. 2,505Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started