Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kindly assist with question 1 2 3 and 4 only please Questions 18 relate to the annual financial statements of MI Ltd that complies with

Kindly assist with question 1 2 3 and 4 only please

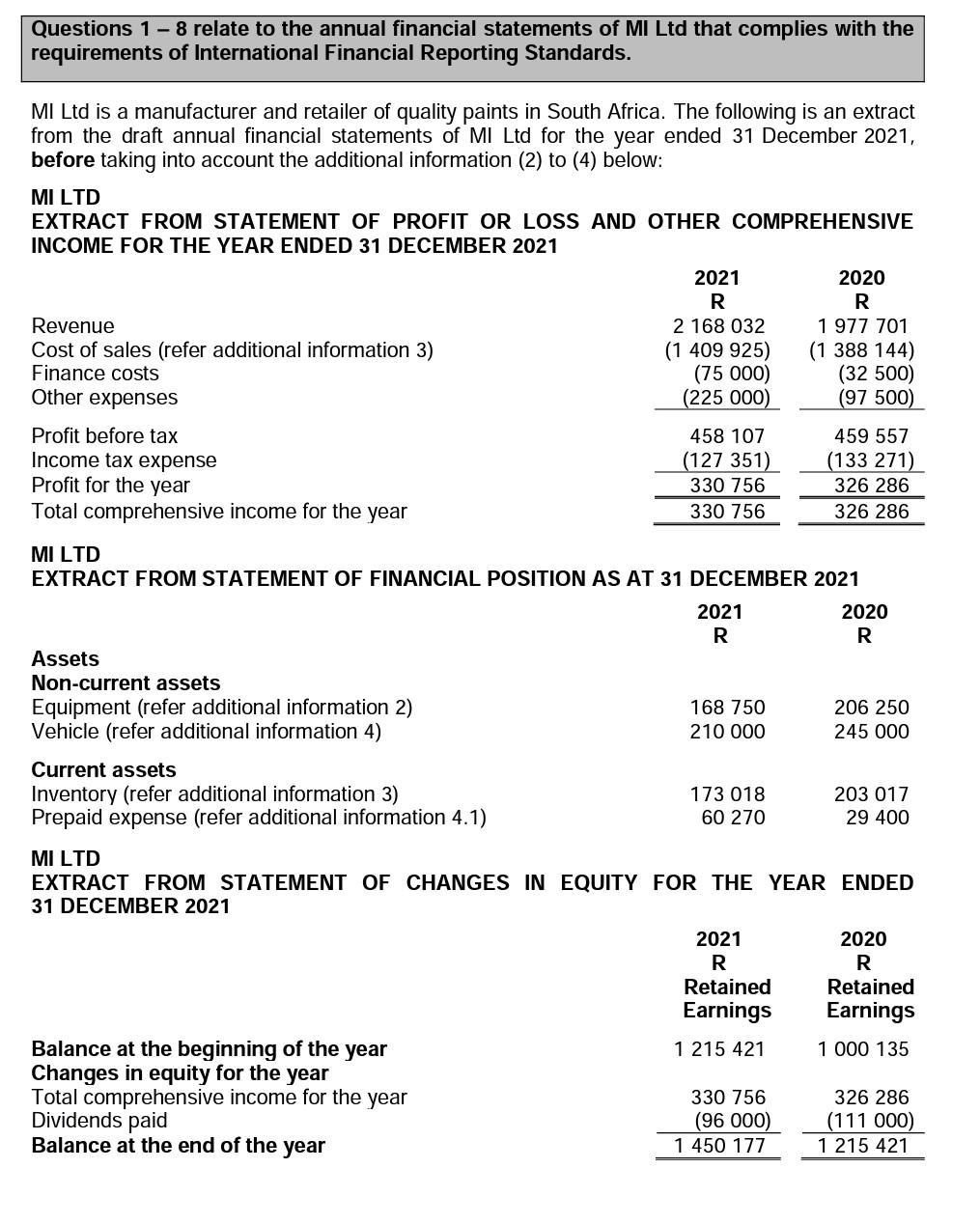

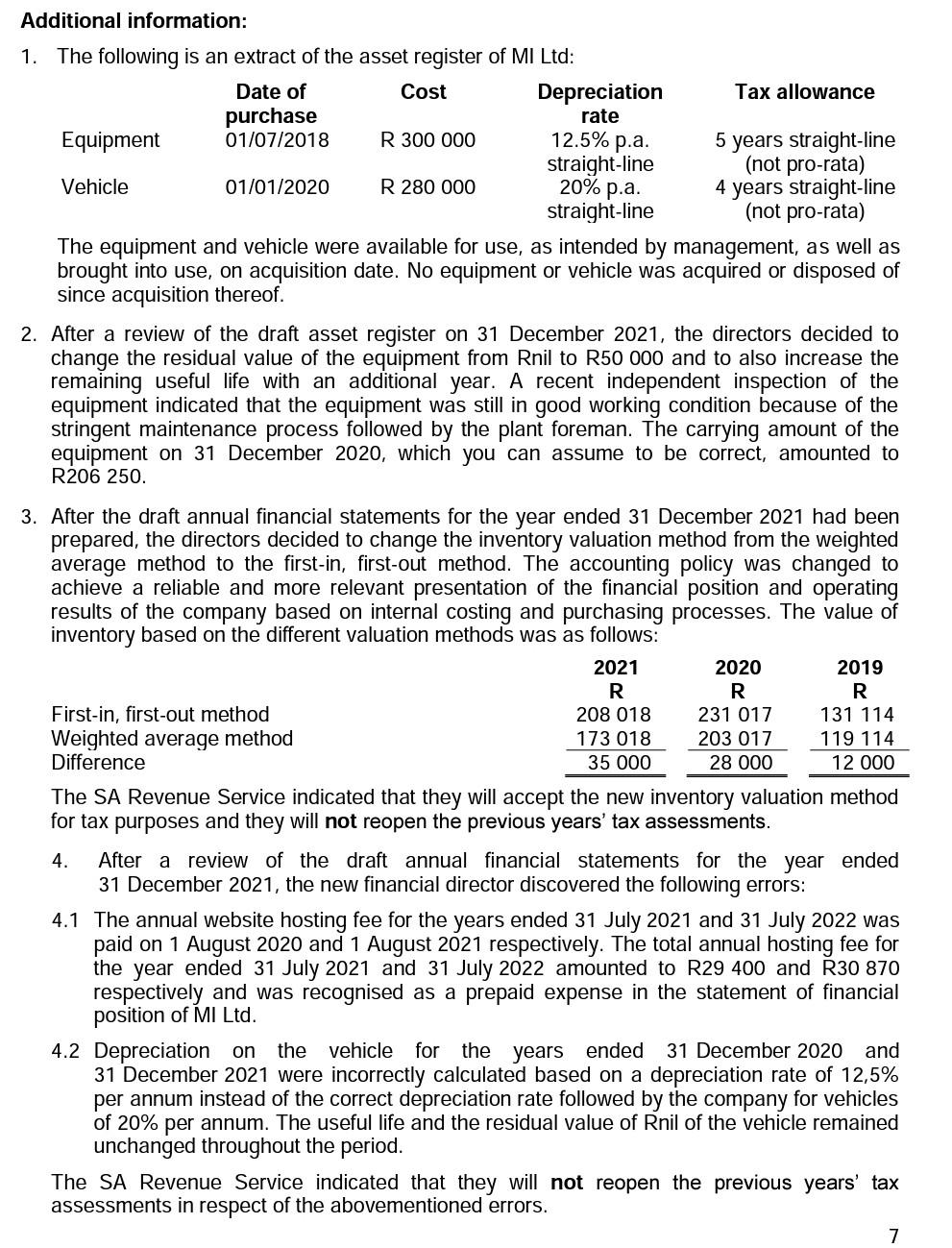

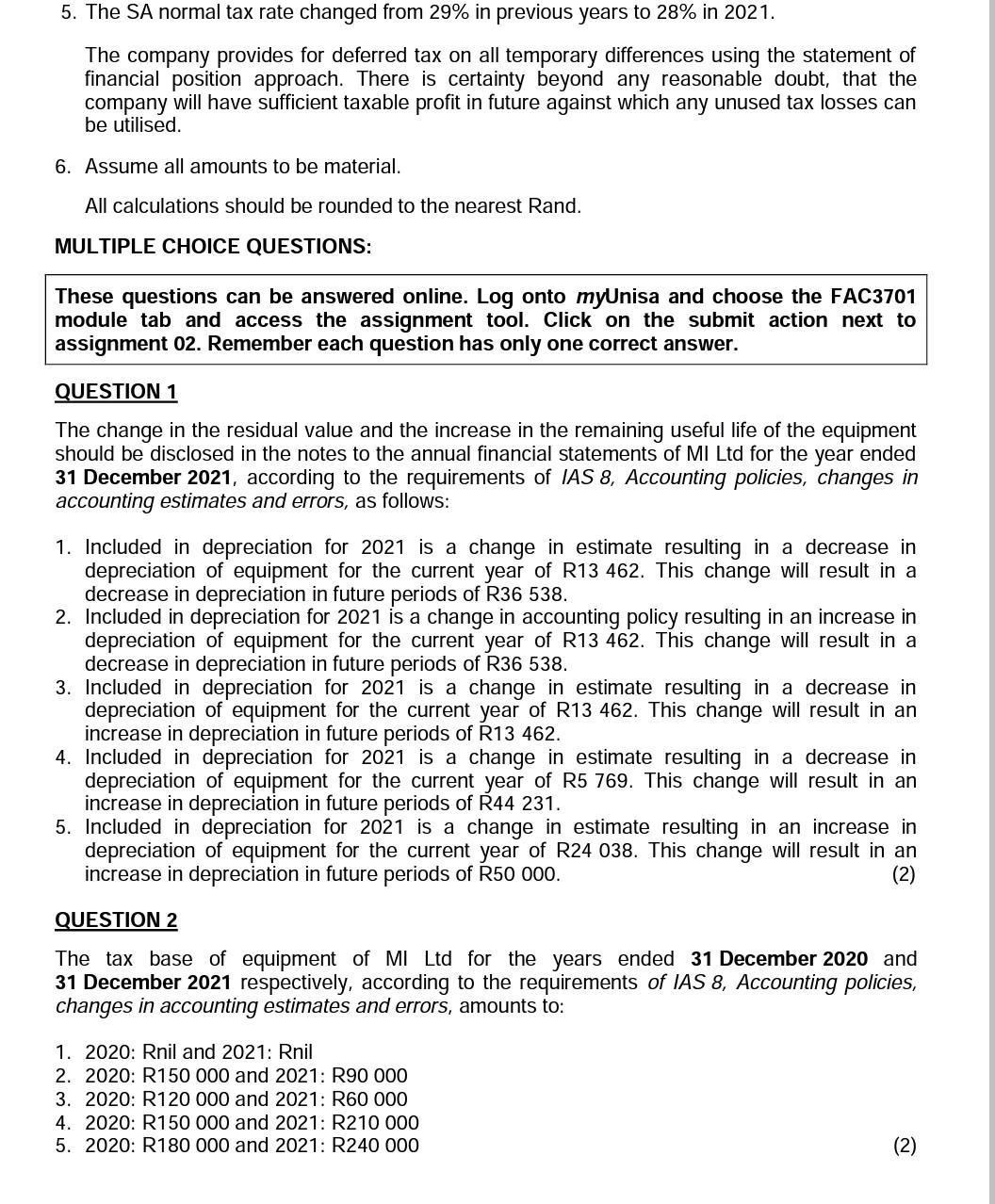

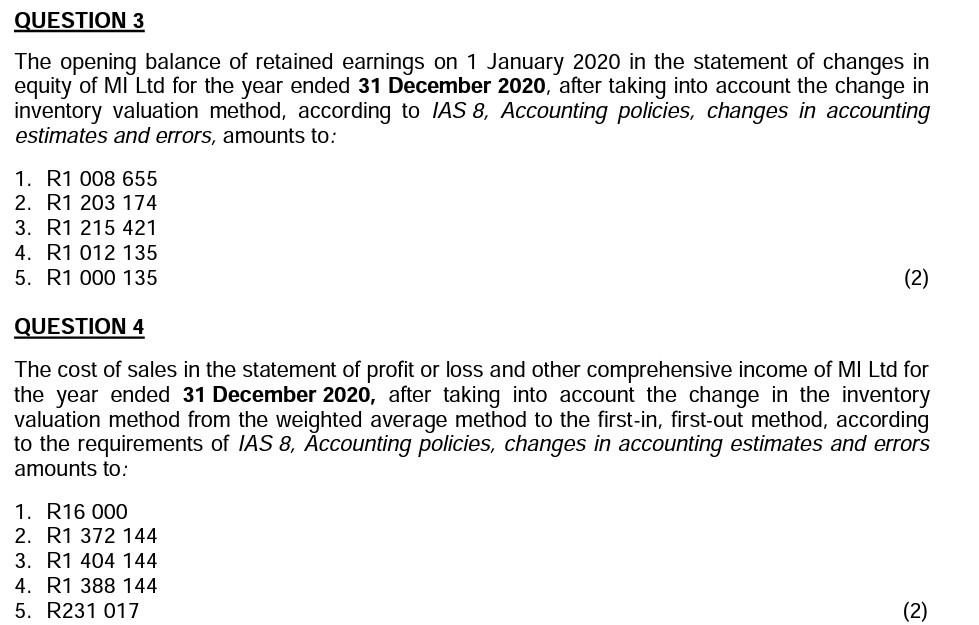

Questions 18 relate to the annual financial statements of MI Ltd that complies with the requirements of International Financial Reporting Standards. MI Ltd is a manufacturer and retailer of quality paints in South Africa. The following is an extract from the draft annual financial statements of MI Ltd for the year ended 31 December 2021, before taking into account the additional information (2) to (4) below: MI LTD EXTRACT FROM STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2021 MI LTD EXTRACT FROM STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2021 MI LTD EXTRACT FROM STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 31 DECEMBER 2021 Additional information: 1. The following is an extract of the asset register of MI Ltd: The equipment and vehicle were available for use, as intended by management, as well as brought into use, on acquisition date. No equipment or vehicle was acquired or disposed of since acquisition thereof. 2. After a review of the draft asset register on 31 December 2021, the directors decided to change the residual value of the equipment from Rnil to R50 000 and to also increase the remaining useful life with an additional year. A recent independent inspection of the equipment indicated that the equipment was still in good working condition because of the stringent maintenance process followed by the plant foreman. The carrying amount of the equipment on 31 December 2020 , which you can assume to be correct, amounted to R206 250. 3. After the draft annual financial statements for the year ended 31 December 2021 had been prepared, the directors decided to change the inventory valuation method from the weighted average method to the first-in, first-out method. The accounting policy was changed to achieve a reliable and more relevant presentation of the financial position and operating results of the company based on internal costing and purchasing processes. The value of inventory based on the different valuation methods was as follows: First-in, first-out method Weighted average method Difference The SA Revenue Service indicated that they will accept the new inventory valuation method for tax purposes and they will not reopen the previous years' tax assessments. 4. After a review of the draft annual financial statements for the year ended 31 December 2021, the new financial director discovered the following errors: 4.1 The annual website hosting fee for the years ended 31 July 2021 and 31 July 2022 was paid on 1 August 2020 and 1 August 2021 respectively. The total annual hosting fee for the year ended 31 July 2021 and 31 July 2022 amounted to R29 400 and R30 870 respectively and was recognised as a prepaid expense in the statement of financial position of MI Ltd. 4.2 Depreciation on the vehicle for the years ended 31 December 2020 and 31 December 2021 were incorrectly calculated based on a depreciation rate of 12,5% per annum instead of the correct depreciation rate followed by the company for vehicles of 20% per annum. The useful life and the residual value of Rnil of the vehicle remained unchanged throughout the period. The SA Revenue Service indicated that they will not reopen the previous years' tax assessments in respect of the abovementioned errors. 5. The SA normal tax rate changed from 29% in previous years to 28% in 2021. The company provides for deferred tax on all temporary differences using the statement of financial position approach. There is certainty beyond any reasonable doubt, that the company will have sufficient taxable profit in future against which any unused tax losses can be utilised. 6. Assume all amounts to be material. All calculations should be rounded to the nearest Rand. MULTIPLE CHOICE QUESTIONS: These questions can be answered online. Log onto myUnisa and choose the FAC3701 module tab and access the assignment tool. Click on the submit action next to assignment 02. Remember each question has only one correct answer. QUESTION 1 The change in the residual value and the increase in the remaining useful life of the equipment should be disclosed in the notes to the annual financial statements of MI Ltd for the year ended 31 December 2021, according to the requirements of IAS 8, Accounting policies, changes in accounting estimates and errors, as follows: 1. Included in depreciation for 2021 is a change in estimate resulting in a decrease in depreciation of equipment for the current year of R13 462 . This change will result in a decrease in depreciation in future periods of R36 538. 2. Included in depreciation for 2021 is a change in accounting policy resulting in an increase in depreciation of equipment for the current year of R13 462. This change will result in a decrease in depreciation in future periods of R36 538. 3. Included in depreciation for 2021 is a change in estimate resulting in a decrease in depreciation of equipment for the current year of R13 462 . This change will result in an increase in depreciation in future periods of R13 462. 4. Included in depreciation for 2021 is a change in estimate resulting in a decrease in depreciation of equipment for the current year of R5 769. This change will result in an increase in depreciation in future periods of R44 231. 5. Included in depreciation for 2021 is a change in estimate resulting in an increase in depreciation of equipment for the current year of R24 038. This change will result in an increase in depreciation in future periods of R50 000. QUESTION 2 The tax base of equipment of MI Ltd for the years ended 31 December 2020 and 31 December 2021 respectively, according to the requirements of IAS 8, Accounting policies, changes in accounting estimates and errors, amounts to: 1. 2020: Rnil and 2021: Rnil 2. 2020: R150 000 and 2021: R90 000 3. 2020: R120 000 and 2021: R60 000 4. 2020: R150 000 and 2021: R210 000 5. 2020: R180 000 and 2021: R240 000 The opening balance of retained earnings on 1 January 2020 in the statement of changes in equity of MI Ltd for the year ended 31 December 2020, after taking into account the change in inventory valuation method, according to IAS 8, Accounting policies, changes in accounting estimates and errors, amounts to: 1. R1 008655 2. R1 203174 3. R1 215421 4. R1 012135 5. R1000 135 QUESTION 4 The cost of sales in the statement of profit or loss and other comprehensive income of MI Ltd for the year ended 31 December 2020, after taking into account the change in the inventory valuation method from the weighted average method to the first-in, first-out method, according to the requirements of IAS 8, Accounting policies, changes in accounting estimates and errors amounts to: 1. R16000 2. R1 372144 3. R1 404144 4. R1 388144 5. R231 017Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started